Exotic power devices head toward the mainstream

Engineers at Siemens Industry Inc.’s New Kensington, Pa. plant have their eye on developments in silicon-carbide power transistors. The reason why: The variable-frequency drives that Siemens makes now boast a system efficiency over 96.5% and a small footprint thanks to an inverter topology employing an innovative multi-level PWM scheme. But if silicon carbide (SiC) power transistors become sufficiently economical, Siemens technical personnel figure the devices can replace silicon IGBTs and boost efficiency another 30%.

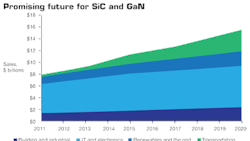

The intense interest of companies like Siemens illustrates why experts think the total market for more efficient power devices in SiC and GaN will eventually be worth billions.

Applications for gallium nitride (GaN) and SiC power devices all have one thing in common: they need components that can withstand high voltages and high temperatures and can switch rapidly with minimum losses. Moreover, low reverse-current losses are a plus as well. In that regard, SiC and GaN power ICs are looking to leapfrog present-day performance levels now available from silicon-based discrete devices and ICs.

The problem so far with SiC and GaN devices is that they have been available only in a relatively narrow range of ratings. No surprise there, because only a handful of suppliers now make them. For example, the GaN power semiconductor market currently has only two major device suppliers, International Rectifier Corp. and Efficient Power Conversion Corp. Cree Inc. accounts for the majority of SiC device sales, with Rohm a distant second. But the potential for power devices has new entrants ramping up. For example, indications are that even a few makers of light-emitting diodes are eyeing the power GaN area as a way to make use of their spare LED fabrication capacity, because the two technologies both grow GaN on a silicon epi layer

Despite the promise, the GaN and SiC power device industry is still tiny today. Estimates are that GaN generated less than $2.5M in revenues last year. And a significant chunk of that went into R&D contracts, qualification tests, and sampling. Market prognosticators say GaN power device revenues are likely to stay below $10M for 2012. SiC is bigger. Estimates are it is something over $50M today, but most of that figure is accounted for by Schottky diodes going mainly into power factor correction (PFC) circuitry.

Expectations are that there will be new entrants in the GaN power device sector that will go into mass production next year, possibly taking revenues over $50 million. By 2015, the thinking goes that qualified 600-V+ GaN devices will hit the market and GaN will start growing rapidly.

Scenarios for this high growth are tied to the electric/hybrid electric vehicle (EV/HEV) sector. If EVs begin to fulfill their promise, sales of GaN devices could top the billion dollar line and sales of GaN-on-Si substrates could exceed $300 million by 2019, explains Yole Développement Power Electronics Business Unit Manager Dr. Philippe Roussel. However, it is still unclear how car makers will decide among SiC, GaN, and established silicon technology.

One reason it is hard to get a fix on the way the SiC and GaN power area will shake out is that there is still ongoing R&D on several substrate options for power electronics: GaN-on-sapphire, GaN-on-SiC, GaN-on-GaN, GaN-on-aluminum nitride (AlN) and GaN-on-Si. In fact, even the most fundamental processing steps for all these approaches are still being discussed in IEEE conference papers. So the technical community doesn’t seem to have settled on one fabrication method. The situation is different among industry watchers, however: The betting seems to be that GaN-on-Si should dominate because device makers can readily get wafers of the stuff.

In that regard, there is speculation that LED makers could start making GaN power devices simply because GaN epi technology came from the LED industry, and current development work in GaN-on-Si epiwafers can apply to both industries. Yole, for example, expects LED and power electronics manufacturing to become intertwined to such a degree in the future that they will be lumped together as the “GaN device industry.”

Interestingly, device makers handle the construction of both GaN and SiC power devices in a similar way: The usual approach is to buy polished silicon wafers, add the epi layer, then build the transistors or diodes on top. But some industry watchers think new GaN producers may instead buy GaN epiwafers and process them in existing CMOS front-end lines, an approach that could reduce processing costs.

