So...NMC Battery Chemistry is No Longer Gonna Fly

What you’ll learn:

- Ford and GM recently announced they will be using manganese-rich lithium chemistries in future EVs.

- Stellantis is also eliminating high-nickel content, but it seems headed toward lithium sulfur and semi-solid-state battery chemistries in future EVs.

- Battery technology is on the cusp of enabling fully electric commercial aviation transport

Like a lead balloon

EV-1 fell to Roadster

NMC is next

Since the 2008 Tesla Roadster, the North American automotive industry has hitched its wagon to nickel-manganese-cobalt (NMC) cell chemistry with BEVs. The 2010s were dominated by the likes of Tesla and Nissan; Chevrolet entered the picture with its compliance offering, the Spark, followed in 2017 by the Bolt EV. Tesla followed through with its Model 3 and Y offerings starting in 2018.

The early 2020s gave us more of the same with Mach-E, Ford F-150 Lightning pickups, Hummer EV, Silverado EV, Cybertruck, Tesla Semi, etc.—all in NMC (>80% Ni). Tesla dipped its toe into a lower-cost LFP offering, which was also available on Ford’s Mach-E. GM’s “Ultium” platform was allegedly chemistry agnostic—being a brand name and not much more these days the way I understand it, why would it be anything else?

With BEV pickup trucks and large SUVs like the Hummer EV approaching four-and-a-half tons in weight and $100,000 in price, we’ve seen announcements over the past month from Ford and GM about a new battery chemistry that’s emerging from their labs: “LMR” (lithium, manganese rich). LMR promises LFP’s cost, while increasing the stored energy to 2.5X that of LFP, and 1.5X that of NMC (see table).

NMC for BEVs

Working from the table, the significance here is on two major counts:

First, for a given BEV gross weight, now in NMC, its range can be increased by 50%. This is particularly attractive for pickup trucks due to consumer sentiment regarding empty ICE trucks having huge range. That’s because they’re gas tanked for diminished fuel economy when loaded or towing—few seem to notice their 17 mpg ICE truck gets 9 mpg towing (I do with my GMC and its fuel computer). But YouTubers have sensationalized the range hit with BEV trucks...yes, your F-250 gets a range hit in addition to the balloon tires on fake beadlocks when towing a heavy (near GCWR, or gross combined weight rating) trailer.

Second, for a given BEV range, in other words a given amount of kWh of stored energy onboard, battery weight can be reduced. For example, a 200-kWh battery would weigh 769 kg in NMC and 1,250 kg in LFP, but for the cost of LFP, the vehicle can be provisioned with the same range at a battery weight of 500 kg using LMR. The gains, in the case of a truck, are lower weight, which means lower structural weight to carry the battery weight, or proportionally higher payload capability.

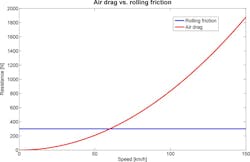

Along with lower mass comes cost and weight benefits on braking systems as well as lower rolling resistance. At city speeds around 60 km/h, a typical box-pushing-air SUV, like the Mercedes G400, has about an equal contribution to the force needed to maintain speed by rolling resistance and aero drag (see figure).

A reduction in weight of 750 kg, in the case of LFP->LMR, means 25% reduction in weight for a 3,000-kg BEV, or an increase in vehicle efficacy and range of 12.5% at city speeds. At highway speeds, rolling resistance contributed a quarter to a third of them Newtons that a drivetrain has to overcome.

Stellantis’ Sulfur Solution

This explains why we’re seeing a pivot away from NMC by Ford and GM in the second half of this decade—just as EVs have passed the 20% market share of new vehicles sold, worldwide. North American manufacturers, referred to as The Big Three, have always meant the Detroit-based crew to me. Stellantis (Chrysler/Dodge) is also abandoning NMC with a couple of forks in their battery roadmap.

Coming next year, in the Dodge BEV offerings, is a “solid state” (it really isn’t; the technology doesn’t have a fully solid electrolyte) battery offering from Factorial Energy. Stellantis has announced strategic partnerships to displace nickel and cobalt out of lithium battery chemistry, via Lyten, and with Zeta Energy, with sulfur. Lithium-sulfur batteries promise to come in at about 14% lower cost than high manganese chemistries at more or less the same energy density of LMR. Lithium sulfur also has theoretical promise to more than quadruple its energy density, unlike the others in the table.

Speaking of the table, if you have better, or any, data to add to it, let’s make it crowd-sourced by shooting me an email with the details and I’ll consider updating it with the information provided. The rest of you should consider bookmarking this article and coming back now and then to check out the latest table.

