This file type includes high resolution graphics and schematics when applicable.

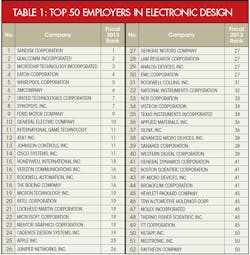

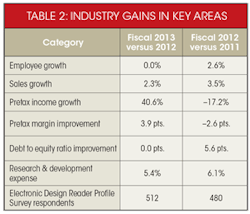

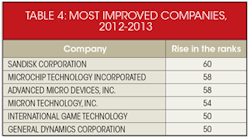

There’s a new game in town for this year’s Top 50 Employers in Electronic Design. SanDisk, bolstered by a shift to solid-state-disk (SSD) solutions, vaulted up 60 places to place number one on this year’s Top 50 list. Following SanDisk is Qualcomm, last year’s top company, and Microchip Technology, another new Top 50 member. The list is based on a formula using public financial data from a “pool” of 97 public companies, with bonus points awarded using the results of our annual Electronic Design Reader Profile Study (see “The Method Behind Our Mathematics, 2014”).

At the start of 2013, the U.S. Department of Labor revealed an unemployment rate hovering around 7.9%. By September, however, it dropped to around 7.2%—historically high, but certainly an improvement, no? The problem was the unemployment-rate decrease paralleled a decrease in the number of newly added jobs, suggesting that more Americans were simply dropping out of the labor force (a familiar phenomenon by now). In fact, the number of people working or actively seeking a job hit a 35-year low in September 2013.

Jobs were added at a rate of 207,000 per month in the first quarter of 2013, slowing down to 182,000 a month in the second quarter, and finally 143,000 a month in the third quarter. Of course, the standoff in Congress centered primarily around the Affordable Care Act that led to the government shutdown on October 1, certainly didn’t help. As global stock markets tumbled on September 30, the partial shutdown left about 800,000 federal workers unemployed. When the shutdown ended on October 16, according to the AP, economists estimated that the government shutdown erased $24 billion from the economy.

Better News for 2014

The Department of Commerce says the economy is expected to grow above a 3% rate for the rest of 2014 into 2015. However, with severe weather triggering a 2.1% decline in the first quarter, followed by second-quarter growth of around 4%, 2014 will likely grow at a rate similar to every year since 2011—around 2.1%.

The good news is that real disposable income jumped 4% for the first half of 2014, fueled by renewed consumer confidence that’s at its highest level since before the recession. Retail sales have rebounded and auto sales in June reached their highest levels in eight years. Hiring seems to be increasing, evidenced by the few initial unemployment claims since May. The Index of Manufacturing Purchasing Managers also points to increased output.

After a terrible first quarter, some of it again weather-related, both building starts and sales of new and existing homes are expected to rise during the second half of 2014. As for retail sales, growth should be slightly higher during the second half, averaging around 4% for the year (a nudge up from last year’s 3.5%).

According to the U.S. Department of Labor, 244,000 jobs per month have been added since February, compared to a monthly average of 187,000 over the last three years. By the end of 2014, 2.8 million workers should be added to payrolls, with growth spread fairly broadly across all industries. The unemployment rate, on the other hand, will most likely not see better numbers. That’s because those who stopped looking for jobs and start actively searching again would still count as officially unemployed. It’s estimated to come out to approximately 6.1% by year’s end.

Improving non-supervisory worker wage should reach a 2.5% annual growth rate by year’s end, and continue to accelerate in 2015 and 2016. This group makes up over 80% of the workforce, which will ultimately help push consumer demand and economic growth.

According to the U.S. Census Bureau, the slumbering business investment segment shows signs of awakening. Capital spending is projected to increase around 4.5%—not great, but an improvement over the 1.5% spent in 2013. The first-quarter decrease in GDP was the largest since the recession hit five years ago, but companies are cautiously starting to add capacity.

That said, success for companies on the list typically results from multiple factors. Below are snapshots of the top three companies on our list:

This file type includes high resolution graphics and schematics when applicable.

1. SanDisk

This file type includes high resolution graphics and schematics when applicable.

This year’s top company, SanDisk, didn’t even break into last year’s Top 50 Employers list. Its meteoric rise revolves around the company’s expertise in always-accessible digital storage, particularly solid-state drives (SSDs).

