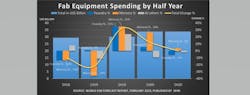

Global fab equipment spending to see 2019 decline before new highs in 2020

The group states that over the past two years, memory accounted for an annual share of about 55% of all fab equipment, but forecasts a drop to as low as 45% in 2019 and then a rise back to 55% in 2020.

"With memory representing an outsize share of total spending, any fluctuations in the memory market impacts overall equipment spending," SEMI's report said. Figure 1 below illustrates the sudden historical and forecast changes for each half year starting with the second half of 2018.

Memory spending

SEMI's data shows that in the second half of 2018, memory inventory levels were high amid weakening demand, which the group said led to a bigger-than-expected decline in DRAM and 3D NAND (NAND) in the latter part of 2018, which drove down memory spending by 14%. SEMI expects this decline to continue into the first half of 2019—with memory spending to fall 36%—but said spending could rebound 35% in the second half of 2019. Still, SEMI's report forecasts an overall 30% drop in 2019 memory spending after hitting record highs in 2018.

Foundry spending

As the second largest fab equipment spending sector after memory, foundry's annual share has ranged from 25 to 30% per year over the past two years, respectively, according to SEMI. In the next two years, the group expects that proportion to hold steady at about 30%. And while foundry has fluctuated less than memory spending, it did decline by 13% in the second half of 2018.

About the Author