This year is proving extremely profitable for the international electronics industry. Thus, as Electronica 2014, the world’s largest electronics show, opens its doors, it begs the question: Will the good times keep rolling or is the crest of the financial wave about to break?

This year’s Electronica event finds itself in much calmer financial waters compared to the Euro crisis that hovered over the 2012 show. The overwhelming question on people’s minds back then was how the electronics industry would deal with the Eurozone monetary crisis that threatened not only the downfall of that currency, but a serious weakening of the European Union in its entirety.

At that time, Europe's semiconductor manufacturers experienced a drop in revenues; as an industry group, the decline was put at around 8% with some individual companies experiencing a 15% reduction. However, analysts and pundits were stubbornly optimistic that 2013 and 2014 would develop into a boom time for the industry, with growth rates being quoted from 6% to 9%.

Trying to accurately predict how a market sector will trade in a forthcoming year is a tricky business. Those who forecast will spend hours scratching the heads, tapping their calculators, feeling the industry pulse, and staring into the swirling mists of their crystal balls in an attempt to gain a clear vision.

Here at Electronic Design Europe, we gathered up all available industry statistics and threw them into a mathematical melting pot. The goal was to come up with a good average market growth figure that had a credible chance of being accurate compared to actual numbers calculated for post-2014 analyses.

Did We Get It Right?

The simple answer is, no, we didn’t. Our estimate that overall growth for the semiconductor industry in 2014 would range from 7% to 9% was way too conservative, confirmed by statistics revealed earlier this year by industry association SEMI.

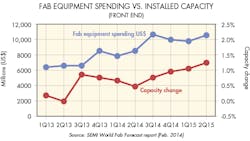

According to SEMI, the worldwide semiconductor manufacturing equipment billings reached US$ 10.15 billion in the first quarter of 2014, an astounding 39% higher than the same quarter from a year ago. This analysis should be taken seriously because data is gathered jointly with the Semiconductor Equipment Association of Japan from over 100 global equipment companies that provide monthly market information.

These figures are important because no industry that feels it’s in a phase of recession will invest heavily in manufacturing equipment (Fig. 1). That situation will only change when the industry outlook has a promise of buoyancy, and even then companies can be reluctant to overly commit on capital expenditure.

Numbers from SEMI Silicon Manufacturers Group’s analysis on worldwide silicon-wafer-area shipments further endorsed 2014’s good fortunes. Shipments increased during the second quarter of 2014 when compared to the first quarter, according to its quarterly report on the silicon wafer industry. In addition, total silicon-wafer-area shipments were 2587 million square inches during the most recent quarter, close to a 10% increase from the 2363 million square inches shipped during the previous quarter.

“For two consecutive quarters, strong silicon shipment growth has been recorded by the Silicon Manufacturers Group,” explained Hiroshi Sumiya, chairman of SEMI SMG and general manager of the Corporate Planning Department at Shin-Etsu Handotai Company. “Silicon wafer shipments reached an all-time high in the second quarter, surpassing the previous peak of 2489 million square inches shipped in the third quarter of 2010.”

These positive electronics industry-trading figures are also reflected in analysis done by the SEI (Semiconductor Industry Association). Of course, it’s reasonable to say that the SEI, as an organization, likes to put forward positive views and statistics when assessing the semiconductor side of the electronics business.

That said, according to SEI’s analysis, worldwide sales of semiconductors reached $82.7 billion during the second quarter of 2014—an increase of 5.5% over the previous quarter and a 10.9% jump over the second quarter of 2013. Global sales in June this year topped almost $28 billion, marking the industry’s highest monthly sales ever recorded. June’s sales were 10.8% higher than June 2013’s total of $24.88 billion and 2.6% more than last month’s total of $26.86 billion. Year-to-date sales during the first half of 2014 were 11% higher than they were at the same point in 2013.

“Through the first half of 2014, the global semiconductor market has demonstrated consistent, across-the-board growth, with the Americas region continuing to show particular strength,” commented Brian Toohey, president and CEO of the Semiconductor Industry Association. “The industry posted its highest-ever second-quarter sales and outperformed the latest World Semiconductor Trade Statistics (WSTS) sales forecast.”

This file type includes high resolution graphics and schematics when applicable.

Furthermore, analysis released on September 9, 2014 shows the latest Cowan LRA model forecasts 2014’s global semiconductor sales to reach $335.5 billion. Cowan’s updated sales forecast result, derived from the WSTS’s July 2014 actual sales, yields a 2014 sales growth forecast of 9.8% when compared to 2013’s final sales of $305.6 billion.

