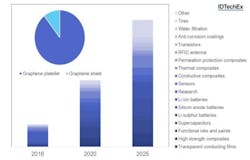

IDTechEx Research projects that the graphene market will grow to $220 million in 2026. This forecast is at the material level and does not count the value of graphene-enabled products. In many instances graphene is only an additive with low percent-by-weight values.

A continual decline in average sales prices will accompany the revenue growth, meaning that volume sales will reach nearly 3.8k tpa (tonnes per annum) in 2026. Despite this, forecasts by IDTechEx Research in the report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2016-2026 suggest that the industry will remain in a state of over-capacity until 2021 beyond which time new capacity will need to be installed. Furthermore, IDTechEx Research forecasts that nearly 90% of the market value will go to graphene platelets (vs. sheets) in 2026.

The market will be segmented across many applications, reflecting the diverse properties of graphene. In general, we expect functional inks and coatings to reach the market earlier. This is a trend that we forecasted several years ago and is now observed in prototypes and small-volume applications.

Indeed, IDTechEx Research projects that the market for functional inks and coatings will make up 21% of the market by 2018. Ultimately however, energy storage and composites will grow to be the largest sectors, controlling 25% and 40% of the market respectively in 2026.

For more information see the market report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2016-2026. You can also visit the Graphene and 2D Materials conference taking place April 27-28, 2016.

Bar chart: Ten-year market projections split by application. Inset pie chart: market share of graphene platelets vs sheets in 2026 by value. Full forecast data is available in the IDTechEx report. Source: IDTechEx Research report “Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2016-2026” (www.IDTechEx.com/graphene).

Will the industry come out of the red?

Last year IDTechEx Research forecasted that the graphene industry would largely remain in the red and that company valuations would mostly deflate. This is now confirmed by the latest filings and company statements showing that most companies are still operating at substantial losses. The valuations have also tended to decline. This in turn has put some firms off floating on public markets to raise money.

The good news is, however, that the industry is experiencing revenue growth across the board. Our research suggests that the industry expects to generate $30 million in 2016. We estimate that research grants make up at least 50% the overall revenue. This demonstrates the vital role that funding bodies are playing in sustaining an early stage industry.

The objective is to help graphene companies survive the commercialization chasm and outlive the often prolonged qualification periods. The downside however is that the business landscape is now populated with too many weakly-capitalized and poorly-differentiated players that each generate small revenues.

IDTechEx Research finds that the scene is now ripe for a consolidation since the actual market demand will not sustain all. This will benefit the whole industry since it will reduce the market fragmentation and creates larger and better consolidated entities able to stand on their own feet.

Graphene becoming increasingly available and affordable

Graphene commercialization follows a substitution strategy. This creates a long-term and severe downward price pressure. This is because even the price of the most expensive carbon that it seeks to replace (carbon nanotubes) is rapidly falling (less than $50/kg for MWCNTs). Therefore, graphene prices must come down whilst the industry still looks for that “killer application.”

This is already happening: some suppliers have already starting quoting prices <<$100/kg for certain types of graphene. The low single-digit capacity utilization prevents many from depreciating CapEx and reducing prices further, whilst many in the industry fear that this approach will lead to a premature commoditization of the industry and a further fall in valuations across the board. These factors, together with the multiplicity of production methods, mean that prices vary by several orders of magnitude on the market today.

Industry begins to focus and converge

In the early days, graphene suppliers targeted many divergent sectors. The industry however now has accumulated sufficient market feedback to find focus and to converge on specific applications.

Conductive inks and other functional coatings are becoming a first year-term priority for many given that it is a lower hanging fruit with a simpler (at least shorter) value chain. The applications are also numerous: anticorrosion coatings, transparent conducting electronics, glucose test strips, car seat headers, de-icers, etc. As in many other sectors, graphene also finds itself playing the role of the additive here. For example, it can be added to carbon inks to improve conductivity and branding, it can be added to zinc-based anti-corrosion coatings to reduce zinc loading, etc. IDTechEx Research forecasts that this will nearly be $25 million market in 2022 at the material supply level.

Energy storage will also emerge as a key area for graphene. IDTechEx Research forecasts that nearly $100 million of graphene will be sold into the energy-storage sector in 2026. Graphene as an additive in Li-ion electrodes is the main near-term opportunity. There are already products on the market and our insight shows that many battery manufacturers, both in Asia and elsewhere, are in the later stages of their qualification periods. We note that CNTs also found success here.

Here too, graphene will play the role of an additive to improve the performance of carbon-based Li-ion electrodes. There will also be no winning graphene morphology or type: the winner may vary from one battery manufacturer to another, and will depend on the exact formulations used in each battery. Note also that battery electrodes are often coated using slurries or pastes. Silicon anode and lithium sulphur batteries also represent long term opportunities. IDTechEx Research forecasts that these devices will become $4.3 billion and $1.2 billion markets in 2026, respectively. Graphene may enable this by helping alleviate a key shortcoming: limited cycle life. Early results show that it can do so in silicon anode batteries by absorbing some of volumetric changes experienced by the Si anodes, and in lithium sulphur batteries by entrapping the LiS particles to prevent the polyshuttle process.

Composites have also always been an attractive market for graphene. We forecast this sector to grow to nearly $60 million in 2026 at the material supply level. The ideal is to use graphene additives for converting low-cost and low-performance in plastics into low-cost and high-performance ones, thus changing the market hierarchy of plastic types. Early results show that graphene platelets are effective in imparting excellent mechanical, thermal, and permeation properties onto their host material at low loading levels. Unlike pastes and slurries, a key challenge will be in formulating a good dispersion.

Note that carbon nanotubes also found success in composites particularly in enabling conductive plastics. IDTechEx Research expects these CNTs to outperform graphene here. This is because CNTs advantage here is intrinsic to its morphology: long and thin tubes enable conduction per percolation at low wt% loading levels.

For more information visit the market report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2016-2026 and join the Graphene and 2D Materials conference taking place 27-28 April 2016 as part of the IDTechEx Show!

About the Author

Rick Nelson

Contributing Editor

Rick is currently Contributing Technical Editor. He was Executive Editor for EE in 2011-2018. Previously he served on several publications, including EDN and Vision Systems Design, and has received awards for signed editorials from the American Society of Business Publication Editors. He began as a design engineer at General Electric and Litton Industries and earned a BSEE degree from Penn State.