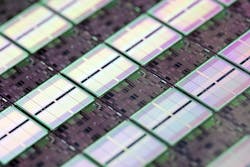

Qualcomm Signs U.S.-Made Chip Supply Deal With GlobalFoundries

Qualcomm is more than doubling its investment in GlobalFoundries, as it seeks to boost U.S. chip manufacturing by 50% in the next five years with the passage of the CHIPS and Science Act.

Under the terms of the deal, the San Diego, California-based smartphone chip giant has agreed to buy an additional $4.2 billion of chips from GlobalFoundries' most advanced facility in upstate New York. The deal brings Qualcomm's total purchasing agreement to $7.4 billion through 2028, according to GlobalFoundries.

The new long-term deal covers chips based on GlobalFoundries' FinFET platforms. The chips are set to be used in RF transceivers for 5G smartphones, Wi-Fi, automotive, and Internet of Things (IoT) connectivity.

CEO Thomas Caulfield said landing Qualcomm as a long-term customer at its upstate New York facility, coupled with new federal and state funding, will fuel the company's manufacturing expansion in the U.S.

The world's largest fabless semiconductor maker, Qualcomm was one of GlobalFoundries' first customers to sign a long-term agreement (LTA) to encompass multiple geographies and technologies in 2021.

The announcement comes as the U.S. prepares to start distributing funds made possible by the CHIPS Act, which will allocate more than $52 billion in federal subsidies for companies that build more production capacity for chips in the U.S. and shun China. Rounding out the package is $24 billion in tax credits for fab equipment to help ease the burden of building new chip plants that can cost more than $10 billion each.

The bill creates tens of billions of dollars to fund fundamental scientific research to drive innovation that in the future could give a boost to Qualcomm and other chip designers that are not eligible for subsidies.

The White House said the funding is the first step in rebuilding the U.S. chip sector and will "unlock hundreds of billions more" in private spending, citing Qualcomm's deal with GlobalFoundries as evidence of that.

Micron Technology intends to spend $40 billion on a U.S. fab expansion through the end of the decade in a bid to bolster U.S. memory production from less than 2% to more than 10% of global supply by 2030.

Senate Majority Leader Chuck Schumer, who was a staunch supporter of subsidies for the American chip industry, praised the deal. "We can already see the semiconductor industry reinvesting in the U.S.," he said.

"With major new federal incentives for microchip manufacturing in the United States, I look forward to many more announcements like this to come," the top Senate Democrat said in a statement on Monday.

GlobalFoundries is the world's No. 3 contract chip supplier behind TSMC and Samsung, but it ranks second when leaving out Samsung's foundry unit that builds chips designed by other divisions of the conglomerate.

GlobalFoundries makes chips for the U.S. Department of Defense and companies such as AMD, Broadcom, and MediaTek. The company has been trying to transform itself after it stepped out of the race with TSMC, Intel, and Samsung to build the most advanced processors in favor of focusing on feature-rich chips based on more mature process nodes that are essential to everything from smartphones to automotive to the IoT.

Business has been booming amid a global chip shortage that has snagged production for a broad range of consumer goods for years—although there are signs the pandemic boom in chip demand is cooling down.

Due to the chip shortage, many semiconductor firms moved to lock in long-term agreements with their foundries. Qualcomm, Nvidia, and others are spending billions of dollars to reserve production capacity years in advance at GlobalFoundries and other contract chip makers overloaded with orders. For its part, GlobalFoundries gains access to more binding long-term forecasts and capital to fund its expansion plans.

The new deal builds on a long-standing partnership between the firms. In 2021, Qualcomm signed a long-term contract for chips based on GlobalFoundries' 22FDX technology at its Dresden, Germany, facility.

The partnership is expanding to include additional capacity at GlobalFoundries' future production facility in France, where it plans to invest around $5.7 billion to build a fab with the help of STMicroelectronics.

Qualcomm said it has also reserved production capacity for the company's RF silicon-on-insulator (RFSOI) technology to use in sub-6 GHz front-end modules (FEMs) for 5G smartphones and other mobile devices.

These chips, which sit in front of the baseband modem in 5G smartphones, will primarily be manufactured at GlobalFoundries' Singapore fab, which currently undergoing expansion. Full ramp-up is due by early 2023.

"With accelerating demand for 5G, automotive and IoT applications, a robust supply chain is critical for ensuring innovation in these areas remains uninterrupted," said Roawen Chen, senior vice president and chief supply chain and operations officer at Qualcomm.

About the Author

James Morra

Senior Editor

James Morra is the senior editor for Electronic Design, covering the semiconductor industry and new technology trends, with a focus on power electronics and power management. He also reports on the business behind electrical engineering, including the electronics supply chain. He joined Electronic Design in 2015 and is based in Chicago, Illinois.