The Digital World Faces Uncharted Waters, Too

Download this article in PDF format.

As 2018 came to a close, the economy in the United States continued to be strong (the roller-coaster stock market withstanding). Employment is officially high, but many people are under-employed and salaries and wages generally haven’t risen with the cost of living. The U.S. Federal Reserve kept the prime lending rate near zero for seven years to stimulate the economy with low-cost lending, only raising it in December 2015. Through 2017 and 2018, the rate rose to 2.25%, pushing residential mortgage rates to nearly 5% from a prior low of near 3.5%.

In China, the economy has been strong and growing, although it may be leveling off now. For Europe and much of the rest of the world, some countries have good economies while others are struggling.

While the authors’ previous annual outlooks have noted politics (click here and here), in 2018 executive action and policy influences intensified, with various forms of “social responsibility” also causing unforeseen disruption in the digital world.

A surge of “nationalism” has citizens and politicians wanting to topple the established world order. Part of the United Kingdom decided it wanted to “Brexit” the European Union (that doesn’t sound very “united”), but that may or may not take place smoothly.

Separately, the Executive branch of the United States is deep-sixing existing alliances and trade agreements, putting up walls against neighboring countries, and threatening stiff tariffs on certain goods from specific countries. This is initiated by someone who fancies himself to be a master negotiator, but may not have a good understanding of how normal business—or Washington—is run. Other countries, many with authoritarian heads of state, are responding in kind. At least Japan—very important in the electronics world—seems to be staying low-key.

One signal of the economy’s strength is the stock market, which in the U.S. has surged on the order of 30% over the last two years. However, volatility of the stock market has increased significantly, with huge, almost-daily swings, reflective of dramatic changes initiated in the political arena that greatly alter the business environment, especially with trade wars between nations arising in a way not seen for decades. With no resolution of these tensions in sight, corporate leaders must craft their business strategies factoring in greater risk—risk that’s outside of their control.

Technology Will Advance

High Tech continues to march forward, dependably, as it always has: faster, better, cheaper, higher integration. Today, the advance of technology is one of the few things that can be counted on in a positive light.

The protection of intellectual-property (IP) rights remains vital to the ongoing investment in research and development in high tech. However, IP abuse is contentious and an impediment to fair and open markets.

Corporate consolidation is slowing a bit, with a number of companies in the electronics industry having already merged. Some acquisitions have been blocked, slowed, or otherwise withdrawn. The global nature of our industry can make government approval difficult. Alliances and partnerships between companies are vital, with technology standards benefitting all who make use of them. The reach of Android has grown tremendously. While some parts of the business have disaggregated, many companies pursue further vertical integration, with nearly all engaging more heavily in software.

Be Responsible

It may seem far upstream from semiconductors and most electronic hardware, but the proliferation of “fake news,” hate speech directed at groups or beliefs, and personal attacks (“shaming”) over social networks has revealed a new dark side of the wide-open internet, (electronic) social networks, and the press/media.

This has subjected many companies and their executives to a good grilling by lawmakers/government bodies, the wrath of the public, the initiation of monitoring systems to detect and control nefarious activities, and potential revenue downsides from users and advertisers. On one hand, some governments or corporations might want to restrict—or capitalize on—the content their citizens or users can access over its wires—for good and for bad. On another hand, there’s little agreement on who should say what qualifies as acceptable content.

Since the internet is expected to be a real-time network with content that can be anything from simple ASCII text to encoded streaming high-definition video, computers running sophisticated algorithms are the only systems that could possibly monitor all of the traffic, at speed. “Artificial intelligence” would have to be something more than a marketing term for such computers to stay ahead of the moment-by-moment trends, let alone the social media bots that may flood the network.

The exploitation of consumers’ rights and privacy has been questioned as more and more data on these end-users has been surreptitiously collected for vague purposes. In May 2018, the European Union’s (EU) General Data Protection Regulation (GDPR) became effective, requiring more than a tacit “your use of this site implies…” caution but an explicit agreement by the person on whom the data is collected. The EU acted but few other countries have followed suit. Moreover, corporations drag their feet embracing such policies because of the revenue and marketing value they can derive from the data. Consumers young enough to understand what the word means, might just shrug, “meh.”

A Pound of Flesh

Ultimately, most of these new social-imposed issues layering over the normal market-driven supply-and-demand factors that impact the next few years’ outlook place new burdens on the companies providing the services sought by the user. They consume additional resources, software, and computing power to mitigate this new noise and distraction. The effort and cost add to the overhead of a business, much like the need for a legal team, building maintenance, or an accounting department. However, it also joins issues like security that are likely to become ever-more sophisticated as bad actors try to overcome the defenses that are erected.

It would be hard to say these issues make companies or society more productive, although they will take more manpower (peoplepower) and computational bandwidth to detect and manage infractions. Perhaps these are opportunities for services offered by third parties to handle. However, like security, it’s just one more moving target that’s difficult to assign an effectiveness or quality number to.

