Roadmaps have been a staple of the semiconductor industry, in particular the International Technology Roadmap for Semiconductors (ITRS). The final ITRS roadmap was issued in 2016. In May 2016 the IEEE announced the launch of the International Roadmap for Devices and Systems (IRDS), a new IEEE Standards Association (IEEE-SA) Industry Connections (IC) program to be sponsored by the IEEE Rebooting Computing (IEEE RC) Initiative in consultation with the IEEE Computer Society. Together, this group will ensure alignment and consensus across a range of stakeholders to identify trends and develop the roadmap for all of the related technologies in the computer industry.

The IRDS represents the next phase of work that began with the partnership between the IEEE RC Initiative and the International Technology Roadmap for Semiconductors 2.0 (ITRS 2.0). With the launch of the IRDS program, IEEE is taking the lead in building a comprehensive, end-to-end view of the computing ecosystem, including devices, components, systems, architecture, and software. The Methods of governance, reports, and strategic roadmaps developed by the ITRS and ITRS 2.0 will inform the IRDS within the IEEE-SA IC program.

Exploration of this activity includes:

- Identifying key trends related to devices, systems, and all related technologies by generating a roadmap with a 15-year horizon.

- Determining generic devices and systems needs, challenges, potential solutions, and opportunities for innovation.

- Encouraging related activities worldwide through collaborative events such as related IEEE conferences and roadmap workshops.

Looking back, the first semiconductor roadmap was published by the Semiconductor Industry Association (SIA) in 1993. In 1998, the SIA became closer to its European, Japanese, Korean, and Taiwanese counterparts by creating the first global roadmap: The International Technology Roadmap for Semiconductors (ITRS).

The ITRS was a set of documents produced by a group of semiconductor industry experts. These experts were representative of the sponsoring organizations which include the Semiconductor Industry Associations of the United States, Europe, Japan, South Korea, and Taiwan. These documents carried the disclaimer: “The ITRS is devised and intended for technology assessment only and is without regard to any commercial considerations pertaining to individual products or equipment.” The documents represent best opinion on the directions of research and timelines up to about 15 years into the future.

This international group had over 900 companies affiliated with working groups within the ITRS. The organization was divided into Technical Working Groups (TWGs), which eventually grew in number to 17, each focusing on a key element of the technology and associated supply chain. Traditionally, the ITRS roadmap was updated in even years, and completely revised in odd years.

In April 2014, the ITRS committee reorganized the ITRS Roadmap to better suit the needs of the industry. The plan was to take all the elements included in the 17 technical working groups and map them into seven focus topics. Focus was on the new tools and processes to produce heterogeneous integration of all these things.

- System Integration

- Outside System Connectivity

- Heterogeneous Integration

- Heterogeneous Components

- Beyond CMOS

- More Moore

- Factory Integration

PEIC Offers 2017 Power Electronics Industry Roadmap

Now, a new group has entered into the roadmap world, this time specifically for power electronics. This roadmap looks at all facets of power electronics from semiconductors to manufacturing. It is the U.S. Power Electronics Technology and Manufacturing Roadmap developed by the U.S. Power Electronics Industry Collaborative (PEIC) and submitted as the final report to National Institute of Science and Technology (NIST) for PEIC’s 24-month project entitled “Strengthening the Domestic Power Electronics Ecosystem,” which was funded by the U.S. Department of Commerce under their Advanced Manufacturing Technology AMTech Program. The report’s lead authors are Keith Evans, president of PEIC, and Dave Hurst, formerly a market analysis expert at NextEnergy.

This roadmap shown in Fig. 1, shows that recent advances in power semiconductor technology have opened up new opportunities for innovation in power electronics. Market and regulatory conditions have created global demand for power electronics systems that take advantage of new semiconductor technologies to enable higher-efficiency devices that operate at higher temperatures, higher frequencies, and higher voltages in smaller packages and lower overall system cost. To meet these demands at scale, several technological and manufacturing challenges need to be overcome. This roadmap provides an overview of these challenges, the current state of the art, and emerging solutions to achieve these benefits. Emphasis is placed on understanding trends including inter-dependencies in semiconductors, capacitors, magnetics, and packaging technology. Using this information, this roadmap also presents key strategic recommendations for the U.S. to take advantage of these technological trends.

Development of wide bandgap (WBG) semiconductor devices is a major component of the global innovation race in power electronics. WBG semiconductor devices, especially SiC and GaN-on-Si devices, are beginning to penetrate the market, although Si devices continue to dominate the industry.

The U.S. WBG semiconductor device manufacturing supply chain is more developed in SiC device technology, while GaN-on-Si devices tend to be manufactured in Asian foundries, leveraging the massive silicon device foundry infrastructure there.

