LED Adoption Set to Increase Over the Next Two Years

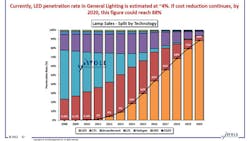

The adoption of LED lighting is set to increase throughout 2014 and 2015, according to a new report from Sterne Agee. Analysts credit the acceleration to three main factors: federal legislation mandating the phase out of incandescent bulbs, utility companies broadening programs to include all forms of energy efficient lighting, and the decrease in price of LED bulbs.

Effective January 1, 2014, the 2007 Energy Independence & Security Act (EISA) Legislation bans the sale and production of 40- and 60-watt incandescent bulbs in the U.S. Following suit, China is set to ban 40- and 60-watt incandescents as of October 2014.With 100-watt incandescent bulbs already effectively banned, the market share is expected to move towards either compact fluorescent lamps (CFLs) or LEDs.

Analysts also found that about 70% of the 2,000 utilities companies across the U.S. offer some form of subsidy for energy efficient lighting. Although there are often different programs for LED bulbs and CFLs, the researchers believe that many companies will combine them into an overriding program, ultimately increasing the subsidy dollars for LEDs. The subsidy increase could also increase bulb volumes by six or seven times the current amount.

Although the price of LED lamps has continually decreased, the upfront cost remains high compared to equivalent technologies. There are ways to reduce costs, however. Analysts expect “historical” levels of price erosion in packaged LEDs which account for 35% of material costs and are a leading factor in LED lamp price. Cost reductions in other components, such as drivers and heat sinks, will also be necessary for wider LED adoption. The simplification and standardization of design by LED manufacturers will similarly play a major ole.

Although LED lighting is still under 1% as part of the existing global infrastructure, the lower bulb prices are expected to driver higher sales and operating leverage. Because of their advancements in LED chip performance, CREE is expected to benefit the most from the increase in adoption. Other companies that stand to benefit include Acuity Brands, Seoul Semiconductor, Semileds, Aixtron, Veeco, and Rubicon.

About the Author

Iliza Sokol

Associate Content Producer

Iliza joined the Penton Media group in 2013 after graduating from the Fashion Institute of Technology with a BS in Advertising and Marketing Communications. Prior to joining the staff, she worked at NYLON Magazine and a ghostwriting firm based in New York.