Trying to choke off billions of losses from its nuclear power plant projects, Toshiba said on Friday that it would spin off its memory chip business and seek out a cash infusion from outside investors.

The move comes after Toshiba said early this month that it was preparing to write down several billions dollars related to construction delays on four nuclear reactors and the 2015 acquisition of a nuclear power construction firm, CB&I Stone and Webster.

An independent chip company could ease some of its financial stress, while severing links that might complicate its plans to sell a fraction of the business. But the company has not said what form the spinoff would take or how much it would sell.

"Splitting off the memory business into a single business entity will afford it greater flexibility in rapid decision-making, and enhance financing options, which will lead to further growth of the business and maximize the corporate value of Toshiba," the company said in a statement.

Toshiba, which is also facing $60 million in fines over an accounting scandal, plans to spin off the business by March 31st. Founded in 1901, the Japanese conglomerate sells everything from office phones and printers to nuclear power reactors and water treatment systems. It employs around 167,000 people.

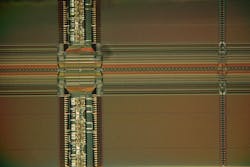

Toshiba's memory chip business is the second largest in the world after Samsung. It sells NAND flash memory based on its BiCS technology, an acronym for bits, cost, scalable. Last August, it unsealed a new version of its memory with 64 layers of circuitry stacked in three dimensions for greater capacity, also known as 3D NAND.

Masashi Muromashi, Toshiba's chief executive, has focused in recent years on further investing in its memory technology as well as factory production. The business, one of Toshiba's most profitable, generated sales of around 845.6 billion yen or $7.4 billion for the year ending last March.

In a statement, Toshiba said it would consider selling part of the new company, which excludes its image sensor technologies. One potential investor could be Western Digital, the maker of hard disk drives and the owner of SanDisk, which for years has partnered with Toshiba on NAND manufacturing.

It is also possible that China's Tsinghua Unigroup could make an offer. Over the last two years, the threat of regulatory action has forced it to abandon a $23 billion deal for Micron Technology and a $4.35 billion deal to acquire 15% of Western Digital. An investment would dovetail with its recently unsealed plans to build a $30 billion memory chip fab in Nanjing, China.

Toshiba is not the only Japanese electronics maker to split its semiconductor unit in recent years. In the most recent example, Sony spun off its chip business with an eye toward moving its image sensors into new markets faster. The move came in 2015 as the company aimed for applications in drones and cars.

About the Author

James Morra

Senior Editor

James Morra is the senior editor for Electronic Design, covering the semiconductor industry and new technology trends, with a focus on power electronics and power management. He also reports on the business behind electrical engineering, including the electronics supply chain. He joined Electronic Design in 2015 and is based in Chicago, Illinois.