Fab equipment spending: look for upward swing into 2016

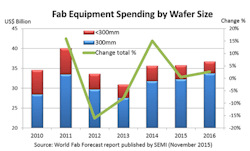

San Jose, CA. Worldwide semiconductor fab equipment capital expenditure growth (new and used) for 2015 is expected to be 0.5% (total capex of $35.8 billion), increasing another 2.6% (to a total of $36.7 billion) in 2016, according to the latest update of the quarterly SEMI World Fab Forecast report.

SEMI reports that in 2015, Korea outspent all other countries ($9.0 billion) on front-end semiconductor fab equipment, and is expected to drop to second place in 2016 as Taiwan takes over with the largest capex spending at $8.3 billion. In 2015, Americas ranked third in overall regional capex spending with about $5.6 billion and is forecast to increase only slightly to (5.1%) in 2016.

In 2015, 80 to 90% of fab equipment spending went to 300-mm fabs, while only 10% was for 200-mm or smaller. SEMI’s recently published “Global 200mm Fab Outlook” provides more detail about past and future 200-mm activities.

Examining fab equipment spending by product type, memory accounts for the largest share in 2015 and 2016. While 2015’s spending was dominated by DRAM, the SEMI World Fab Forecast reports that 2016 will be dominated by flash, mainly 3D-related architectures. Capacity for 3D-NAND will continue to surge. SEMI’s report tracks 10 major 3D producing facilities, with a capacity expansion of 47% in 2015 and 86% in 2016.

The foundry segment is next in terms of the largest share of fab equipment spending in 2015 and 2016. In general, the foundry segment shows steadier, more predictable spending patterns than other device product segments. Coming in third place in fab equipment spending, MPU had lower spending in 2015. Logic spending was very strong in 2015, with 90% growth, driven by SONY’s CMOS image sensors.

Throughout 2015, SEMI anticipates that there will be 1,167 facilities worldwide investing in semiconductor equipment in 2016, including 56 future facilities across industry segments from analog, power, logic, MPU, memory, and foundry to MEMS and LEDs facilities. For further details, reference to the latest edition of SEMI’s World Fab Forecast report.

About the Author

Rick Nelson

Contributing Editor

Rick is currently Contributing Technical Editor. He was Executive Editor for EE in 2011-2018. Previously he served on several publications, including EDN and Vision Systems Design, and has received awards for signed editorials from the American Society of Business Publication Editors. He began as a design engineer at General Electric and Litton Industries and earned a BSEE degree from Penn State.