Download this article in PDF format.

Nonvolatile flash memory dates back over two decades. Invented in 1994, the first application for flash memory was replacing audio tape in a phone answering machine. Digital film and cassette tapes were other early casualties of the new technology.

The first devices used a NOR structure with random-access capability. NAND flash, although slower, offered lower cost per bit and has replaced NOR technology in almost all applications. In 2019, a broad range of products uses high-density NAND flash storage—Figure 1 shows a sampling—and the technology shows no signs of slowing down.

1. From individual devices to end applications, NAND flash memory is ubiquitous. (Source: Seoul National University/Google)

Smartphones and SSDs Dominate Current NAND Market

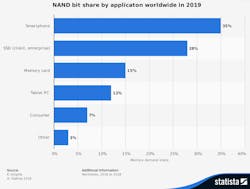

Today, although almost every embedded application contains a microcontroller with integrated flash memory for program storage, four types of applications drive the standalone NAND flash memory market (Fig. 2). The top four have a combined market share of over 90%, with the top two applications being responsible for 63% of sales.

Smartphones currently consume 35% of all NAND flash production. Although sales of smartphones are currently in a slump, with four consecutive quarters of year-over-year declines, that isn’t necessarily bad news for NAND flash sales: Newer products are more feature-rich and contain more memory than their predecessors.

2. Smartphones are responsible for 35% of NAND flash sales. (Source: Statista)

Storage has been steadily rising over several generations of smartphones. In 2019, it’s becoming hard to find a phone with less than 64 GB, and the latest models raise the bar considerably. The recently announced Samsung S10, for example, contains from 128 to 512 GB flash depending on model. Even entry-level feature phones feature 16-GB internal storage, typically with the option to add more memory with a microSD card.

Solid-state drives (SSDs) for client and enterprise applications are in second place with a 28% share. Client SSDs include netbooks, notebooks, and desktop computers, plus embedded applications such as gaming kiosks, digital signage, and industrial storage. Among the enterprise SSD applications are high-performance computing and data-center servers.

In the cloud, NAND flash storage does face a few challenges. As a semiconductor technology, NAND’s read and write speed is far faster than an electromechanical hard-disk drive (HDD). On the other hand, flash NAND’s cost per gigabyte is still considerably higher than that of HDD storage. As a result, the initial uses in the cloud for all-flash storage are low-latency applications such as real-time analytics, transactional databases, and machine learning. Although prices are declining, industry analysts expect that HDDs will continue to be the most economical near-term choice.

Tablets are in their own category with 12%, and consumer application, coming in at 7%, complete the picture, with devices such as MP3 players, digital cameras, and USB flash drives.

Emerging Automotive, IoT Apps Will Drive Growth

NAND flash has a positive outlook over the next few years. It’ll continue to expand into existing applications, but applications still on the horizon are demanding further improvements—higher density as well as higher performance.

Traditional floating-gate NAND technology has reached the limits of scalability, leading to the development of three-dimensional (3D) flash structures that stack 2D flash arrays in up to 96 layers with current technology. 3D flash makes possible higher-density products, up to 1 TB at the die level. As 3D devices continue the historical trend toward lowest cost per bit, it will help NAND flash increase penetration into cloud-storage applications.

New types of flash will be needed for enhanced AI or real-time image recognition, and other emerging applications that require even lower latency. The latest flash technologies under development optimize performance over cost, adding product differentiation to address different market segments.

Examples of emerging nonvolatile technologies, generically referred to as storage-class memories, include optimized flash, phase-change memories, and resistive memories. Although these new technologies aren’t as fast as volatile memory technologies such as dynamic or static RAM, they allow systems to gather and store data for applications such as learning systems for AI.

Advanced driver-assistance systems (ADAS) in automobiles are expanding the market for both high-density and low-latency flash. The ADAS category includes adaptive cruise control, collision-avoidance systems, automatic lane centering, and more. ADAS technologies like radar and light-distance-and-ranging (LiDAR) systems use flash for real-time image recognition to help the vehicle map its surrounding environment. Longer term, autonomous vehicles will build on existing ADAS applications to become prolific users of flash memory.

Data-heavy Internet of Things (IoT) devices constitute another emerging market for NAND flash. These applications cover a broad range. Industrial automation in the form of Factory 4.0 is one segment, of course, but the IoT also includes wearables, aviation, healthcare, plus just about anything that begins with “smart”: smart homes, smart metering, smart farms, smart logistics, and more. The flash requirements of the smallest IoT applications—a remote edge node, for example—are quite modest, but with 30 billion connected devices forecast by 2020 and 75 billion by 2025, the numbers quickly add up.

Rounding out the picture are augmented- or virtual-reality devices in both the consumer and industrial sectors, and the infrastructure necessary to support all of the new portable and wearable devices.

IHS Markit forecasts that the NAND flash-memory market will grow at a compound annual growth rate (CAGR) of 4.9% during the 2017-2022 period (Fig. 3). The Asia-Pacific region will play a large part in continued growth due to its increasing adoption of flash memory in the consumer electronics and enterprise storage sectors, plus the adoption of IoT technologies.

3. Flash-memory applications include most of the high-growth sectors over the next few years. (Source: IHS Markit)

IHS expects that the mobile and SSD segments will maintain their dominance in NAND sales, with up to 80% market share through 2022, plus robust growth: a mobile CAGR of 28.6%, and a CAGR of 47.5% for SSDs in the compute, cloud, and enterprise sectors.

Conclusion

Over its 20-year life, NAND flash has become the dominant choice in low-latency, high-density storage. New variants continue to meet the evolving requirements of both existing and emerging applications.

About the Author

Paul Pickering

Paul Pickering has over 35 years of engineering and marketing experience, including stints in automotive electronics, precision analog, power semiconductors, flight simulation and robotics. Originally from the North-East of England, he has lived and worked in Europe, the US, and Japan. He has a B.Sc. (Hons) in Physics & Electronics from Royal Holloway College, University of London, and has done graduate work at Tulsa University. In his spare time, he plays and teaches the guitar in the Phoenix, Ariz. area