In corporate data centers and in the cloud, flash technology has begun replacing mechanical hard drives for storing and accessing mission critical data. As far as computing, the company’s SSDs offer a more efficient, compact, and durable alternative to mechanical hard drives for desktops, laptops, and today’s ultra-thin PCs. With respect to mobile, the company delivers high-performance flash storage to manufacturers of smartphones, tablets, and other mobile devices. Finally, in terms of consumer electronics, SanDisk technology finds homes in multiple platforms, including digital cameras, mp3 players, flash drives, and storage cards.

For the second fiscal quarter of 2014, the company reported record revenues and net income, illustrating further progress in its strategic shift to SSD solutions. SSDs, both client and enterprise, now account for 29% of revenue and are on track to exceed 2014 revenue mix goals. In fact, SSD revenue has doubled year over year and grown 30% sequentially (quarter to quarter), driven by increases in both SATA (Serial ATA) and SaaS (“Software as a Service” is a software delivery method that provides access to software and functions remotely as a Web-based service) products.

According to research firm IHS iSuppli, SSD shipments jumped 82% (57 million units) while hard-drive shipments declined 7% year-over-year in 2013. IHS iSuppli estimates SSD shipments to grow 50% this year and reach 190 million units by 2017, which is close to half the size of the HDD market of 397 million. The real opportunity, however, comes in the form of enterprise SSDs.

During the second quarter, SanDisk introduced the Lightning 12-Gbit SaaS and 4-Tbyte Optimus MAX SaaS SSDs. Also, the new 4-Tbyte MAX SaaS SSD received lots of customer interest for replacing legacy 15k and even 10k release-to-manufacturing (RTM) hard-disk drives in mission-critical storage and data-center applications.

In June, SanDisk signed a definitive agreement to acquire Fusion-io, a market leader in enterprise PCI Express (PCIe) hardware and software solutions. Fusion-io develops flash-based PCIe hardware and software solutions to boost application performance in enterprise and hyperscale data centers. This acquisition should help further enhance the transformation into a value-added solutions provider and improve capabilities with various new solutions, channels, customers, and go-to market expertise.

Record quarterly revenue also was achieved for client SSDs. The company’s portfolio of SATA and PCIe client SSD solutions serves a multitude of personal-computer OEMs, and its making rapid progress toward qualifying 1Y nanometer client SSDs (19 nm) at many of these OEMs.

The SanDisk Extreme PRO also debuted during the second quarter. The client SSD features up to 1-Tbyte class capacity that, SanDisk says, is the first to come with a 10-year warranty. Moreover, the company will start to ship its X3-based client SSDs in the retail and distribution channels, as well as initiate qualifications with OEM customers, in the third quarter. The company is buoyed by the increasing attach rate of SSDs to notebook computers, particularly in corporate PC platforms.

Overall revenue for embedded solutions grew slightly from the prior quarter. Though solid growth was seen in terms of sales of custom embedded solutions, iNAND sales declined (embedded flash drives for mobile devices), primarily stemming from some weakness at certain high-end smartphone customers and the timing of 1Y product transitions.

Partnerships with China-based mobile-device manufacturers resulted in solid revenue growth. Moreover, the company expanded mobile offerings for mid- and entry-level smartphones and tablets with the launch of the iNAND Standard, which is an X3-based embedded offering. Customer qualifications of X3-based embedded solutions are proceeding as planned, which should boost revenues in the third quarter and the rest of 2014.

In terms of fab output in the second quarter, its 1Y (19 nm) technology mix represented approximately 60% of total bit output and should remain at approximately this level for the remainder of 2014. OEM customer demands for 19-nm technology nodes grow louder by the day. Greater success with OEM and enterprise accounts means the trend of longer product lifecycles on older technology generations becomes more pronounced as customers look for supply continuity. The company expects 5% wafer capacity growth in 2014, and given OEM and enterprise demand for 19-nm supplies, it expects supply bit growth to be closer to 25%. Estimates for industry supply bit growth remain at approximately 40%.

With a projected healthy industry demand/supply environment for the remainder of the year, the company expects to be somewhat supply-constrained during the second half of the year. As such, its revenue mix will primarily focus on strategic priorities and customer relationships.

SanDisk will begin installation and qualification of equipment for technology transition in phase two of its Fab 5 in the third quarter of 2014. Phase II of Fab 5 is not expected to contribute any meaningful incremental wafer capacity during this calendar year. Strong progress with 15-nm technology development should lead to a ramp-up of production toward the end 2014, with meaningful contribution to product shipments in the first quarter of 2015. Progress also marches on with 3D NAND technology development; pilot production is expected to begin in the second half of 2015, with target production in 2016.

This file type includes high resolution graphics and schematics when applicable.