All this action has resulted in 1,200-V SiC and 600-V GaN devices becoming commercially available, with both kinds of devices able to withstand operating temperatures of 250 to 300°C. The first application areas to benefit include solar inverters and converters, PFC, and UPS backups. Military satellites and aircraft will also benefit from the radiation hardening that these devices can deliver.

Farther out, a look at the inverters in today’s EVs shows why EVs and HEVs could be the high-volume “killer app” : Presently, the silicon-based IGBTs in these power converters get boiler-plate-hot as they convert battery dc to ac for driving propulsion motors. To keep things reasonably cool, the vehicles generally incorporate a water-ethylene glycol cooling system. But replace the silicon IGBTs with GaN and SiC devices and the need for cooling drastically diminishes (though EV batteries may still need their own cooling systems).

As the technology progresses, the market research firm Lux Research sees the power devices going into four main industry segments: building and industrial, IT and electronics, renewable energy sources and the grid, and transportation. “There’s clearly a growing opportunity in power electronics, but the challenge for current market players and would-be entrants is finding the places these emerging technologies meet customer needs at the right price points,” says Lux Research analyst Pallavi Madakasira.

It’s likely GaN power devices will come down the price curve more quickly than SiC simply because their fabrication more closely resembles that of LEDs. That resemblance has market research firms like Yole Développment forecasting that GaN revenues will grow at a 250%/year clip for the near future compared to 35%/year for SiC. Yole sees GaN sales reaching about $325 million by 2015 versus $200 million for SiC.

But it is not clear who will get the lion’s share of this business because there are several new entrants in the GaN power device field. One notable entry is Efficient Power Conversion Corp. (EPC), founded by Alexander Lidow, co-inventor of the HEXFET and formerly CEO of International Rectifier Corp. In fact, the two companies are in a legal dispute over the latter’s claim that EPC is using IR’s technology to produce FETs that it labels eGaN devices.

There is a general consensus that IR’s approach differs from EPC’s. As characterized by EPC’s Lidow, IR uses a point-of-load silicon IC embedded with a GaN MESFET. IR releases few details about the make-up of its GaN devices other than to say they incorporate a proprietary insulated gate structure that drastically reduces gate and drain-source leakage currents. The first IR product was a 12-to-1-V buck regulator power stage.

EPC on the other hand, is selling discrete GaN transistors and is more forthcoming about some of their construction details. In a nutshell, EPC grows layers of AlN, AlGaN and then GaN as a foundation on which to build the eGaN FET. A very thin AlGaN layer then grows on top of the highly resistive GaN to create what’s called a strained interface between the GaN and AlGaN crystal layers. This interface, combined with the intrinsic piezoelectric nature of GaN, creates a two-dimensional electron gas which is filled with highly mobile and abundant electrons. Gate electrodes built on top of this material effectively allow operation that is analogous to turning on an n-channel, enhancement-mode power MOSFET. Thus, says EPC, eGaN FETs behave similarly to silicon MOSFETs in many ways.

Other companies in the GaN space include Transphorm Inc., MicroGaN GmbH, GaN Systems Inc., and heavyweight Fujitsu Laboratories Ltd. They’re all trying to capitalize on what they see is a looming lucrative GaN market opportunity as it becomes practical to go from 200-V GaN to the new 600-V GaN ICs.

And they have a point which becomes evident from comparing the size of a GaN FET to that of a commercially available silicon device with the same power ratings; the GaN device can be about a factor of ten smaller. Ditto for its packaging. EPC, for example, puts its GaN devices in a flip-chip arrangement that isolates the silicon substrate from the circuit board. Switching frequency improves as well. A demo board from EPC called the EPC9102 illustrates this fact. It implements a 36-to-60-V input to 12-V output, 375 kHz phase-shifted full-bridge (PSFB) eighth-brick converter with 17-A maximum output current. EPC says the operating frequency is roughly 50 to 100% higher than similar commercial eighth-brick dc-dc power converters. The EPC9102 uses the firm’s 100-V EPC2001 eGaN FETs.