The defense mechanisms likely involve sophisticated algorithms for pattern-matching and quirks of human behavior and therefore could increase demand for computing resources (good for semis). But this isn’t likely to support a new fab and is far more nuisance than energizing.

Memory Losses

An Objective Analysis of the DRAM and NAND flash-memory markets gives valuable insight to how the greater semiconductor market will fare in 2019. When revenues from these two technologies grow or collapse, the rest of the semiconductor market reacts the same, only more modestly, without the extraordinary gyrations suffered by NAND and DRAM.

Because DRAM and NAND flash are undifferentiated commodities, systems can replace any provider’s product with any other provider’s product, so buyers largely choose suppliers based on price. In a commodity market, an oversupply results in a price collapse, and that’s where the market was going late in 2018.

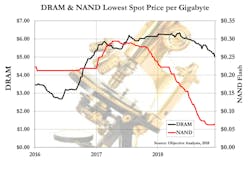

The figure shows the lowest weekly DRAM and NAND flash spot market prices for the past two years. Thus, it’s clear that NAND flash prices (red line, right axis) have already declined significantly and that DRAM prices (black line, left axis) have just begun their downturn.

This chart shows the lowest weekly DRAM and NAND flash spot market prices for the past two years, making it clear that NAND flash prices (red line, right axis) have already declined significantly and that DRAM prices (black line, left axis) have just begun their downturn.

Spot market prices always have greater price swings than the contract market. The spot market is only a very small (<5%) portion of the overall market, though, so these numbers need to be considered with some caution.

Some industry participants have hypothesized that the DRAM market’s consolidation will create an “oligopoly” that will cause prices to “normalize,” e.g. stop gyrating the way they always have in the past. While this is a comforting thought for memory makers, there’s no evidence that normalization is likely to occur. A reduction in the number of suppliers doesn’t naturally lead to a change in price behavior unless only a single company remains, creating a monopoly. Two or more competing commodity suppliers will see price gyrations, known as the “Commodity Cycle.”

Collusion between sellers offers an alternate way to prevent a price collapse, but this is illegal so it seldom occurs, and when it does it triggers trade sanctions and even imprisonment for the offenders.

Thus, the current price downturn will become just as severe of a collapse as any that have occurred before, so the next two years are most likely to be profitless for DRAM and NAND flash makers. This is why Objective Analysis expects a semiconductor revenue decline of 5% or more in 2019. A full explanation of our outlook for 2019 appears in a video found here: https://www.wesrch.com/electronics/wevision-EL1J9YM-memory-market-forecast-2019-with-jim-handy-of-objective-analysis.

There are two reasons the memory market got to this state:

- NAND flash became oversupplied once NAND makers found a way to efficiently produce 3D NAND. Until early this year, 3D NAND was more costly to produce than older planar NAND. Once NAND fabs started to be used efficiently, they started to produce more flash than the market needed, so prices started to fall. The chart shows a 78% drop from $0.29/GB down to $0.06/GB. Remember that this is the spot market, and contract prices react far less dramatically.

- Once NAND contract prices fell below the production cost of planar NAND (about $0.15/GB), eligible vendors converted excess planar NAND capacity to DRAM manufacture. This accelerated the onset of a DRAM glut that would have happened in early 2019 anyway, thanks to an overabundance of capital spending in late 2016.

The price collapse may not really help OEMs. These companies have been suffering from chip shortages and high prices for a couple of years, making it a challenge to remain profitable. While a price reduction will lower the OEM’s cost of goods, which can lead to higher profits, the wider availability of supply might motivate them all to overproduce, which will hurt their prices.

Another phenomenon that results from a price collapse is the possibility that OEMs who haven’t managed their inventory in anticipation of a price reduction, may need to take an inventory write-down against their profits. It’s only natural for a company to build a larger inventory than normal during a shortage. If that shortage rapidly shifts to an oversupply, prices collapse and the inventory holder will suddenly find their multi-million-dollar inventory is soon worth half as much.

Objective Analysis clients have been ready for this, so they should be in good shape. Others might be in trouble.

How will this play out over the longer term? Most semiconductor cycles follow a pattern of “Two Years Up, Two Years Down” as long as there are no external factors (like the 2008 Global Financial Collapse or the 2001 Internet Bubble Burst) to influence the cycle. But this time, other factors are at play that might prolong the downturn.

About the Author

Tom Starnes

Analyst

Tom Starnes is arguably the best-known embedded processor analyst in the semiconductor industry. Covering a range of products, Starnes' insight, coupled with his no-nonsense approach to processor and end-use analysis has led to his becoming one of the most sought-after consultants in the world of processors. It is through his hard-hitting insights that many key players in this industry have found their focus and refined their product strategies.