Milpitas, CA. SEMI today announced the addition of a new high-profile program on China to its 2017 conference lineup for SEMICON West (July 11-13). Slated for July 11 at San Francisco’s Yerba Buena Theater, the China Strategic Innovation & Investment Forum will focus on the extensive business opportunities resulting from the semiconductor industry’s largest regional growth spurt now occurring in China.

While the global semiconductor industry continues to consolidate through large-scale mergers and acquisitions, China is embarking on a new round of expansion with heavy investment from public and private funding. China’s semiconductor industry is growing at an explosive rate, leading the rest of the world with a projected increase of 68% in fab equipment spending year-over-year (2017 to 2018), according to the May 2017 SEMI World Fab Forecast. China will be equipping over 50 facilities through 2018, and is forecast to spend more than $11 billion.

The rise of the semiconductor industry in China need not be viewed as a threat to other global players, but rather as a significant driver of growth and business opportunity for suppliers worldwide. With its low indigenous market share for chips and nascent technical breadth in IC design, manufacturing, packaging, testing, equipment, and materials, China has become an enormous market for suppliers across the supply chain. In fact, ICs still top the list of all Chinese bulk imports in terms of U.S. dollar value.

At the China Strategic Innovation & Investment Forum, semiconductor and investment executives as well as key China government and trade officials will share their views on the industry’s evolution and offer insights on growth, investment opportunities, M&A, and the latest innovations emerging in China. Attendees will hear from C-Level executives from Ali Cloud, AMEC, Applied Materials Venture Capital Group, Goldman Sachs, Verisilicon, Walden International, SEMI China, and more. An hour-long panel discussion, moderated by Lung Chu, president of SEMI China, will feature speakers and a Q&A session. With access to China experts presenting and multiple networking opportunities, the China forum will offer a collaborative platform where markets, technology, talent, and funding can meet up for mutual benefit.

SEMICON West is focused on keeping industry players informed about where the semiconductor market is headed, and where they can find—and leverage—new opportunities. The flagship event for connecting the electronics manufacturing supply chain and adjacent segments will be held July 11-13 at Moscone Center in San Francisco, CA.

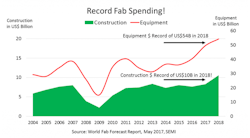

The May 2017 World Fab Forecast has good news for other countries and regions as well. Korea and Taiwan in addition to China all see large investments, and spending in Europe will also increase significantly, SEMI reports. In 2017, over $49 billion will be spent on equipment alone, a record for the semiconductor industry. Spending on new fab construction is projected to reach over $8 billion, the second largest year on record. Records will shatter again in 2018, when equipment spending will pass $54 billion, and new fab construction spending is forecast at an all-time high of $10 billion.

SEMI reports that these unprecedented high numbers are not only driven by a handful of well-known, established companies, but also by several new Chinese companies entering the scene with large budgets. An increase in overall fab spending (construction and equipment together) of 54% year-over-year (YoY) in China is expected. Total spending rises from $3.5 billion in 2016 to $5.4 billion in 2017, and then to $8.6 billion in 2018, another 60% year-over-year (YoY).

Some of these China-based companies are well known, such as Hua Li Microelectronics or SMIC (top investors in 2017 and 2018), though newcomers in the arena, including Yangtze Memory Technology, Fujian Jin Hua Semiconductor, Tsinghua Unigroup, Tacoma Semiconductor, and Hefei Chang Xin Memory, add to the spending surge.

The SEMI World Fab Forecast breaks down fab equipment spending by region. Korea leads both years of the forecast period, with spending of $14.6 billion in 2017 and $15.1 billion in 2018. In 2017, Taiwan is projected to be the second largest spending region on equipment, but China will take over second place in 2018 as it equips the many new fabs being built in 2016 and 2017. Americas is in fourth place, projected to spend $5.2 billion in 2017 and $5.5 billion in 2018. Japan will come in fifth, spending $5.1 billion in 2017 and $5.3 billion in 2018. Although the Europe/Mideast region is in sixth place with relatively modest investments of $3.8 billion in 2017, this represents remarkable growth for the region, 71% more than in 2016; and the region will bump spending another 20% in 2018 (to $4.6 billion).

This growth cycle could continue well beyond 2018. Record fab construction spending of $10 billion for 2018 means new fabs will need to be equipped at least a year down the road, leading to high expectations for good business beyond the current two-year forecast period.

Since the last publication on February 28, the SEMI Industry Research & Statistics team has made 279 changes on 244 facilities/lines. In that time frame, 24 new facilities were added, and four fab projects were closed.