Conflict Minerals and the Tantalum Capacitor Supply Chain

A shorter version of what you’ll read below will appear as the lead editorial in Electronic Design’s June issue. I’m blogging the longer version because most of it consists of a long response from Per Loof, CEO of KEMET Electronics, one of the largest and oldest capacitor suppliers on the planet. Those capacitors include tantalum electrolytics, the compact size of which, relative to the capacitance they supply, makes possible the ever-shrinking size of personal electronic device.

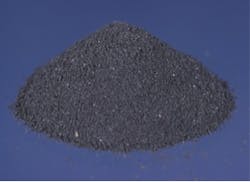

Regrettably, because of the global distribution of tantalite, columbite and coltan, the ores that are the source of tantalum, tantalum electrolytics, without stretching the analogy too far, might be considered the “blood diamonds” of electronics.

In fact, tantalum has been designated a “conflict mineral.” These are minerals “mined in conditions of armed conflict and human rights abuses.” Much of it comes from the Democratic Republic of the Congo where, it is said, the sale of raw tantalum and/or its ore supports continuing murder and atrocities by indigent groups and mercenaries.

People of good will have begun at least call attention to products that do and do not contain conflict minerals. Since 2010, Section 1502 of the Dodd–Frank Wall Street Reform and Consumer Protection Act has required manufacturers and goods producers to audit their supply chains and report conflict minerals usage. The requirements are codified in the "Conflict Mineral Law," enforced by the Securities and Exchange Commission.

Essentially, the law requires traceability audits, with the results reported to the SEC. The requirements for reporting trickle down deeply through the supply chain. In mid-February, Apple, which had been under fire by various groups asserting the company’s use of tantalum caps, released its supplier responsibility report, stating that its hardware factories did not use any tantalum. According to the NY Times, in 2012, Nokia published a list of steps it was taking to avoid transactions involving conflict minerals.

To get a picture of what’s happening further down the supply chain than companies at the end of the chain, like apple and Nokia, I invited KEMET’s Per Loof, to comment. We’ve used part of that in the June lead editorial, but here’s what he said in full:

“The news media has spent quite a bit of time repeating, dissecting and commenting on Apple’s and other major OEMs promise to use only conflict-free minerals in its products. Consumers are suddenly very aware of Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and more inclined to want their electronics conflict-free.

‘Of course, conflict-free materials often cost more and, given the price-competitive nature of the electronics industry, it is very doubtful that most consumers will pay extra for conflict-free electronics. It is even more doubtful that electronics manufacturers will absorb the cost. This puts the electronics component industry between a rock and a hard place: do we sell more affordable products using morally tainted minerals, or take the moral high ground and lose sales, profit margins, or both?

“KEMET is one of the leading manufacturers of tantalum capacitors in the world, and we saw this dilemma coming some years ago. We decided to keep our products affordable and take the moral high ground, by completely controlling our tantalum supply chain, beginning to end.

“In 2011, we began executing our vertically-integrated, “closed-pipe” tantalum supply chain strategy. We purchased a tantalum powder manufacturer in Nevada, and changed its name to KEMET Blue Powder Corporation. We also constructed a tantalum ore processing facility in Matamoros, Mexico. Naturally, KEMET needed ore to supply these facilities.

“In retrospect, those moves were relatively easy compared to finding a conflict-free source of tantalum ore. A large source of this mineral has long been the Democratic Republic of Congo (DRC) in Africa. Sadly, this country has been the scene of constant fighting between rival factions for years. Many of these groups have been stealing and selling the DRC’s natural resources, including tantalite, to fund their operations – while terribly abusing human rights and terrorizing civilians. The tantalum industry was well aware of the situation, and many people suggested we just stop doing business in the DRC altogether.

“At KEMET, however, we saw things differently. Pulling out would just make a bad situation worse for the people of the DRC, so we set out to develop a comprehensive, sustainable solution. After researching mining companies for a potential partner, we approached Mining Mineral Resources (MMR), a company with a successful history of working in the country. MMR had concessions from the DRC government to mine tantalum in the conflict-free Katanga Province. Our goal was to build a sustainable foundation that embraced lasting prosperity and security for all the involved parties, as well as demonstrate that solutions combining social sustainability and economic interests are not mutually exclusive. Our efforts, coupled with traceability schemes such as those developed by the International Tin Research Institute (ITRI) and the implementation of other “in-region” sourcing initiatives, substantiate the success of this approach.

“We started our Partnership for Social and Economic Sustainability initiative, and committed $1.5 million over its first two years for social sustainability projects at the mine and village. With MMR, we also created the Kisengo Foundation, a non-profit organization aimed at improving the standard of living in and around the village of Kisengo in Katanga Province. We are happy to say our efforts have been successful there, helping to improve education, healthcare, sanitation, infrastructure and recreational opportunities.

“As a result of our vertical integration, KEMET has a unique position in the supply chain as both an upstream and downstream supplier. All of the KEMET facilities have been audited and validated compliant with the Electronic Industry Citizenship Coalition (EICC)/Global e-Sustainability Initiative (GeSI) Conflict-Free Smelter Program (CFSP).

“Right now, our vertically integrated supply chain meets the majority of our tantalum needs. The rest is supplied by valued partners who are also EICC/GeSI CFSP compliant. We think the tantalum capacitor has a bright future. Tantalum has inherent dielectric properties that make it unique, and in many cases, a better capacitor versus the available alternatives. The supply chain is relatively simple to control. New powder types are being developed, making it a viable and sustainable solution for current and future applications, one that design engineers can confidently consider as they select their capacitance solution

“Even before the U.S. Securities and Exchange Commission (SEC) issued a final ruling on Section 1502 of the Dodd-Frank bill, KEMET’s tantalum vertical integration efforts were being commended by the U.S. government. In the July 2012 U.S. Government Accountability Office (GAO) report Conflict Mineral Disclosure Rule: SEC's Actions and Stakeholder-Developed Initiatives (GAO-12-763), KEMET’s Partnership for Social and Economic Sustainability initiative of establishing a “closed-pipe” supply chain for responsible sourcing of tantalum from Katanga Province was positively cited. We hope it can serve as a roadmap for other manufacturers to follow.”

About the Author

Don Tuite Blog

Don Tuite covers Analog and Power issues for Electronic Design’s magazine and website. He has a BSEE and an M.S in Technical Communication, and has worked for companies in aerospace, broadcasting, test equipment, semiconductors, publishing, and media relations, focusing on developing insights that link technology, business, and communications. Don is also a ham radio operator (NR7X), private pilot, and motorcycle rider, and he’s not half bad on the 5-string banjo.