Bitcoin is arguably the most well-known of the cryptocurrencies in part because it has been around for nearly 10 years and seen dramatic increases in value over the last few years. Another reason Bitcoin is in the news revolves around the high energy usage of the cryptocurrency mining industry.

For example, Iceland is a popular destination for Bitcoin mining because energy costs are very low, temperatures are cool, and internet speeds are high. It’s estimated that the Bitcoin mining industry in Iceland will use about 840 gigawatt-hours of electricity in 2018, which is more than all of Iceland’s homes did in 2017 (Morris, 2018). What’s driving the large electricity consumption in Bitcoin mining? And what role does thermal engineering play in in it all?

What is Bitcoin Mining?

Simply put, Bitcoin miners run a hashing algorithm on computer hardware to determine the correct hash, a fixed-length 64-character (256-bit) string, which represents a block of Bitcoin transactions. Once a miner determines the correct hash, as verified by other miners, that block of data is added to the Bitcoin blockchain, which is an encrypted ledger of all Bitcoin transactions. The miner that determines the correct hash is rewarded Bitcoins (BTC), currently 12.5 BTC. The Bitcoin block mining reward halves every 210,000 blocks, or about every four years.

1. When the rate of block solutions, or hashes, increases, it makes generating the correct hash that much more difficult.

The total number of Bitcoins that will ever be produced is 21 million, of which about 80% have been mined. It’s estimated that the last Bitcoin will be mined in 2140. The time estimate should be accurate since the Bitcoin mining difficulty of generating the correct hash is managed such that a new block is added to the blockchain about every 10 minutes. As the rate of block solutions, or hashes, increases, so does the difficulty of generating the correct hash (Fig. 1). The current hash rate of the Bitcoin mining network is about 25 EHash/s (1018 Hash/sec).

Evolution of Bitcoin Mining

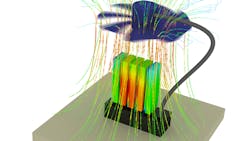

From 2009, when the first Bitcoins were mined, to 2012, the Bitcoin mining network hash rate increased from MHash/s (106) to THash/s (1012) to today’s EHash/sec (1018). As a result, mining hardware has evolved. In the early days, miners could use their CPUs to mine at a hash rate on the order of MHash/s. Desktop computers could also be used to mine, as well as dedicated custom mining rigs like the one shown in Figure 2. Note the excessive use of cooling fans on each chip. Many mining rigs are simply a collection of existing systems with little redesign with respect to cooling efficiency.

2. CPU mining rig with cooling fans, and airflow pattern.

The increasing hash rate of the network has led to the emergence of two important metrics. The first is simply the hash rate of the mining hardware. Similar to a single ticket in a raffle, the odds of winning are greatly increased with more than one ticket, but it only takes one to win. The greater the hash rate, the greater the chance of calculating the correct hash. It’s therefore much more likely that many calculations will be required. So, in addition to the hash rate, it’s important to consider the efficiency of each calculation, or the energy required to produce the hash. The second metric that’s used when comparing mining hardware is the energy consumed per hash.

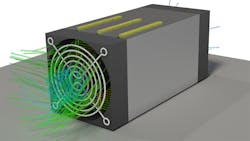

Because of low hash rates as compared to the Bitcoin network and efficiencies in the J/MH (Joule per Mega-Hash) range CPU, mining using CPUs became financially unviable (Mining - Bitcoin Wiki, 2018) and evolved to the use of GPUs. The popularity of GPUs was presumably aided by the availability of off-the-shelf graphics cards with integrated cooling solutions (Fig. 3), and the ability to scale up to an entire mining rig fairly easily.

3. CPU graphics card with integrated cooling solution.

Bitcoin mining subsequently evolved to the use of FPGAs that offer hash rates similar to a GPU with increased efficiency due to lower power consumption as compared to a GPU. In 2013, the first ASIC specifically designed for Bitcoin mining was released (Mining - Bitcoin Wiki, 2018). The year the ASIC was introduced the Bitcoin mining network hash rate increased from THash/s (1012) to PHash/s (1015) range and BTC increased in the open market from about $100/BTC to around $1000/BTC by the end of the year (Bitcoin.com Charts, 2018). Note that it peaked at $20,000/BTC in December 2017 but has fallen below the $7,000/BTC mark recently.

4. Typical Bitcoin ASIC USB miner.

Bitcoin miners looking for “off-the-shelf” solutions that use ASICs have a number of options available that address varying investment comfort levels. At the lower end, a miner might invest in a USB miner (Fig. 4). At the higher end are mining rigs like that shown in Figure 5 (from companies such as Bitmain with its AntMiner units).

