SiC and GaN vs. IGBTs: The Imminent Tug of War for Supremacy

Download this article in PDF format.

After years of R&D in the lab, compound semiconductor materials like silicon carbide (SiC) and gallium nitride (GaN) used for ICs are taking a bigger role in handling electrical power. These wide-bandgap (WBG) devices are ready to carve out a niche in applications that demand the ability to work at high voltages and temperatures while demonstrating high efficiency. They’re poised to take over designs based on insulated-gate bipolar transistor (IGBT) technology.

One big factor to be overcome is a relatively higher price, which manufacturers are trying to tackle by using larger wafers. Another issue concerns instabilities in the threshold voltage level caused by a messy transition region between the pure SiC and the grown SiO2 that inhibits carrier mobility. Progress, however, is being made here as well.

Nevertheless, IGBT technology isn’t sitting back, with companies looking to make improvements. IGBTs can block high voltages with low on-state conduction losses and well-controlled switching times. But they’re limited by how fast they can switch while delivering low on-state conduction losses. This leads to a need for costly and large-size thermal-management methods and a limitation on power-conversion system efficiency.

Still, IGBT developers are busy trying hard to overcome these performance challenges. Major firms pursuing IGBT technology include Fujitsu, Infineon, Microsemi, and Semikron.

Zeroing in on Electric Vehicles

Two of the most lucrative and looming applications for SiC and GaN are electric vehicles and hybrid electric vehicles (EVs and HEVs). Some specific industrial applications are also in the mix. There are multiple reasons for the rising popularity of SiC and GaN: They operate at higher voltages and temperatures, are more rugged, have longer lifetimes, and switch much faster than conventional semiconductor devices.

One of the leaders in SiC and GaN device development and products is Wolfspeed, a Cree company. The firm’s WAS300M12BM2 1.2-kV, 300-A SiC module is driven using existing Wolfspeed gate drivers for 62-mm modules. It features 4.2 mΩ of on-resistance and switches more than five times faster than existing latest-generation IGBT modules. It was stressed in an 85% RH environment at 85ºC while biased at 80% of its rated voltage (960 V).

By the end of this year, STMicroelectronics expects to have qualified a new-generation of 1.2-kV MOSFETs to the AEC-Q101 standard. It already has qualified 650-V SiC diodes grown on 4-in. wafers. Like Wolfspeed, it’s engaged in growing SiC devices on larger wafers to bring down manufacturing costs, improve quality, and deliver the large volumes needed by automotive manufacturers.

1. Semikron’s hybrid SiC power modules feature 50% less power loss by using the MiniSKiiP, a solder-free PCB assembly method that exploits spring contacts for improved cost-effectiveness.

Germany-based Semikron produces hybrid SiC power modules with 50% less power loss by using the MiniSKiiP (Fig. 1). The solder-free printed-circuit-board assembly method utilizes spring contacts, leading to very short assembly times, easy pc-board design, and increased connection reliability.

According to the company, this approach produces immediate system cost benefits. It claims that its modules can cover the range of 1 to 10 kW as motor drivers. MiniSKiiP packaging is said to optimize the thermal resistance between the SiC chip(s) and the heat sink. This allows for an increase in power density of more than 30% over existing solutions.

2. This 1.2-kV/600-A SiC power module from Rohm packs a punch in a G-type case measuring 62 by 152 by 27 mm.

On another front, Rohm took a different path by developing an optimized heat-radiation approach. It enabled the creation of 1.2-kV/400-A (BSM400D12P3G002) and 1.2-kV/600-A (BSM600D12P3G001) SiC power modules (Fig. 2).

GaN Making Inroads

Efficient Power Conversion Corp. (EPC), a leader in enhancement-mode GaN-on-silicon power FETs, upgraded GaN performance while lowering its off-the-shelf cost with the EPC2045 (7 mΩ, 100 V) and the EPC2047 (10 mΩ, 200 V) eGaN FETs. Applications include single-stage 48-V-to-load open-rack server architectures, point-of-load converters, USB Type-C, LiDAR, wireless charging, multi-level ac-dc power supplies, robotics, and solar micro inverters.

The EPC2045 cuts the die size in half compared to the prior-generation EPC2001C. The EPC2047 also cuts the size in half, making it about 15 times smaller than equivalently rated silicon MOSFETs.

GaN is also a promising power technology for automotive and industrial applications. France’s startup Exagan is partnering with X-Fab to develop a mass-manufacturing process for GaN ICs on 200-mm wafers. It recently announced that it solved issues related to detectivity, material stress, and process integration, and is ready to help GaN chipmakers mass-produce GaN devices for a variety of applications.

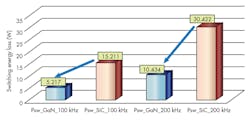

3. This chart compares switching loss between GaN Systems’ GS66508T E-HEMT and Cree’s (Wolfspeed’s) C3M0065090J SiC MOSFET. (Source: “A Performance Comparison of GaN E-HEMTs in Power Switching Applications,” June 27, 2017 issue of Bodo’s Power Systems).

Other top suppliers of GaN products are GaN Systems, NXP Semiconductors, and Wolfspeed. GaN Systems’ enhancement-mode high-electron-mobility-transistor (E-HEMT) technology was demonstrated to have lower switching losses than those of a competitor’s SiC MOSFET at frequencies of 100 kHz and 200 kHz (Fig. 3).

About the Author

Roger Allan

Roger Allan is an electronics journalism veteran, and served as Electronic Design's Executive Editor for 15 of those years. He has covered just about every technology beat from semiconductors, components, packaging and power devices, to communications, test and measurement, automotive electronics, robotics, medical electronics, military electronics, robotics, and industrial electronics. His specialties include MEMS and nanoelectronics technologies. He is a contributor to the McGraw Hill Annual Encyclopedia of Science and Technology. He is also a Life Senior Member of the IEEE and holds a BSEE from New York University's School of Engineering and Science. Roger has worked for major electronics magazines besides Electronic Design, including the IEEE Spectrum, Electronics, EDN, Electronic Products, and the British New Scientist. He also has working experience in the electronics industry as a design engineer in filters, power supplies and control systems.

After his retirement from Electronic Design Magazine, He has been extensively contributing articles for Penton’s Electronic Design, Power Electronics Technology, Energy Efficiency and Technology (EE&T) and Microwaves RF Magazine, covering all of the aforementioned electronics segments as well as energy efficiency, harvesting and related technologies. He has also contributed articles to other electronics technology magazines worldwide.

He is a “jack of all trades and a master in leading-edge technologies” like MEMS, nanolectronics, autonomous vehicles, artificial intelligence, military electronics, biometrics, implantable medical devices, and energy harvesting and related technologies.