Semiconductors 2022: A Growth Market Comes into Focus

This article is part of the 2022 Electronic Design Forecast issue

What you'll learn:

- Key components that go into developing the forecast.

- What factors are making this year's forecast more difficult?

- Predictions for this upcoming year in the semiconductor market.

The past two years have been eye-opening. Who would have guessed that the semiconductor market would shine through a multi-year pandemic of a deadly disease? Yet, that’s exactly what happened. With that as a starting statement, what might lie in store for 2022?

Objective Analysis has seen forecasts that run the gamut from the very negative to wildly optimistic. We will add our voice to this clamor with our 6% growth prediction, but the following paragraphs will explain both how we arrived at 6% and the circumstances that could move that number either up or down.

Forecast Drivers

The Objective Analysis Forecast Model has provided the company with consistently accurate forecasts for the past 14 years. In fact, unlike other forecasters, we post our past successes and failures on our website because we’re proud of our success rate. But our forecast model doesn’t count on being able to predict events like those driven by a pandemic. Let me explain the basic underpinnings of this forecast model:

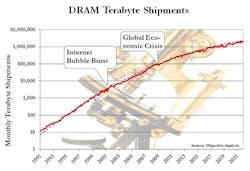

Demand grows predictably: With rare exceptions, demand increases at a relatively steady rate. This is borne out by Figure 1, which illustrates monthly WSTS DRAM gigabyte shipments from 1991-2018. There’s remarkably little noise in this curve, but a very close look will find drops in 1996, 2000, and 2009, two of which are called out. We’ve also had shortages that are harder to observe in 1995, 1999, and 2018. While these shortages and oversupplies might appear as mild fluctuations in this chart, they dramatically impact pricing. It’s not too difficult to produce a reasonably accurate demand forecast by extrapolating this trend.

Supply increases less consistently: As a general rule, chip manufacturers add capacity during profitable years, and fail to add capacity during unprofitable years. Combined with predictable demand, this leads to oversupplies and shortages. If you know this year’s semiconductor capital spending, then you can make a reasonable guess at whether the semiconductor market will be oversupplied or in a shortage two years from now.

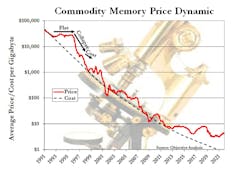

Pricing follows a pattern: When there’s a shortage, commodity prices typically flatten and rarely increase significantly. At the end of the shortage these prices typically fall to cost, and then hug the cost curve until the next shortage occurs. This is graphically illustrated for DRAM prices in Figure 2. Although the prices for non-commodity products vary much less than those of commodities, they tend to increase and decrease at the same time as the commodities. The only trick here is determining the timing of oversupplies and shortages.

Chip production costs decrease predictably: Gordon Moore was the first to point out the predictability of chip price declines when he wrote the article that created Moore’s Law in 1965. While the rate of advancement has slowed over time, costs still decrease at a rate faster than almost any other industry. Since we can predict costs for the next few years with some degree of accuracy, it’s not difficult to apply the above pattern to determine prices. These costs show up in Figure 2 as a black line.

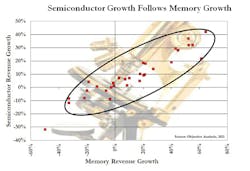

The overall semiconductor market’s growth is a function of commodity growth: The memory business, largely DRAM and NAND flash, is the largest commodity in the semiconductor business, accounting for about 30% of revenues, depending on the year. This means that swings in these markets have a profound effect on the total semiconductor market. The chart in Figure 3 shows the relationship of semiconductor revenue growth to memory revenue growth. The black orb emphasizes the relationship between the two. This means that anyone who can accurately predict the memory market can simply use a ratio to produce an accurate semiconductor forecast.

That’s all there is to it.

Market Anomalies

So, what’s making the current market difficult to predict?

- Demand is behaving abnormally: At the onset of the pandemic, cell phone and automobile sales simply stopped. In late 2020, cell phone sales rebounded, and in summer 2021, automotive sales recovered. Meanwhile, the work/study/learn/play-from-home phenomenon drove a massive build-out of internet data centers as well as boosted laptop PC sales while dramatically reducing desktop PC sales. In all of this chaos, chip demand has been much greater than the producers expected. This has not only caused a dire shortage of older technologies, but also made both 2020 and 2021 banner years for memory, processor, and other chip makers by driving mild shortages in those markets. It has hampered our ability to predict the timing of shortages and oversupplies.

- Prices have increased during shortages: Although commodity prices rarely increase significantly during a shortage, as we saw in Figure 2, they have recently undergone important upturns in 2018 and in 2021. Since prices aren’t behaving the way they typically do in a shortage, they render it challenging to accurately predict revenues.

- We are in a pandemic, yet the global economy is faring well: While Objective Analysis, along with other semiconductor market forecasters, doesn’t try to forecast the global economy, a collapse like the one in 2008 can create massive changes to our forecast. We’re concerned that the current stimulus packages and lower tax revenues caused by COVID-19 are creating government debt that will be extremely challenging to overcome. Part of that is already causing inflation concerns, and we mustn’t be surprised if there’s a dramatic economic correction sometime soon. In the near term, though, it appears that stimulus payments, at least in the U.S., are being spent largely on discretionary items, and this is part of the reason for today’s demand surge.

With all of this background, how does Objective Analysis see the market developing in 2022?

Predicting 2022

As mentioned at the beginning of this article, we’re predicting another 6% growth on top of an amazingly strong 2021, a year in which growth is now poised to reach 26%. This will take 2021 world semiconductor revenues over $550 billion, and 2022 revenues to $590 billion. This is based on our analysis of capital spending vs. the requirements to supply a market in its current state with its current level of demand.

Looking at the worst case, should the global economy fail early in 2022, and should demand dry up as a result, how badly could the market do? Given the current profitability levels of DRAM and NAND flash, memory market revenues could drop by 35%, taking the total semiconductor market down by the high teens.

Could there be further upside from the 6% that our model predicts? It’s certainly possible, but it would be driven by phenomena that are incredibly rare in this market, so we don’t account for them. This includes significant price increases that, as mentioned earlier, are extremely unusual occurrences.

Our recommendation for corporate management is to plan for our 6% market, but to organize to be able to quickly respond to market changes. That’s because there’s a higher likelihood than normal such changes will occur in the near future.

Read more articles in the 2022 Electronic Design Forecast issue

About the Author