Bosch to Invest $1.5 Billion in New U.S. Fab to Expand SiC Output

Bosch is looking to expand its U.S. production of silicon carbide (SiC) power devices for electric vehicles (EVs).

The Tier-1 supplier has agreed to buy the assets of U.S.-based TSI Semiconductors. Subsequently, Bosch plans to invest $1.5 billion to retool TSI's fabrication plant in Roseville, California, where it aims to start mass production of SiC devices by 2026.

The chips Bosch plans to mass-produce at the new site are playing a major role in EVs, as they can facilitate higher levels of power density than silicon MOSFETs and IGBTs dominant today.

They’re increasingly being tapped for traction inverters in EVs. A traction inverter is used to convert direct current (dc) from the high-voltage battery pack in the EV into alternating current (ac) that powers the motor driving the front and rear axles of the EV and turning the wheels. SiC is also being used in on- and off-board chargers that connect the EV to the electric grid to replenish the battery pack.

The chemistry of SiC enables it to distribute power in a way that limits power losses and heat compared to silicon. That makes a difference in EVs where longer range and faster charging times matter most.

Bosch said the existing clean-room facilities and expert personnel as part of the deal will enable it to mass-produce SiC devices for EVs “on an even larger scale.” But the company explained that the investment in the U.S. fab depends largely on “federal funding opportunities" through the Chips and Science Act as well as various state subsidies.

High-Voltage Era

Modern cars are transforming into complex high-voltage power systems. While many of the battery packs in today’s EVs operate at 400 V, 800-V bus voltages will be standard in future EVs.

Doubling the operating voltage of power electronics cuts the current flowing through the wiring harness by about 50%, which reduces the weight of an EV and, in turn, improves its overall range per charge. It costs less when you use less wiring, too. On top of that, the higher voltages can facilitate faster charging while reducing losses due to resistance heating, which takes a load off the EV’s cooling systems.

The unique physical and electrical properties of SiC help it safely and more efficiently handle higher voltages when used in power electronics that convert or distribute power around EVs.

Bosch said chips based on SiC consume up to 50% less power than silicon. They can also handle 10X higher breakdown voltages, which, in turn, reduces the resistance between the drain and source regions of the FET when turned on—otherwise known as on-resistance (RDS(on)). Consequently, conduction losses are reduced. Thanks to its relatively wide bandgap, less current leaks out of the average SiC FET when it’s turned off.

SiC MOSFETs and other devices also have higher junction temperatures, giving them a greater tolerance for heat that can break a system. Higher thermal conductivity means they’re easier to cool, too.

Furthermore, such chips have 2X higher electron saturation velocity, which suits them for faster switching frequencies. In the world of power electronics, faster transitions mean smaller transformers, capacitors, filters, and other passives that are key building blocks in a power supply, giving a boost to power density. One of its other key qualities is a reduction in reverse-recovery charge (Qrr).

When installed in the power electronics, SiC enables the EV to drive a longer distance on a single battery charge. Bosch said the average EV can travel 6% further with SiC than silicon.

Alternatively, the EV can support the same range with a smaller, cheaper battery if it’s equipped with SiC MOSFETs and other devices. SiC can enable faster charging as well, according to Bosch.

Worth the Price

The major tradeoff is that SiC power devices cost more than silicon chips. They also possess unique characteristics that require you to control and drive them differently than MOSFETs and IGBTs on the way out.

In traction inverters that can supply tens of thousands of watts at a time to the EV, SiC devices must be paired with more robust and intelligent gate-driver ICs that deliver the high currents they need. Higher currents are necessary to support the slew rates that reduce the time the device spends between on and off states when switching. Doing so limits the amount of power it loses in the process.

These fast transitions are vitally important, as they enable the high-speed waveforms needed to drive the electrical motors used by many EVs, which run at speeds as high as 20,000 RPM. These high speeds offer many advantages, but they can also cause electromagnetic interference (EMI) that must be carefully managed. As a result, care must be taken when, among other things, figuring out where to put everything on a PCB.

Gate-driver ICs specifically designed for SiC FETs also have to shut down fast to protect the devices against damage from short circuits and other potentially harmful surges of current.

All of the advantages of SiC are apparently more than worth the trouble for automakers. Demand for power electronics based on the material is growing by about 30% per year, said Bosch.

Securing Supply

As major players in the automotive market take steps to lock in supplies of SiC power devices, chip companies are investing aggressively in the market, too.

Wolfspeed is building several new facilities in the U.S. and Europe, along with what it said will be the world’s largest plant for manufacturing the raw materials used in SiC chips. It also worked out a deal last year to supply GM with a new class of easy-to-cool SiC chips for EVs. In another “strategic agreement,” onsemi will supply high-voltage SiC chips and modules to VW.

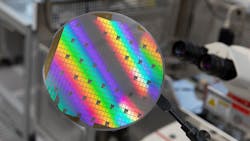

Bosch intends to buy the existing clean-room facilities and equipment in TSI’s fab as well as its semiconductor business, which now has a workforce of about 250 people. Once it upgrades the fab for power semiconductors, it plans to start building chips based on 200-mm SiC wafers. The fab will ultimately have 10,000 square meters of clean-room space.

Bosch said the fab outside of Sacramento will become the "third pillar" of its in-house semiconductor production, along with its existing sites in Europe. It has been rolling out SiC chips at its Reutlingen site outside Stuttgart, Germany since 2021.

“By growing our chip-making operations internationally, we are strengthening our local presence in an important electric-vehicle market,” said Markus Heyn, head of Bosch’s Mobility Solutions unit.

About the Author

James Morra

Senior Editor

James Morra is the senior editor for Electronic Design, covering the semiconductor industry and new technology trends, with a focus on power electronics and power management. He also reports on the business behind electrical engineering, including the electronics supply chain. He joined Electronic Design in 2015 and is based in Chicago, Illinois.