The newly calculated year-over-year sales growth forecast rose slightly from last month's published forecast estimate of 9.5%, which was based on the WSTS’s June 2014 actual sales reported last month. According to the WSTS, July’s actual global semi sales number came in at $27.600 billion, topping last month’s July forecasted sales estimate of $26.447 billion

Looking at geographic regions, 2014 sales figures compared to June 2013 figures showed increases in the Americas (12.1 %), Europe (12.1%), Asia Pacific (10.5 %), and Japan (8.5 %). All four regional markets posted better year-to-date sales through the first half of 2014 than they did through the same point last year.

Well…What About Europe?

Electronica may well be an international event, but geographically it’s also regarded as having a strong European influence. So does all of the optimism and industry growth already reported in this column also include Europe? The answer is maybe.

Why so unsure? Even though the major Euro currently crisis that served as a backdrop to 2012 Electronica may have dissipated, there are various harbingers indicating dark financial clouds could bubble up on the horizon.

Italy and France, for example, recently posted disappointing economic results. France may well be the fifth largest economy in the world and the second largest in the EU, but its growth has stagnated at 0.0%. And Italy’s gross domestic product figures have declined for the past three years. Thus, it’s no surprise that the country is now officially considered to be back in recession, which is particularly troubling news for Europe since it’s the third largest economy in the Eurozone.

Worrisome Signs

France and Italy aren’t the only countries facing uncomfortable economic truths. Germany, Europe’s industrial power house, is combating a weakening economy with a GDP decline of 0.2%, while Portugal and Greece can’t seem to climb out of their financial stresses of recent years.

One European Union member experiencing a positive economic situation is the United Kingdom. Estimates of 3.2% GDP growth comes in well above the March 2014 forecast of 2.7% made by the Office for Budget Responsibility, the UK Government's independent fiscal watchdog.

Earlier this month, the Bank of England upgraded its growth forecast for this year to 3.5% from 3.4%. However, it must be remembered that the UK is not a member of the Eurozone, having decided to stick with its own pound currency.

What Do the Numbers Mean?

While the Eurozone economic woes may have declined since those days of Electronica 2012, it’s quite clear they haven’t vanished. Nonetheless, the question we asked in this magazine at that time, “Can The Chip Makers Beat The Euro Zone Blues?,” has been answered with a resounding yes.

The WSTS would certainly agree with that. It predicts that the world semiconductor market will reach US$325 billion in 2014, up 6.5% from 2013. Moreover, all major product categories will show a high single-digit growth rate, except for a soft decline in microprocessors. Smartphones, tablets, and automotive applications will largely drive the growth. Overall highest growth rates belong to the analog (9.1%) and sensor (9.1%) sectors.

Looking Ahead to 2016

Over the next two years, WSTS suggests continued growth for the worldwide semiconductor market, forecasting US$336 billion in 2015 and up to US$350 in 2016. In terms of applications, the automotive and communications sectors, particularly wireless, will gain strength while consumer- and computer-related sales remain almost flat.

By region, Asia-Pacific will see the largest upswing. It’s expected to reach US$207 billion in 2016, which is almost a 60% share of the total semiconductor market.

Europe Must Improve

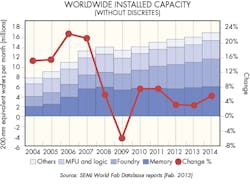

While healthy semiconductor sales growth is expected in the Asia Pacific region, Europe’s electronics industry needs to step up its game to compete with major players like the US, Taiwan, and Japan. Just recently, a group of 11 European electronics industry CEOs, including the heads of ARM, Infineon, and STMicroelectronics, recommended that the European Commission (EC) create research centers focused on the IoT. It would be just one part of an overall strategy to reverse the Europe’s declining share of the worldwide semiconductor industry.

In its Electronics Strategy for Europe, the EC will also attempt to boost Europe’s share of the worldwide semiconductor market. The region boasted more than 16.5% of world production 20 years ago, but that number has shrunk to under 10% in the past decade. It pales in comparison to Japan, which has a 22% share, followed by South Korea (18%), Taiwan (17%), and the US (13%).

The EC wants to build on Europe’s strengths in vertically integrated markets, such as automotive, energy, security, and smartcards, as well as its strong position in new markets like sensors and microprocessors. Other key sectors include virtual components and low-power processors, plus the supply of equipment, materials, and IP. Also, as mentioned, maximizing IoT-based opportunities is a critical piece of the puzzle.

In summary, the global electronics industry can continue to prosper and grow despite the economic concerns that continue to stalk nations in the Eurozone and the cyclical financial downturns that inevitably effect countries economies through the world. Prosperity will continue thanks to the development of new technologies to serve the constantly expanding number of tech-reliant applications, much of which will be on display at Electronica 2014.