There is a big question whether the semiconductor industry in 2015 will continue to enjoy the good times that it has experienced for the past two years or if it will finally turn down.

2014 was a solid growth year for semiconductors despite continuing challenges in the rest of the world economy. Memories, the most volatile segment of the semiconductor market, showed a 12/12 growth trend of 17.7% through November. Since the rest of the semiconductor market makes more modest moves than memories’ wild gyrations, semiconductors overall only saw a 9.9% equivalent growth. 2014 should end with approximately 10% growth, which is respectable but not stunning.

This growth is lower than Objective Analysis had forecast one year ago (see "Forecast for Semiconductors and Things in 2014" on electronicdesign.com). At that time Objective Analysis predicted memory revenue growth of 40%, driving the semiconductor market to grow 20% or more. This was based on assumptions of memory bit growth that were a little higher than what actually occurred. Producers also anticipated higher consumption growth than actually materialized, and slightly overproduced certain chips, causing prices to slide modestly and mute revenue growth.

Even the actual, lower semiconductor consumption is surprisingly healthy in the face of ongoing global economic issues. Oddly enough, semiconductor consumption rarely changes significantly over time. Over the last 40 years there have only been four times that DRAM gigabyte consumption (a very impartial measure of consumption) has undergone a significant quarterly decrease due to softness in the economy: 2009 (after the global economic collapse), 2001 (the Internet bubble burst), 1986, and 1974. Such demand declines are clearly very rare.

Check Your Memory to Pace Semiconductor Growth in 2015

The prior years’ capital spending coupled with a good understanding of traditional semiconductor market cycles can lead to a relatively accurate semiconductor forecast.

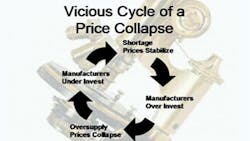

Memory capital spending was relatively slow until late 2014. NAND flash is facing a conversion to 3D processes which limit producers’ ability to re-use their existing investment in planar NAND production equipment. DRAM has been facing similar issues even though the technology is not expected to convert to a 3D process. For the planar versions of both technologies, higher capital investments are required than ever before simply to migrate from one planar process node to the next, and manufacturers have been reluctant to make these investments. This has extended the 2012 upturn right through 2014, and may result in the longest upturn in the history of the semiconductor market.

It is unclear when production will once again out-strip demand, since technical issues related to the ramp of 3D NAND and other daunting technical challenges threaten to extend this slow-investment shortage by another couple of years. Inputs from highly-informed industry sources lead Objective Analysis to estimate that the technical issues facing these two key technologies may not be resolved until the middle of 2017, causing a price collapse at that time. Until then, the semiconductor market will continue to see healthy growth.

At the onset of this oversupply, though, one can guarantee that DRAM and NAND prices will drop to the products' manufacturing cost within one or two quarters’ time. This will cause 2015 will be a very strong year, 2016 will be even better, and then 2017 will start out well enough, but will totally unravel in the second half. During this record-long upturn expect to hear many pundits loudly profess that the semiconductor cycle has ended. Don’t believe them.

Overall 2015 memory revenues should approach $98 billion, up 25% from 2014’s $79 billion, with total semiconductor revenues rising from 2014’s $334 billion to a record-breaking level of slightly over $389 billion.

Readers can investigate the semiconductor market cycle and its use in forecasting by watching the past seven years of Objective Analysis forecast videos at www.WeSRCH.com and by visiting www.Objective-Analysis.com .

About the Author