Last December saw the 3GPP announce release 15, which specifies the first elements of the 5G NR (5G New Radio) standard, a widely anticipated development with far reaching implications.

This joins the Verizon pre-5G specification, sparking memories of the 3G roll-out (with the competing, but ultimately doomed, NTT DoCoMo 3G standard) in which early equipment could work in a limited subset of countries only. It prompted the need for tri-band phones, which increased the overall cost for manufacturers.

Will lessons have been learned this time?

As for 4G, the biggest challenge (or failing) here hasn’t been the equipment, or even speed, but the quality of service received. With a slow roll-out in many countries, nationwide coverage has suffered and operators were forced to trade off coverage for speed. The takeaway lesson here is that capacity needs to be ramped up quickly.

If you can get a strong signal, LTE is easily fast enough to stream HD content, but the availability of this signal is often limited, even in cities. Here in the U.K., we’re roughly on the median line for both metrics.

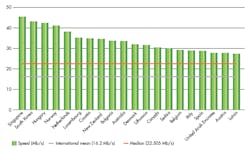

1. The world’s top 20 mobile networks, based on coverage. Data extrapolated from OpenSignal’s June 2017 report.

Conversely, some countries, including the U.S., have focused on coverage rather than speed. Thus, only four countries (South Korea, Norway, Netherlands and Hungary) are listed in the top 10 for both coverage and speed. And just five of the top 10 for coverage make it into the top 20 for speed (adding Lithuania) (Fig. 1).

What Will 5G Be Like?

The final standards aren’t set, and we’re still in the trial phase, but it’s certain that speeds will be important in consumer take up of 5G. For instance, Etisalat has already hit speeds of over 70 Gb/s using an unlicensed band transmission—over 1500 times the current national average of Singapore, which has the world’s fastest national network (Fig. 2). But 5G is about so much more than 4K TV streaming.

2. The world’s top 20 mobile networks, based on speed. Data extrapolated from OpenSignal’s June 2017 report.

In fact, lower latency is going to be the real breakthrough with 5G, dropping from 25 to 40 ms to approximately 1 ms. Latency this low will enable new paradigms, such as the remote control of industrial robots and the long-awaited autonomous vehicle, by dramatically cutting reaction times. With LTE’s latency (admittedly still far lower than a human’s reaction times of 670 to 1,500 ms), a self-driving vehicle moving at 120 kph (75 mph) would travel between 0.83 and 1.33 m before even starting to decelerate. With 5G’s predicted latency of 1 ms, this drops to just 3 cm.

But for autonomous vehicles to take off, then coverage needs to be everywhere, and this means a very fast rollout.

5G Frequencies

In the U.S., the FCC has made three millimeter-wave licensed bands (28, 37, and 39 GHz) available for high-speed transmission, plus added capacity in the 60-GHz band (traditionally used for WiGig). However, 5G NR will also be able to use the sub-millimeter-wave frequencies, notably the 3.5-GHz band. In fact, AT&T is starting its initial trials on the 15-GHz band before switching to 28 GHz, and T-Mobile in the U.S. is even talking about using the 600-MHz band.

Each band comes with tradeoffs in terms of range and capacity. The 60-GHz band delivers 14 GHz of bandwidth, enabling ultra-high-speed transmissions or, more likely reducing the need for MIMO and high-order modulation. In turn, it allows for lower power consumption at the handset. The 28-GHz band is already being used by Verizon, and now AT&T will trial 5G for fixed wireless access in 13 U.S. cities (11 Verizon, 2 AT&T). The 39-GHz band has also undergone trials.

It’s also worth noting that Verizon and AT&T recently had a bidding war for the small U.S. firm Straight Path, with Verizon winning with its 3.1 billion USD. Though Straight Path has no IP, it offers a considerable amount of spectrum in these licensed millimeter-wave bands.

Indeed, 2018-2020 will see trials being run in many of the traditional early-adoption countries, with Australia and Japan timing theirs to coincide with international sports events (the Commonwealth Games/Winter Olympics) and the likes of China, South Korea, Sweden, Estonia. and the U.K. also running trials on these frequencies. Telecom Italia has announced that the small, mountainous principality of San Marino will be the first to have nationwide coverage, using the 5G NR specification (Fig. 3).