In addition, next-generation WBG semiconductors like bulk GaN and so-called ultra-wide bandgap (UWBG) semiconductors like gallium oxide (Ga2O3), aluminum gallium nitride (AlGaN) and diamond are in aggressive development as they promise additional performance advantages over SiC and GaN-on-Si.

Semiconductors are just one part of the overall power electronics system. While WBG and UWBG semiconductors are capable of operating at higher voltages and temperatures, today’s capacitors are not. Similarly, while WBG semiconductors are capable of operating at higher frequencies, today’s soft magnetics are not. Additionally, advances in packaging and thermal management are required before WBG semiconductors can be fully leveraged. The implication of improved semiconductor performance has ripple effects throughout the supply chain for power electronics.

Components that support the overall power electronics systems, including capacitors, magnetic components, and packaging technologies are being pushed to match the new semiconductor performance levels, which in turn is creating market conundrums that are hampering growth of advanced semiconductors.

Current capacitor technologies struggle to match the high temperature performance needs, as existing capacitor technologies are limited by the properties of the dielectric used. Consequently, this presents a global innovation whitespace for the discovery and development of materials that exhibit the desired properties with reliability and durability that can meet a variety of applications.

Ferrites are the dominant form of soft magnetics used in power electronics systems today, primarily due to their low cost. However, they are bulky and reducing their size requires higher frequency operation, which causes high losses. Amorphous alloys and nanocrystalline materials are being explored as potential solutions to this issue, but none of the materials developed exhibit the desired performance characteristics at a competitive cost yet.

New packaging techniques and materials are being developed to improve the performance of power electronics systems at high temperatures with improved reliability over many thermal cycles. These innovations focus on two critical areas of packaging, the die attach and the interconnection. In order to ensure reliability at higher temperature, new die-attach techniques and materials are under development, including silver-tin alloy soldering, silver sintering, and embedded packaging. Current interconnection methods are also prone to failure and lose reliability at higher temperatures. New interconnection techniques are under development, including ribbon bonding, ball bonding, and embedded packaging.

The Complete Roadmap

The complete U.S. Power Electronics Technology and Manufacturing Roadmap explores these technology and market trends in detail and summarizes those trends in easy-to-understand technology and manufacturing roadmaps. Key challenges to and growth opportunities for the U.S. supply chain are identified and a number of detailed recommendations are made to close important gaps and to leverage positions of strength, all aimed toward strengthening the domestic power electronics ecosystem.

PEIC

PEIC is a national member-based consortium comprised of industry, academic, and government stakeholders in power electronics that undertook the roadmap project to provide an in-depth analysis of the domestic supply chain to identify its strengths and weaknesses and to apply that analysis toward advancing power electronics technology development in the U.S.

The completed technology roadmap/supply chain report was presented to members at PEIC’s 2016 annual meeting. The full text of the report (~90 pages) is available to PEIC member companies. The full report is also available for purchase by non-members–an executive summary and pricing details are available by e-mailing PEIC at [email protected].

EPC

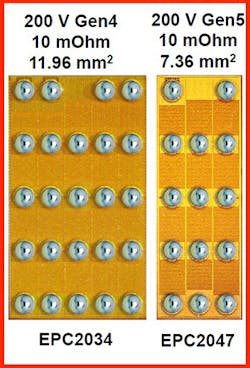

Efficient Power Conversion (EPC) is working its way toward improved GaN-on-Si devices that appear on the PEIC roadmap. The company’s recently introduced Generation 5 devices are physically smaller and have significantly lower capacitance than Generation 4. This translates into lower gate-drive losses and lower device-switching losses at higher frequencies for the same on-resistance and voltage rating. In the case of the EPC2045, a 30% reduction in power loss with 2.5 percentage points better efficiency than the best comparable MOSFET was achieved in a 48 V to 5 V circuit operating at 500 kHz switching frequency. Figure 2 compares Gen 4 and Gen 5.

Widening the performance/cost gap with equivalent silicon power transistors, the 100 V, 7 mΩ EPC2045, cuts the die size in half compared to the prior-generation 10 EPC2001C eGaN FET. The 200 V, 10 mΩ EPC2047 eGaN FET also cuts the size in half so that it is now about 15 times smaller than equivalently rated silicon MOSFETs.

The performance, size, and cost improvement evidenced in Gen 5 products were made possible by an innovative method of both reducing the electric fields in the drain region during breakdown, and significantly reducing the number of traps that could cause electrons to become inactive.

Alex Lidow, CEO of EPC, said he felt the PEIC roadmap was good. In particular, he said that he thought it was a good idea to include other components in addition to semiconductors. The one area that he felt was keeping pace with GaN products were core materials. He has run into applications where the core material prevented GaN devices from working up to their full potential.

Navitas

GaN-on-Si is in mass production now at 650V and below, and Navitas would welcome the option of US-based manufacturing capability.