5. Typical Bitcoin ASIC mining rig.

The USB miner is clearly a low-power solution that’s limited by the USB port capability. Even at the 2.5-W maximum power supplied by the USB port, the heatsinked ASICs on the device can get very warm. The ASIC temperatures are well within typical operating limits, but the heatsink would feel hot to the touch. You often see these devices operating with one or more fans directing air across them. USB miners offer hash rates in the 1-GH/s range with efficiencies of about 1 J/GH, easily outperforming the CPU-based miners from the early days of 2009.

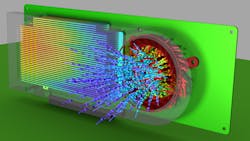

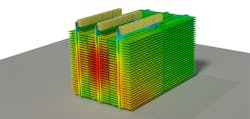

The ASIC mining rig, which will have multiple PCBs filled with Bitcoin-hashing ASICs, consumers about 1 kW. Rather than a collection of existing systems, this type of rig has more of a holistic cooling approach. The cooling strategy might therefore involve forced convection with two fans in a push-pull arrangement. The ASICs will have heatsinks, either a monolithic approach as shown in Figure 6, or simply a small heatsink mounted on each ASIC with thermal adhesive. Mining rigs offer fantastic performance with hash rates in the 1-TH/s range and efficiencies of 0.1 J/GH, although they do require a significant initial investment of ~$1,000-$3,000 in equipment.

6. Bitcoin ASIC mining rig internals.

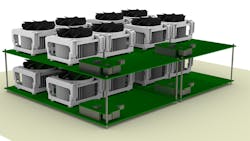

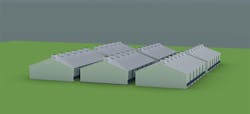

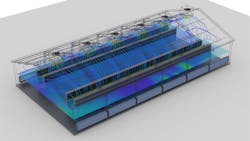

An even bigger scale of Bitcoin mining involves mining farms. These large mining operations are located in regions that have low energy costs like Iceland (with its cheap geothermal energy and cold-air cooling climate), or central Washington State in the U.S. (with its cheap hydropower). The buildings used in mining farms (Fig. 7) are typically much more like a barn or warehouse, or shipping container, than a data center. These operations clearly use megawatts of electricity and cost $10,000,000 to build, and millions of dollars a month just to maintain.

7. The illustration represents a typical Bitcoin mining farm (effectively a data center).

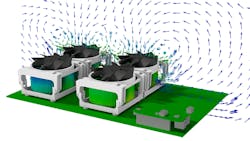

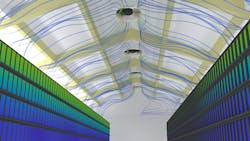

The Bitcoin farms in places like Iceland also benefit from the year-round cool air that can be drawn in via vents on the building exterior, and across the mining equipment, exhausting from the roof of the building (Fig. 8).

8. Bitcoin farm ventilation flow and exhaust system.

Challenges and Opportunities

Nearly all of the technical innovation in the Bitcoin mining industry has happened at the IC package level with the development of the Bitcoin mining ASIC. Innovations continue at the IC package level that will no doubt provide higher hash rates, but presumably at an increased power.

Other areas of innovation will involve submerging the mining rigs in oil or engineered fluids suitable for electronics (i.e., liquid cooling). The advantage of this approach is the ASICs could be more densely packed and operate in a much smaller facility than the current Bitcoin farm approach.

It was much easier to mine for Bitcoin when they had essentially no value. Now BTC trades for thousands of dollars and the mining network hash rate is at the EHash/s level, which makes it very difficult for a small mining operation to compete, or even turn over a profit. As a result, individual miners join mining pools, where resources are pooled and rewards are split.

What’s the Prognosis?

Our conclusion from a thermal perspective is that the cost of mining for cryptocurrencies, in terms of electronics cooling capital costs as well as 24/7 electricity usage and maintenance costs, are such that it might be a better use of your cash to buy a lottery ticket, especially with the accelerated gold rush and diminishing number of coins to be mined.

Moreover, there’s a major ethical question over the use of our planet’s power-generation resources (which are stretched as it is) for something that essentially appears to be speculative mining to gain a fortune in cryptocurrencies in what may turn out to be a big bubble. Indeed, cryptocurrencies are known to be used extensively in the dark web, money laundering, and drug deals.

Only time will tell on the cryptocurrency mining boom. Of course, the major traditional banks are actually better placed today with their massive data centers to do hashing calculations for blockchain creation than rough-and-ready mining operations. We do think that there will definitely be a place in the cashless world and banking sector of the future for blockchain creation algorithms and computer data centers, particularly because of its secure encryption capabilities.

John Wilson is Technical Marketing Engineer and Electronics Product Specialist in the Mechanical Analysis Division for Mentor, a Siemens Business.

References:

Bitcoin.com Charts. (2018, March 28).

Mining - Bitcoin Wiki. (2018, February 2018).

Morris, C. (2018, February 13). Bitcoin Mining Uses More Energy Than Homes Do in Iceland. Retrieved from Fortune.com.