Yole Développement, a group of market research, technology analysis, and strategy consulting companies based in Lyon, France, has examined silicon-carbide (SiC) adoption for automotive applications. over the next 5-10 years. The company’s report “Power SiC 2018: Materials, Devices and Applications” gives an overview of SiC power-device markets, including electric and hybrid electric vehicles (EV/HEV), as well as charging infrastructure, PV, power supply, rail, motor drives, and uninterruptible power supplies (UPS).

In automotive applications, the SiC implementation rate “differs depending on where SiC is being used,” says Dr. Hong Lin, Technology and Market Analyst, Compound Semiconductors, at Yole. “That could be in the main inverter, in the onboard charger (OBC) or in the dc-dc converter.”

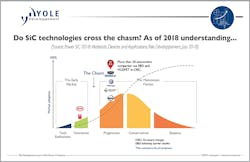

Use of SiC technologies has entered the mainstream market. (Source: Yole Développement)

Dr. Lin notes, “More than 20 automotive companies are already using SiC Schottky barrier diodes (SBDs) or SiC MOSFET transistors for onboard charging, which will lead to 44% CAGR through to 2023.”

The firm expects SiC adoption in the main inverter will result in “an inspiring 108% market CAGR for 2017-2023.” This will be possible because Yole found that nearly all carmakers have projects to implement SiC in the main inverter in coming years. In particular, Yole reports that all Chinese automotive players are strongly considering the adoption of SiC.

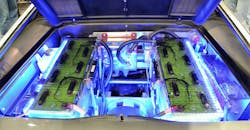

The recent SiC module developed by STMicroelectronics for Tesla and its Model 3 is a good example of this early adoption. The SiC-based inverter, analyzed by System Plus Consulting, Yole’s sister company, is composed of 24 1-in-1 power modules. Each module contains two SiC MOSFETs with an innovative die-attach solution and connected directly on the terminals with copper clips and thermally dissipated by copper baseplates. The thermal dissipation of the modules is performed thanks to a specifically designed pin-fin heatsink.

SiC MOSFETs are “manufactured with the latest STMicroelectronics technology design,” explains Dr. Elena Barbarini, Head of Department Devices at System Plus Consulting. “This technical choice allows reduction of conduction losses and switching losses.”

STMicroelectronics sees SiC adoption as happening “faster than expected.” (Source: STMicroelectronics)

In general, the Yole study found system manufacturers are interested in implementing cost-effective systems that are reliable, without any technology choice, either silicon or SiC. “Today, even if it’s certified that SiC performs better than silicon, system manufacturers still get questions about long-term reliability and the total cost of the SiC inverter,” comments Ana Villamor, Technology & Market Analyst, Power Electronics & Compound Semiconductors at Yole.

The Yole report concludes: “We are confident that the market is going to grow. The question for the SiC device market today is how big it will be in five years, rather than whether the market will increase. Another question is whether the supply chain is ready to embrace the market acceleration? Wafer supply is one of the bottlenecks as of 2018.”

Addressing the short SiC wafer supply situation, which has been in place since late 2016, Yole says “Last year, we heard complaints. Some expected the situation to be resolved in the second half of 2017. But we are in the middle of 2018 and the supply issue remains. Two main reasons account for the current situation. First, the transition from 4-in. to 6-in. wafers is much faster than suppliers expected. Second, the wafer demand increase is also faster than expected.”

Will the situation continue? According to Yole “some say that it is temporary and quite normal and typically happens when shifting to larger wafer sizes. Others consider the situation to be critical. It’s a good problem for wafer suppliers as the supply-constrained situation allows them to maintain high wafer prices. But they are also investing heavily to satisfy demand from numerous clients. We estimate that several hundred million U.S. dollars will be invested in coming years. The leading SiC wafer suppliers, Cree-Wolfspeed, II-VI Advanced Materials, and Dow, are all investing to expand their capacity.”