COVID-19’s Impact on the Semiconductor Market

This article appeared in The Memory Guy and has been published here with permission.

In mid-March, the U.S. stock market was still trying to understand what was happening with the global coronavirus pandemic, having lost nearly 20% of its value in one week. Cooling-off periods (also called “Circuit Breakers”) automatically stopped overheated trading at different intervals.

Market indexes fell sharply, as shown in a chart from Google Finance, which shows the relative performance over the first part of the year for both the Dow Jones Industrials and NASDAQ (Fig. 1). It’s been a roller-coaster ride since that date, with the market rising sharply last week and once again tumbling to start off this week.

In this time of great financial uncertainty, what does it mean to the chip market?

Since The Memory Guy is an engineer by training, I can’t easily explain what’s happening to the global economy, but my background as a semiconductor industry analyst gives me clarity about what’s most likely to happen in the chip market. My aim, in this post, is to provide an extremely abbreviated version of the story that I’m now telling in detail to my clients. It’s today’s version of the story that I always tell when forecasting semiconductors since the market regularly repeats the same cycles.

The line of thought, which I will explain below, is the same one that has led to the fact that the Objective Analysis semiconductor forecast has been the most consistently accurate forecast in the industry for the past 13 years. It’s a fact that we highlight by sharing videos of each year’s forecast on a page on our website.

Where Memories Go, Semiconductors Follow

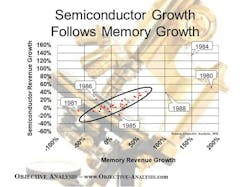

There’s a very strong relationship between memory revenue growth and overall semiconductor revenue growth. Figure 2 illustrates this fact.

The points show memory revenue growth vs. total semiconductor revenue growth for every year from 1974-2018. With the exception of six years in the 1980s, the points all fall within the range outlined in the orb. This relationship simplifies the task of creating a semiconductor forecast.

Memories are the more volatile portion of the semiconductor market: If you know what memories are likely to do, then you can predict semiconductor revenues.

Demand-Driven Downturns are Rare

I used to tell my clients that demand-driven downturns occurred regularly every 15 years, and that all other downturns were caused by over-investment. Demand downturns occurred in 1970, 1985, and 2000. The pace has recently picked up, with demand-driven downturns in 2009 and 2015. All other semiconductor cycles have been the result of excess capital spending.

This isn’t commonly believed, since chip makers usually blame demand for every downturn.

Memory Bits Grow Predictably

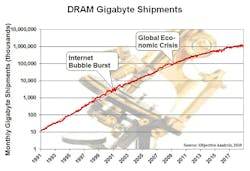

Figure 3 plots DRAM gigabyte shipments starting in 1991 (red), with a trend line (black) illustrating the gradual slowing of memory bit growth. It’s on a semi-logarithmic chart, since a linear chart would look like a hockey stick. In a semi-log format constant growth shows up as a straight line.

Note the call-outs for the Internet Bubble Burst in 2000 and the Global Economic Crisis of 2008-9. While demand did indeed dip in 2009 (from being slightly over trend), it’s relatively difficult to pinpoint a specific drop from the Internet Bubble Burst. Another demand drop, in 2015, shows up on this chart, too, but isn’t called out.

COVID-19 is almost certain to cause a demand lapse similar in magnitude to the dips in 2009 and 2015, and that lapse will trigger an oversupply.

Throughout this history, growth has resumed as soon as the calamity was brought under control. Objective Analysis expects a COVID-driven demand shortfall that will last less than a year. This may be followed by a short period of unusually high consumption driven by pent-up demand.

After that, long-term gigabyte consumption will return to its previous growth rate.

Memory Pricing is Also Predictable

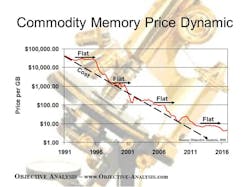

It’s a little more difficult to predict memory prices, but it’s not all that difficult. Memory prices tend to flatten during a shortage and collapse to cost at the onset of an oversupply. If you understand what cost is, and if you know when shortages and oversupplies are likely to occur, then you can predict prices.

This historical chart (Fig. 4) explains the phenomenon.

DRAM price per gigabyte history trend line: With today’s events causing a demand shortfall, the result will be an oversupply, and that will cause prices to fall to cost. Once demand catches up with supply, prices will rise above cost.

The Market Will Eventually Recover

What this leads us to is an expectation that 2020 will be a down year in the chip market, yet this is something that Objective Analysis was already predicting based on excessive capital spending in 2018. The anticipated CapEx-driven oversupply will be accompanied by a demand downturn that will cause more immediate damage to semiconductor revenues.

This situation will not last. Since demand is likely to rise back to the trend line, then the future shortage that we have already been predicting is likely to happen on time, driven by insufficient capital spending. The net impact of COVID-19 will be to cause an earlier downturn in 2020 than would have otherwise occurred, but the impact is unlikely to go beyond that.

For More In-Depth Information

Objective Analysis’s regular clients get a far deeper look into this analysis and much better insight that allows them to plan around such predictable results of unpredictable phenomena like the COVID-19 pandemic. Readers who aren’t already clients of ours are welcome to contact us to explore ways that we can help you to outperform your competition using a deeper understanding of the market to assist in your planning.

We also express our sympathy to those already impacted by the pandemic, as well as those yet to be impacted. Such events are a true test of our strengths as human beings, but we should emerge stronger as a result of the ordeal.

About the Author