EPC is also working with WiTricity Corp. on a scheme to wirelessly transmit electrical power. The basic idea is to transfer energy via oscillating magnetic fields to remote objects without wires. In a demo, EPC’s eGaN FETs operating at 6.78 MHz generated a field strong enough to power a 15-W load.

Transphorm Inc. has also demonstrated a dc-dc boost converter board with 99% efficiency and a three-phase motor board with 98.5% efficiency using its GaN-on-silicon diodes and transistors. Transphorm is being funded by the U.S. Government’s Advanced Research Projects Agency-Energy (ARPA-E) to develop high-performance high-electron-mobility transistor (HEMT) modules. The goal is to improve electric-motor drive energy efficiency by 2 to 8%. The project is part of DoE’s Adept (Agile Delivery of Electrical Power Technology) program.

Of course, all companies working in GaN are trying to find ways to reduce fabrication costs. A good example is MicroGaN which promises to deliver GaN power devices at silicon device prices. It claims to be the sole developer of 600-V GaN devices using what it calls a three-dimensional approach: It uses epitaxial growth of GaN and AlGaN on silicon to form a two-dimensional electron gas that arises because of the internal electric fields in these materials. It then deposits metallic ohmic contact layers that are tens of microns apart from one another to form what are called surface-state transistors that don’t require doping or implanting steps in their manufacture.

GaN Systems in Canada also develops GaN power switching ICs based on its Cool Switching platform, though it releases few details about its fabrication methods. Recently it teamed up with U.K.-based Converter Technology, a design consulting and prototyping services, to advance GaN power device applications.

CMOS and GaN

Because GaN can be epitaxially grown on a CMOS process, most newcomers in GaN work with CMOS foundries rather than fab their own devices. EPC for example, is collaborating with giant Taiwanese CMOS foundry Episil. Germany’s MicroGaN is also working closely with Azzurro Semiconductor.

Will SiC Reign Supreme? A lot of GaN device makers think their costs will drop more rapidly than those of SiC devices and believe they can have 1.2-kV GaN ICs within the next few years. But they also feel that in the long term, SiC will become low enough in cost and deliver performance levels that will allow them to dominate the power IC market.

They’re more difficult to manufacture due to a lack of suitable materials and are presently much more expensive. But SiC devices can theoretically reduce the on-resistance of silicon devices two orders of magnitude, can handle high voltages and temperatures and are efficient. They can reduce power losses extensively in power conversion systems.

The list of companies involved in SiC device production is impressive. It includes Cree, Fairchild (Transic acquisition), Infineon (SiCed acquisition), Rohm (SiCrystal acquisition), SKC (Crysband acquisition), STMicroelectronics, SemiSouth Laboratories Inc., United Silicon Carbide Inc., and large Japanese semiconductor IC manufacturers Hitachi, Mitsubishi Electric, Toshiba, and Sumitomo Electric. Industry watchers say some of these companies may be interested strictly in EV and HEV systems rather than selling discrete components.

So far, SiC diodes have been commercially available for some time and are finding use in power circuits where they can typically boost efficiencies by a few percentage points. But SiC MOSFETs are only now starting to be made in large volumes. An example of a recent development here is a state-of-the-art 1,200-V SiC power module, consisting of six BitSiC power transistors and six diodes for HEV applications. BitSiC is the term Fairchild (TranSiC) uses for its power SiC devices. The module features on-state losses of 1.15 V at 100 A and room temperature. At an elevated temperature of 150°C, the module exhibits low losses of 1.75 V at 100 A. Specific on-resistance of the module is said to be a competitive 3.1 mΩ/cm2 at room temperature.