AllGaN monolithic GaN Power ICs (with lateral integration of FET, logic and drive) deliver higher switching frequencies and higher efficiencies simultaneously, so enable higher power densities and alleviate thermal management concerns. Operation is already well above the 100 kHz mentioned, and has been demonstrated in commercial-ready designs up to 1 MHz and in development up to 40 MHz.

Today, 650V single and half-bridge GaN Power ICs may be applied to all ac-dc, 380V dc-dc and dc-ac topologies. Initial applications are consumer and mobile, with near-term design in also possible in industrial, automotive, and new energy applications. True “digital-in, power-out,” easy-to-use converter building blocks, with features such as level-shifting, high-side bootstrap charging and UVLO, ESD protection, etc., maximize design productivity and reduce design-time and costs. Two to three times smaller converters can be achieved at powers from 25W to 3kW+. Low-voltage silicon is used for advanced control and logic functions but AllGaN technology can integrate everything high current, high voltage, and high power today. High-frequency control IC platforms exist today, with new ASIC designs being introduced throughout 2017 and 2018 to enable mass adoption of GaN in soft-switching PFC, LLC, and Active Clamp Flyback circuits.

Monolithic gate-drive and power-device integration dramatically lowers the switching losses, enables the high frequency loss-less operation, and is the key to driving system power density to 30 kW/L and higher in the medium term. Navitas is collaborating with industry and academic partners and the DoE ARPAe Circuits program to demonstrate this. Integration of the gate drive also addresses the high-temperature gate-drive concern, since the gate driver is made with the same WBG material as the power switch.

Power density is a system consideration, though the chart refers to WBG packaging. The main drivers of system size are the passives and heatsinking. High frequency and soft switching enable both of these to be dramatically reduced. Cost-effective wafer production and industry-standard QFN packaging, plus the reduced system costs due to smaller magnetics, PCBs, heatsinks, and cases enable BOM costs to remain flat or even reduce as performance increases and sizes shrink. Magnetics are available and cost-effective for applications up to and above 1 MHz from Hitachi Metals, TDK, and Ferroxcube. With system efficiencies of 95-99% now possible, the amount of thermal management in packaging and at the system level is substantially reduced. (Note: Magnetics should be highlighted in green and shifted to left on the chart.)

The combination of fast-switching resonant topologies, fast GaN transistors, and GaN lateral integration enables a shift in power conversion performance not seen since the late 1970s/early 1980ss brought the MOSFET and PWM ICs.

Infineon Technologies

Tim McDonald, senior director, GaN applications and marketing at Infineon, agrees with the GaN on silicon technology on several key points made in the U.S. Power Electronics Technology and Manufacturing Roadmap. In particular, GaN on silicon devices is ready for use in applications where highest efficiency is a key performance parameter.

It is important to note that the full PEIC roadmap (and many of our customers) all list “reliability” as one of the main barriers to wide market adoption of GaN on silicon power conversion devices. Infineon has studied this issue and determined to establish new application-specific qualification criteria for GaN devices. Basically they match the intended use (stress conditions, targeted lifetime hours of operation in each key stress mode, quality level, etc.) with failure models for their devices in each key stress mode. These models are based on highly accelerated testing to failure that allows determination of useful life and quality level at normal operating conditions. In this manner, Infineon has established an application-specific GaN qualification process.

Infineon recently completed successful qualification of 600V GaN on silicon emode devices for use in 1 to 3+ kW ac:dc datacenter applications that demand the highest efficiency and/or density. The company has started shipping of these devices to select customers.

Infineon further concurs with PEIC that in the medium-term GaN ecosystem, items such as magnetics, drivers, and controllers are limiting near-term adoption of solutions at high (>1 MHz) frequency /density. Here, there is a body of promising commercial development and university work available and underway that points the way.

About the Author

Sam Davis

Sam Davis was the editor-in-chief of Power Electronics Technology magazine and website that is now part of Electronic Design. He has 18 years experience in electronic engineering design and management, six years in public relations and 25 years as a trade press editor. He holds a BSEE from Case-Western Reserve University, and did graduate work at the same school and UCLA. Sam was the editor for PCIM, the predecessor to Power Electronics Technology, from 1984 to 2004. His engineering experience includes circuit and system design for Litton Systems, Bunker-Ramo, Rocketdyne, and Clevite Corporation.. Design tasks included analog circuits, display systems, power supplies, underwater ordnance systems, and test systems. He also served as a program manager for a Litton Systems Navy program.

Sam is the author of Computer Data Displays, a book published by Prentice-Hall in the U.S. and Japan in 1969. He is also a recipient of the Jesse Neal Award for trade press editorial excellence, and has one patent for naval ship construction that simplifies electronic system integration.

You can also check out his Power Electronics blog.