For years, Mentor Graphics has wanted to sell more than just software for laying out electronics in an airplane or automobile. It wanted its software to help design everything else about it, too.

But on Monday, it became clear that the third largest maker of electronic design automation tools would not do it alone. The company struck a $4.5 billion deal to be acquired by Siemens, the industrial conglomerate based in Munich.

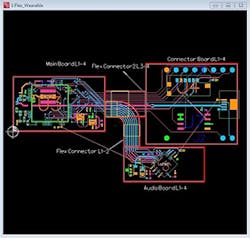

The deal is the latest bet that the industrial and other fields are increasingly using sensors and internet-connectivity to make operations more efficient. Mentor Graphics sells software tools to help engineers design the circuit boards used to digitize products: everything from factory equipment and airplanes to self-driving cars and wearables.

Mentor Graphics is best known as one of the “Big Three” in electronic design automation software, behind Cadence Design Systems and Synopsys. In recent years, it has focused on supplying tools for laying out circuit boards and modeling machines, as well as the embedded software running inside them.

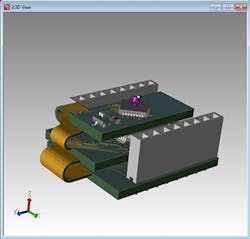

Siemens described the deal as something of a keystone for its software business, which also includes products that simulate electric vehicle batteries and analyze mechanical stress in wind turbines. The company said that the acquisition makes it a “unique digital industrial player to offer mechanical, thermal, electrical, electronic, and embedded software design capabilities on a single integrated platform.”

Klaus Helmrich, one of Siemen’s managing board members, said that Mentor Graphics gives the company access to all the complex software tools to create “a very precise digital twin of any smart product and production line.”

Mentor Graphics, based in Wilsonville, Ore., will become part of the product life cycle management software business in Siemens’ digital factory division. The group sells software to help companies manage the life-cycle of a product, from design and production to service and disposal, using computer-aided manufacturing and analytics.

The deal also hints at the blurring lines between mechanical and electrical engineers, who are working closer together to hook sensors and wireless transmitters into machines. In the view of industry analysts, both types of engineers are collaborating more closely on products like autonomous cars so that the designs can be finished faster.

“EDA is a natural outgrowth” for companies like Siemens with an encyclopedia of mechanical engineering software, said Laurie Balch, the chief analyst at technology research firm Gary Smith EDA. From that perspective, the deal makes a lot of sense, she said.

“There is a big need for engineers to come together on designs, integrate effectively, and employ a top-down approach to design cost-effective products,” Balch said, adding that now equipment makers can buy things like simulation software and computer-aided design tools directly from Siemens.

Joseph Kaeser, Siemens’ chief executive, has been aggressive in recasting the company as a torchbearer for digital manufacturing technology. The company is trying to jump ahead in the industrial Internet of Things, which aims to increase manufacturing efficiency by installing new machines that share data over the cloud.

American rivals are also pushing into software products. General Electric is betting that it can efficiently analyze the flow of data from embedded sensors in jet engines and gas turbines. Jeffrey Immelt, GE's chief executive, has vowed to invest $1.4 billion this year into its new software division called GE Digital.

Honeywell has created a software division for its industrial control business, selling products for data analysis to chemical and mining companies. It recently offered around $3 billion to acquire JDA Software, a supply chain management company, but its offer was rebuffed.

Siemens appears to view its role deeper in the trenches with engineers. In 2007, the company bought industrial design software firm UGS for $3.5 billion. Earlier this year, it spent around $1 billion to acquire CD-Adapco, an aerospace and automotive design software firm.

Walden Rhines, who has served as the chief executive of Mentor Graphics for over two decades, said in a statement that he was optimistic about the deal. In the last five years, the software maker has deflected buyout offers from Cadence and jousted with shareholders like Carl Icahn, who tried buying the company in 2011. For the last two months, it butted heads with activist hedge fund Elliott Management, which complained that its 8.1% stake in the company was severely undervalued.

“Siemens is an ideal partner with financial depth and stability, and their resources and additional investment will allow us to innovate even faster and accelerate our vision of creating top-to-bottom automated design,” Rhines said in a statement.

The market for electronic design automation software has cooled over the last couple years, prompting industry analysts to speculate about how to restart growth. Robert Smith, the executive director of the Electronic System Design Alliance, has pointed to embedded software as a new responsibility. Others have urged companies to start selling mechanical design software. In May, at the Design Automation Conference, Balch predicted that “if EDA does not expand outwards, others may decide to eat EDA.”

Though Mentor Graphics was eaten, industry analysts expect that many of its products will survive the deal. Aside from several types of thermal simulation software, the two companies have very little overlap, Balch said.

The deal is expected to close in mid-2017. Mentor’s board of directors has approved the transaction, while Elliott Management has also said that it would support the deal.