Global Revenue for Solar PV Inverters Expected to Drop Due to Cost Pressure

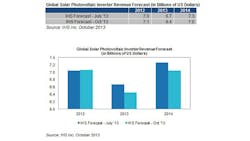

Due to rapid price declines for commercial and utility-scale inverters and intense cost pressure in mature markets, global market revenue for solar photovoltaic (PV) inverters is expected to drop by 9% in 2013. Although worldwide solar inverter unit shipments will rise by 7%, IHS reports that revenue is set to decline to $6.4 billion, down from $7.1 billion in the previous year.

The price of inverters, devices that convert direct current (DC) electricity from solar panels into alternating current (AC), is also set to decrease to $0.18 per watt in 2013, down from $0.22 in 2012. Total PV system prices continue to decrease as well, as all parts of the supply chain are under increasing pressure to reduce prices.

Over the past few years, solar module makers have dealt with much more price pressure— but module prices have now reached an inflection point and are on the rise. Now, inverter makers most absorb some of the price pressure that module suppliers can no longer sustain. Further pressure within the market comes from overcrowding and a subsequent need to decrease prices in order to win business as well as a reduction in government subsidies.

In large solar markets, such as Germany and Italy, where subsidies have been greatly reduced or removed entirely, a decline in demand has been a major catalyst for the inverter price pressure. Combined inverter shipments in both the Italian and German markets will fall by more than half this year, dropping to 5.7 gigawatts (GW) in 2013 from 1.5 GW in 2012. Suppliers that relied heavily on both markets are now being forced into an even more competitive environment, forcing them to decrease prices as they enter emerging markets such as South Africa and Thailand.

The price of low-power three-phase inverters (up to 35 kilowatts in size) has already decreased rapidly in the first half of 2013, due to supplier competition, the release of new inverter products, and the shrinking size of markets, specifically in Europe. IHS, however, predicts that shipments of 20- to 35-killowatt inverters in the U.S. will reach more than 200 megawatts (MW) in 2013, thanks to new products from SMA and Power-One, the two largest certified suppliers.

Utility-scale installations are expected to rise to one-third of global demand in 2013, compared to 29% in 2012, but the global prices for the large central inverters that serve the market are forecast to decrease by 16%, or $0.12 per watt. The largest markets, including China, India, and Thailand, command even lower prices— $0.06 per watt. Even though these markets represent significant growth opportunities, for suppliers without a local presence, the extremely competitive prices don’t make the risk worth it. Another factor for the price decrease in large central inverters is the increasing number of projects awarded through bids and tenders, which place a stronger emphasis on the up front price, as opposed to fixed feed-in-tariffs.

About the Author

Iliza Sokol

Associate Content Producer

Iliza joined the Penton Media group in 2013 after graduating from the Fashion Institute of Technology with a BS in Advertising and Marketing Communications. Prior to joining the staff, she worked at NYLON Magazine and a ghostwriting firm based in New York.