2. Qualcomm

This file type includes high resolution graphics and schematics when applicable.

Communications technology is the backbone of Qualcomm, the second-ranked company in the Top 50 Employers list. Its singular goal is to push the envelope on mobile technology, evidenced by the company’s hardware showing up in hundreds of smartphones (as opposed to the few that use Intel technology). Qualcomm also dominates the emerging LTE cellular baseband processor market, holding a 66% market share according to Strategy Analytics.

Its success in part is attributed to the $14 billion poured into R&D over a four-year period. Such massive R&D investments were made possible by the cash flow generated by its 3G technology licensing. Because Qualcomm owns the IP, it produces licensing fees of 3-5% of a 3G phone’s wholesale price.

GSMA Intelligence estimates approximately 8.5 billion global cellular connections by 2017, 4.5 billion of which will still be 3G. If so, Qualcomm looks to retain a strong licensing revenue position at least up until then, even with most of the growth coming in emerging markets with cheaper handsets, thus lowering average licensing fees. Keep in mind that tablets, smart watches, automobiles, and whatever else comes along will require these connections.

Qualcomm is making progress in striking 4G deals with LG, Nokia, Samsung, and ZTE, but it’s nowhere near as dominant as in the 3G arena. While China Mobile chose to develop its own proprietary 3G network, it decided not to pursue the 4G area—a potential opportunity for Qualcomm.

For the third quarter of 2014, the company produced record revenue and earnings results, driven by broad demand for its 3G and multimode 3G/4G chipsets. Shipments totaling 225 million mobile-station-modem (MSM) chipsets were driven by strength in emerging market regions, which spiked 17% quarter to quarter and 31% year over year.

The company is accelerating the transition from its current-generation Mirasol display technology to licensing of the next generation that focuses on wearable devices (although it will continue to make the current Mirasol displays). Mirasol is a trademarked name for its interferometric modulator display (IMOD) technology used in electronic visual displays. It consumes little power when not being addressed, and is visible in ambient light (e.g., sunlight).

Qualcomm launched its first device based on its Snapdragon 805 processor and fourth-generation multimode 3G/4G modem, dubbed the Samsung Galaxy S5 broadband LTE-A. According to the company, the Snapdragon 805 is the first mobile processor to offer system-level Ultra HD support, 4K video capture and playback. Also, coupling the processor with the company’s Gobi modems enables users to stream and watch 4K content over LTE.

Qualcomm CDMA Technologies (QCT) has seen strong design traction with emerging China customers. Success to date in China is based on chipsets launched last year. This quarter, the company plans to commercialize a new low-cost architecture with the Snapdragon 410.

Wi-Fi and RF360 solutions continue to ramp up, with overall Wi-Fi unit volumes on track to grow more than 40% this fiscal year, as their attach rate in mobile continues to extrapolate. Qualcomm has now launched, or is in design with, over 100 devices incorporating RF360, including the first to feature an envelope tracker, antenna tuner, and power amp. The RF360’s singular design can be used to support the 40 and growing different global cellular bands.

The continued rollout and sustained growth of multimode 3G LTE presents a significant opportunity: According to the Global Mobile Suppliers Association (GSA), 300 operators have deployed, with 200 more committed to deploy, LTE. In addition, over 55 operators have or plan to deploy LTE Advanced services, including carrier aggregation. In this vein, Qualcomm will supply chipsets across multiple product tiers, leading with the launch later in 2014 of the Snapdragon 810, which is a premium-tier integrated system-on-a-chip (SoC) with Category 6 for smartphones.

To date, over 2000 multimode 3G LTE devices have been launched or are currently in design, based on Qualcomm chipset solutions. The LTE feature set continues to evolve, with features such as LTE Broadcast and LTE Direct.

LTE Direct is a device-to-device technology that offers privacy-sensitive and battery-efficient proximity-based discovery of friends, services, offers, and other relevant value in one’s proximity. The company recently announced an LTE Direct trial in Germany in collaboration with Deutsche Telekom.

Although still early in the adoption cycle, opportunities in the automotive, healthcare, and wearable segments continue to take shape. The company’s leadership in LTE brings an advantage to the automotive segment, with the move from 3G to multimode LTE in addition to General Motors’ launch of OnStar LTE. In addition, new Android Wear devices were recently unveiled to bolster this segment. On top of that, Snapdragon 400 has turned into a key driver in various devices offered by Samsung and LG.

