Infineon Stacks Its Chips on the Future of Silicon Carbide

Infineon introduced its first chips made from silicon carbide (SiC) more than 20 years ago and has long touted the material as the future of power electronics. Now a lot more companies are perking up their ears.

Most notably, car manufacturers such as GM and Tesla are investing in chips made of SiC in a bid to build electric vehicles (EVs) that can travel farther on a charge and recharge faster when the battery is depleted.

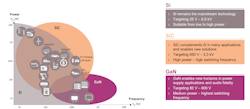

Peter Friedrichs, VP of the SiC business at Infineon, said silicon carbide is a generational shift in power switching at voltages of 650 V or above that must operate at high temperatures and in harsh environments. He noted SiC devices have unique physical properties that give customers the ability to squeeze more power into more compact envelopes that weigh less and create less heat, thus, resulting in better power density.

Friedrichs said Infineon sells SiC MOSFETs and other power devices to more than 3,000 customers today, including Delta Electronics, Hyundai, Schneider Electric, and Siemens. They are building them into the heart of electric vehicles, motor drives, solar inverters, and industrial-grade switch-mode power supplies (SMPS) that demand up to tens of thousands of watts—and many of these companies are not looking back.

“Some customers don’t want to talk about silicon at all,” Friedrichs said last month at APEC 2022.

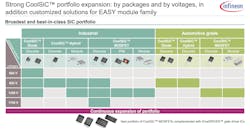

The power semiconductor giant last month rolled out a new series of SiC MOSFETs for everything from EVs to solar inverters, taking on standard MOSFETs and IGBTs in the very competitive market for 650-V devices.

It is also stepping up investment in the production of chips based on SiC—a material that fuses silicon and ultra-hard carbon—in a bid to shore up supplies and reduce the elevated cost of manufacturing SiC devices.

Upgraded 650-V SiC MOSFETs

At APEC, Infineon introduced its latest line of 650-V SiC MOSFETs, joining the 1200- and 1700-V devices in a product family that uses its SiC trench MOSFET technology to tap into the inherent advantages of the material.

The new chips are crammed in a compact D2PAK SMD 7-pin package relying on Infineon’s XT interconnect technology. They deliver better switching characteristics at higher currents and 80% lower reverse-recovery charge and drain-source charge than MOSFETs using legacy silicon. The interconnects build on the package’s thermal capabilities. Compared to a standard interconnect, up to 30% of extra power loss can be dissipated.

SiC is a wide-bandgap semiconductor, a property that helps it tolerate higher voltages—up to thousands of volts—before breaking down and handle higher temperatures—175°C or more—than silicon MOSFETs.

On top of high-voltage tolerance, SiC devices run at higher frequencies and more efficiently without the unwanted losses of standard IGBTs and MOSFETs that dominate electric vehicles on the road.

SiC also has less on-state resistance at higher voltage levels, which leads to lower conduction losses, higher current density, and dissipates more heat when regulating or converting electricity from one level to another. Furthermore, SiC delivers faster switching speeds than MOSFETs and IGBTs, which allows you to surround the immediate power stage with smaller external components such as transformers and passives.

Power devices based on SiC also lose less power to heat, opening the door to more compact and lightweight heatsinks. Altogether, these attributes translate into cost savings at the system level, industry experts said.

Featuring a wide gate-to-source range from −5 to 23 V and supporting a 0-V turn-off and gate-source threshold voltage (VGS(th)) of 4 V, the 10 new devices also work with standard MOSFET gate-driver ICs.

The SiC MOSFET is the top contender to take on IGBTs in high-voltage power supplies due to its decreased turn-on and turn-off losses in switches, which can help reduce the weight and bulkiness of power supplies. The IGBT unites the high input impedance and fast switching speeds of MOSFETs with the high conductivity of a bipolar junction transistor (BJT), and it can deliver tens of thousands of watts of power to electric cars.

However, engineers are less accustomed to the trade-offs of designing with SiC devices, which are relatively new to the power semiconductor world. IGBTs also remain popular because they are not as expensive as SiC MOSFETs.

Taking Over Electric Vehicles

While the IGBT is getting EVs on the road, Friedrichs said SiC devices are propelling them into the future.

He said SiC devices are competing for around 80% of the power electronics at the heart of the powertrain in electric vehicles, including the main traction inverter that converts direct current (dc) stored in the car’s battery pack into alternating current (ac) and feeds it to the electric motor turning the wheels. These chips are also fighting for design wins in other parts of the EV, such as the onboard charger and dc-dc converters.

Infineon has previously stated that SiC can help boost the range of electric vehicles on a single charge by 5% to 10%, or give auto makers the ability to use smaller, lighter, and less costly batteries.

Infineon is not alone in supplying silicon carbide to the EV market. Last year, GM agreed to buy SiC devices from Wolfspeed for the integrated power electronics in GM's Ultium Drive system.

The market for SiC devices in EVs alone will surpass $2.5 billion in 2030, according to estimates by Exawatt.

Infineon’s new MOSFETs bring SiC’s advantages to hard and resonant switching topologies in industrial and data-center power supplies, solar inverters and other renewable-powered infrastructure, and motor drives.

They also offer improved protections against avalanche—when the breakdown voltage of the MOSFET is exceeded—and short circuits. Thus, they are ideal for power-supply topologies with repetitive hard commutation and systems that need to be more robustly constructed to withstand tougher environments, such as under the hood of electric cars and trucks, on factory floors, or in the scorching heat of a solar farm.

The 650-V devices support bidirectional topologies to reduce system cost and support ease of integration.

Supply, Demand, and Prices

Friedrichs said that Infineon is trying to stay a step ahead of power design challenges with newer SiC devices. For example, the company is on the verge of rolling out the second generation of its unique SiC trench MOSFET technology in 2022, which will bring new levels of power density and power efficiency.

But he said it is also looking to stay ahead of global demand for silicon carbide as industries race to reduce their carbon footprints. Infineon plans to invest more than $2 billion to boost its production output of SiC and GaN.

Furthermore, Infineon is already planning to convert a portion of 200- and 300-mm production capacity at its fab in Villach, Austria, where it only started volume production last year, for SiC and GaN devices.

The challenge ahead is making sure the cost savings at the system level outweigh the higher cost of manufacturing SiC devices. Infineon and other companies are taking steps to close the cost gap with silicon, but they remain years out from closing it completely, according to analysts.

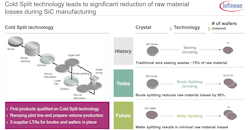

Companies have long understood how to create SiC by mixing silicon and carbon in a scorching-hot furnace. But it is significantly harder and more brittle than silicon, and thus it is more difficult to saw, grind, and polish the surface of a wafer without leaving scratches that can drag on the performance or power efficiency of the power devices. The result is that it tends to cost a lot more to manufacture SiC in large quantities.

Executives said Infineon has tricks up its sleeve. The company is ramping up production with a technology called Cold Split to cut wafers more carefully out of pillars of raw silicon carbide in a process analogous to splitting slates from rock. Cold Split promises to double the number of chips that can be sliced out of a wafer of SiC, helping it boost production and increase cost savings.

Infineon said it is preparing for volume production with the Cold Split technology in 2023.

About the Author

James Morra

Senior Editor

James Morra is the senior editor for Electronic Design, covering the semiconductor industry and new technology trends, with a focus on power electronics and power management. He also reports on the business behind electrical engineering, including the electronics supply chain. He joined Electronic Design in 2015 and is based in Chicago, Illinois.