Paradigm-Shifting Advances for EV Transportation

There’s lots of really interesting stuff going on in terms of reducing EV cost, increasing energy density, and enabling further performance/efficacy improvements—not merely in the rest of the world, but among the major Western, “Detroit,” automotive OEMs. Their EVs are already compelling enough to where those consumers who have driven an EV have already decided to purchase one as their next vehicle.

The question of affordability, range, and efficacy is being addressed in the road, and off-road, vehicle traction battery space right now. We're living during an inflection point favoring EV cost and performance that’s as disruptive to ICE as the use of lithium batteries in mobility was to lead-acid and NiMH.

I, for one, as a grounded former pilot, am looking forward to seeing >450 Wh/kg fall out of the current efforts that are planned to go to production. This energy-density threshold (400 Wh/kg is close enough for me) cracks aviation open. I’m not talking about the scaled-up billionaires’ quadcopter toys, but legit, fixed-wing, regional transportation we can all use. Meanwhile, some of us might get a head start on Stellantis and rescue the pack out of a crashed 2029 Silverado and see how its repackaged cells do in a converted Cessna 182.

All for now,

AndyT

Editor Note (5/22): Some of you have had issues with all of the acronyms and abbreviations in this piece, so we're adding an auto-generated glossary here, which I've hand-checked and edited as needed, for your convenience. Will try to do this going forward...

Glossary of Acronyms & Abbreviations

BEV

Battery Electric Vehicle

A vehicle powered entirely by electricity stored in rechargeable battery packs, with no internal combustion engine.

C

A one-hour rate indicator, e.g., "C-rate." So, a 66-kWh battery has a "C-rate," a one-hour charge or discharge rate of 66 kW—charging at 0.5C would then be at 33 kW.

EV

Electric Vehicle

Any vehicle powered by an electric motor, typically using energy stored in batteries.

GCWR

Gross Combined Weight Rating

The maximum allowable combined mass of a vehicle, including its own weight and the weight of any trailers and cargo.

GM

General Motors

A major American automotive manufacturer.

ICE

Internal Combustion Engine

A traditional vehicle engine that generates power by burning fuel (usually gasoline or diesel) inside the engine.

kWh

Kilowatt-hour

A unit of energy commonly used to measure battery capacity in electric vehicles.

LFP

Lithium Iron Phosphate

A type of lithium-ion battery chemistry known for its stability, safety, and lower cost, but with lower energy density compared to some other chemistries.

LMR

Lithium Manganese-Rich

A newer lithium-ion battery chemistry with high manganese content, promising higher energy density and lower cost.

NMC

Nickel Manganese Cobalt

A widely used lithium-ion battery chemistry that balances energy density, lifespan, and cost by combining nickel, manganese, and cobalt.

NiMH

Nickel Metal Hydride

A type of rechargeable battery used in earlier hybrid and electric vehicles before lithium-ion became dominant.

OEM

Original Equipment Manufacturer

A company that produces parts or equipment that may be marketed by another manufacturer; in automotive, it refers to the vehicle manufacturers themselves.

SUV

Sport Utility Vehicle

A larger passenger vehicle designed for both on-road and off-road use.

Wh/kg

Watt-hour per kilogram

A measure of energy density in batteries, indicating how much energy is stored per unit of weight.

If I've missed definitions for any other terms from the article, please drop a note in the comments or pop me an email. Thanks!

Andy's Nonlinearities blog arrives the first and third Monday of every month. To make sure you don't miss the latest edition, new articles, or breaking news coverage, please subscribe to our Electronic Design Today newsletter. Please also subscribe to Andy’s Automotive Electronics bi-weekly newsletter.

About the Author

Andy Turudic

Technology Editor, Electronic Design

Andy Turudic is a Technology Editor for Electronic Design Magazine, primarily covering Analog and Mixed-Signal circuits and devices and also is Editor of ED's bi-weekly Automotive Electronics newsletter.

He holds a Bachelor's in EE from the University of Windsor (Ontario Canada) and has been involved in electronics, semiconductors, and gearhead stuff, for a bit over a half century. Andy also enjoys teaching his engineerlings at Portland Community College as a part-time professor in their EET program.

"AndyT" brings his multidisciplinary engineering experience from companies that include National Semiconductor (now Texas Instruments), Altera (Intel), Agere, Zarlink, TriQuint,(now Qorvo), SW Bell (managing a research team at Bellcore, Bell Labs and Rockwell Science Center), Bell-Northern Research, and Northern Telecom.

After hours, when he's not working on the latest invention to add to his portfolio of 16 issued US patents, or on his DARPA Challenge drone entry, he's lending advice and experience to the electric vehicle conversion community from his mountain lair in the Pacific Northwet[sic].

AndyT's engineering blog, "Nonlinearities," publishes the 1st and 3rd Tuesday of each month. Andy's OpEd may appear at other times, with fair warning given by the Vu meter pic.