No surprise that SiC device makers are trying to get their costs down, but there are challenges here associated with the SiC fabrication process. Though several 1,200-V SiC power devices are available, SiC wafers need higher purity levels. SiC fabs are also in the midst of upsizing to six-inch wafers from the four-inch wafers now in use. And present SiC power ICs have defect densities greater than 1,000 defect dislocations/cm2. Compare that with present silicon defect densities of less than 1 dislocation/cm2.

Regardless of what happens in power semiconductors, SiC can provide impressive performance levels in LED lighting. For example, Cree has used its S3 technology platform to this year demonstrate a prototype LED light bulb that produces 170 lumens/W. This tops the 152-lumens/W level Cree announced last year. The S3 technology platform is designed to enable significantly higher-efficiency and less expensive LED light bulbs for use in luminaires.

Finally, one area where SiC has no competition is in military electronics where the technology excels in delivering ruggedness and radiation resistance. One example of developments there comes from the Tank, Automotive Research, Development and Engineering Center of the U.S. Army’s Research, Development and Engineering Command (RDECOM-TARDEC) in Warren, Mich. The center worked with Arkansas Power Electronics International, Inc., and Science Applications International Corp. on a power module incorporating Rohm SiC trench MOSFETs for future HEV platforms. The module offers 10x greater voltage blocking capability, a 10 to 100x faster switching speed, and one-tenth the energy losses of comparable silicon devices while operating up to 600°C. Packaging innovations developed by APEI let it operate at 600 V/1,000 A, and it has achieved switching speeds on the order of tens of nanoseconds. The special APEI-developed packaging dramatically lowered parasitic inductance by shrinking the module area and further optimizing its layout.

Use of the Rohm trench MOSFETs enabled an on-resistance half that of conventional Si-IGBT modules. Reports are that the design can perform a switching operation on the order of dozens of nanoseconds, which in turn reduces switching loss to one-third that of Si-IGBT modules.

Resources

Efficient Power Conversion Corp., epc-co.com/epc/documents/papers/Gallium%20Nitride%20GaN%20Technology%20Overview.pdf

Fairchild Semiconductor International, Inc., www.fairchildsemi.com

Fujitsu Laboratories Ltd., www.fujitsu.com

GaN Systems Inc., www.gansystems.com/

International Rectifier Corp., powerelectronics.com/discrete-semis/gan-based-power-devices-coming-of-age-0711/

Lux Research, www.luxresearchinc.com/

MicroGaN GmbH, www.microgan.com

Transphorm Inc., www.transphormusa.com/

U.S. Army RDECOM-TARDEC, tardec.army.mil/

WiTricity Corp., www.witricity.com/

Yole Développment, www.yole.fr/

About the Author

Roger Allan

Roger Allan is an electronics journalism veteran, and served as Electronic Design's Executive Editor for 15 of those years. He has covered just about every technology beat from semiconductors, components, packaging and power devices, to communications, test and measurement, automotive electronics, robotics, medical electronics, military electronics, robotics, and industrial electronics. His specialties include MEMS and nanoelectronics technologies. He is a contributor to the McGraw Hill Annual Encyclopedia of Science and Technology. He is also a Life Senior Member of the IEEE and holds a BSEE from New York University's School of Engineering and Science. Roger has worked for major electronics magazines besides Electronic Design, including the IEEE Spectrum, Electronics, EDN, Electronic Products, and the British New Scientist. He also has working experience in the electronics industry as a design engineer in filters, power supplies and control systems.

After his retirement from Electronic Design Magazine, He has been extensively contributing articles for Penton’s Electronic Design, Power Electronics Technology, Energy Efficiency and Technology (EE&T) and Microwaves RF Magazine, covering all of the aforementioned electronics segments as well as energy efficiency, harvesting and related technologies. He has also contributed articles to other electronics technology magazines worldwide.

He is a “jack of all trades and a master in leading-edge technologies” like MEMS, nanolectronics, autonomous vehicles, artificial intelligence, military electronics, biometrics, implantable medical devices, and energy harvesting and related technologies.