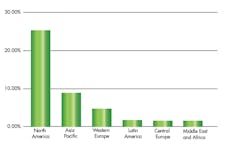

3. Proportion of mobile subscribers in each region that will have 5G come 2022. Data extrapolated from Ericsson’s June 2017 Mobility Report.

But it’s the 3.5-GHz band (C-Band) that will likely be most used to deliver nationwide coverage, according to ABI:

“The industry has had to tap into a wide range of radio spectrum frequencies from sub-1-GHz to 100 GHz, including licensed, unlicensed, and shared spectrum to address the potential of 5G. According to new findings from ABI Research, while the use of mmWave is one of the most distinguishing features of 5G, in the near term, the C-Band is emerging with the most global consensus for the timely launch of commercial 5G network in 2019. Many of the lab and field 5G trials conducted by industry participants have focused on higher frequencies, but based on the recent regulatory announcements by about 20 countries, the C-band is the most common spectrum range identified for 5G.”

With 150 MHz of bandwidth, the C-Band will bring about significantly lower speeds (versus 60 GHz’s 14 GHz of bandwidth, 28 GHz’s 0.85, and 37 GHz’s 1.4). However, it will enable operators to better balance range and coverage, while being easier to control than mmWave technologies. In addition, by being licensed, it allows the operators to guarantee a Quality of Service.

Flexible Architectures Can Speed 5G Rollouts

4G’s rollout has been slow in many countries. Here in the U.K., mobile phone coverage has been described as “deplorable” by chair of the National Infrastructure Commission. Even a 2G call on the transport network is considered “nearly impossible.”

While infrastructure requires investment, operators could rollout 5G rapidly and cost-effectively through alternate means, namely flexible architectures. Software-defined-radio (SDR) platforms have significantly grown in capability in recent years, and last year saw the launch of the first designed specifically for carriers. The LimeNET base station uses two LMS7002M RF transceiver chips to deliver 4×4 MIMO, running at 700 GHz (LTE) plus 1.8 GHz, 2.6 GHz, and 3.5 GHz (Fig. 4).

4. The photo shows the LimeNET base station.

This technology has already been backed by Vodafone, the world’s second biggest operator. While LimeNET was the first, I doubt it will be the only carrier-grade base station for long. Indeed, it was trending at the recent MWC.

Taking this SDR approach not only drops the infrastructure costs significantly versus hardware-based solutions, but because they’re software-defined, it also means their functionality can be changed remotely, via over-the-air software upgrades, as standards evolve. Quortus has already announced a carrier-grade LTE cellular core network app to run on SDR base stations.

And Vodafone isn’t alone. Possibly the highest-profile adopter is BT/EE, which is using low-cost SDR systems in collaboration with 10 academic partners to understand and develop ways they can add 4G capacity affordably in even the very remote mountainous and island regions of the U.K. We’re seeing similar moves from several other major operators around the globe, too.

Flexible Architectures Enable Network Customization

The needs of a small, remote village will not be the same as that of traders in the city, and the needs of an autonomous vehicle will differ from those of a commuter on a train desperately trying to access Netflix.

The move by the likes of Vodafone and BT/EE to a software-based infrastructure will also enable them to tailor the features of that base station to suit the needs of its community, changing how it is configured over time. This allows permanent and temporary infrastructure to be used to meet the needs of temporary events, such as a sports match or music festival, switching back to normal use after these are held.

So, Will Lessons be Learned from the Rollouts of 3G and 4G?

That we can’t say. But in terms of the 4G issue (capacity), early-adopting operators and equipment manufacturers are now able to at least use more agile, programmable RF technologies to help them quickly add 5G capacity where it’s needed—with services that suit local needs, not the national average.

And vitally, when early adopters find that the rest of the world adopts a different 5G standard, causing mobile handset equipment to become costlier or less available, it allows them to switch the network quickly and offer better value to customers.

About the Author

Dr. Danny Webster

Principal RF Design Engineer

Dr. Danny Webster graduated from Swansea University in 1988, and worked for Thorn EMI Electronics Ltd. He was awarded a PhD at University College London in 1995 and then worked as a Research Fellow at University College London, leading to consultancy work with Nokia, Roke Manor Research, and Agilent. From 2001, Webster has worked for Hipertech Ltd. He is a senior member of the IEEE.