Also pushing the needle for Qualcomm were several key acquisitions. First was Velocity, a leader in the development of 60-GHz chipsets based on the IEEE 802.11ad standard, also referred to as WiGig. The standard operates within the unlicensed 60-GHz frequency range and promises data transmission rates of up to 7 Gbits/s. The other acquisitions were Black Sand Technologies, which supplements its RF team and expands its RF360 roadmap, and digital still-camera technology developed by CSR.

This file type includes high resolution graphics and schematics when applicable.

3. Microchip Technology

This file type includes high resolution graphics and schematics when applicable.

Microchip Technology landed at number three on the Top 50 mainly due to always being under control—that is, embedded control. The company develops, manufactures, and sells specialized semiconductor products used by customers for a wide variety of embedded control applications.

Products include general-purpose and specialized 8-, 16-, and 32-bit microcontrollers; linear, mixed-signal, power-management, thermal-management, RF, safety, security, wired connectivity and wireless connectivity devices; serial EEPROMs (a type of volatile read only memory); serial flash memories; parallel flash memories; and serial static random-access memory (SRAM) memories. The company also licenses flash-IP solutions that are incorporated in a broad range of products.

The first quarter of 2014 produced record sales of $531 million, up 7.7% over the previous quarter. Record revenues were recorded in the microcontroller (MCU) and analog segments, and geographically, revenues reached new highs in the Americas and Asia. Improved gross margins and strong expense control also shattered quarterly earnings marks.

MCUs, also occasionally referred to as “embedded controllers,” represented 65% of Microchip’s overall revenue in the quarter. Overall MCU revenue grew strongly at 5.3% sequentially in the quarter, and was up 14.5% versus the year-ago quarter, achieving a new revenue record. The 8-, 16-, and 32-bit MCU segments all experienced sequential growth, as well as record revenues, in the quarter.

Not only did 8-bit MCU revenue bump to a new high in the first quarter, cumulative revenue in the last four quarters was up 11.5% over the previous four-quarter stretch. While competitors have defocused in this arena, Microchip continues to expand its market share.

In fact, it’s reached the point where manufacturing can’t keep pace with demand for Microchip’s latest 8-bit MCU products. Its 8-bit PIC MCUs are finding their way into applications such as smartphones, audio accessories, video gaming peripherals, and advanced medical devices.

Conventional wisdom has been that 8-bit MCUs are slipping, and all customers simply want to convert to 32-bit MCUs. Bucking that trend, the company introduced a raft of new 8-bit products, including a high-efficiency 8-bit core and a family of core-based products that use C programming language, much like higher-end 16-/ 32-bit MCUs.

Microchip also introduced core-independent peripherals that allow customers to run the peripheral functions without the MCU core engine running or without consuming CPU power. As a result, customers can expand the use of 8-bit MCUs, leading to renewed popularity. Demand for this process technology is rising at a rate of 15% to 20% per quarter, starting from a fairly large base.

Its 16-bit MCU business was up 0.6% sequentially in the June quarter, achieving a new record, and up 26.5% versus the year-ago quarter. Records were reached for 32-bit MCUs, too, up 21.5% sequentially in the quarter, and 59.8% versus the year-ago quarter.

Including the acquisition of Supertex analog products (maker of high-voltage analog/mixed-signal integrated products), the analog business grew 18.9% sequentially in the quarter and was up 23.8% from the year-ago quarter. The analog sector represented around 24% of Microchip’s overall revenue in the quarter, achieving over $500 million.

The memory business, which consists of the Serial E-squared and SuperFlash memory products, was sequentially up 0.7%. This high-profitability segment represented 6.3% of Microchip’s overall revenue in the quarter.

In May, the company acquired Taiwan-based ISSC Technologies Corp., a fabless Bluetooth SoC design-house. It offers Bluetooth-compliant solutions for mono and stereo headsets, car kits, and MFi adjunct solutions (made for iPhone/iPod/iPad), among others.

End markets such as industrial, automotive, housing, consumer electronics, and personal computing are showing strong growth across the board for Microchip. For example, the strategy in automotive has been to focus on a broad range of auto applications as opposed to a single control item. If purchasing a new S Class Mercedes, one will find around 50 Microchip “chips” inside the car, with about 30 of them being MCUs.

To summarize, the economy’s recovery from the 2008/2009 recession is slogging along at about half the rate from past recoveries since WWII. Thus, adding capacity and payroll is a riskier option than automated equipment to increase production and match variations in demand. Also, wage growth has averaged around 2% since the recession, so consumer demand simply doesn’t merit large increases in capacity.

This file type includes high resolution graphics and schematics when applicable.