SEMI: Global semiconductor test equipment sales on pace for 16.4% slump in 2019

It's been a downtrodden year so far for sales of semiconductor manufacturing equipment, but according to SEMI, better days are soon ahead.

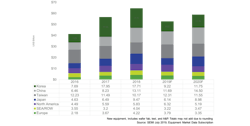

SEMI's forecast shows that global sales of semiconductor manufacturing equipment by OEMs are projected to be $52.7 billion in 2019, an 18.4% drop compared to 2018's historic high of $64.5 billion. Looking ahead to next year, SEMI's forecast shows growth in equipment sales resuming in 2020 to the tune of 11.6% yearly growth to $58.8 billion. SEMI said the current forecast reflects recent downward adjustments in capital expenditures and rising market uncertainty due in part to geopolitical tensions.

Read More: Mike’s Blog: Here’s what test vendors are saying about the semiconductor market

From a geographic market perspective, SEMI's forecast shows that Taiwan will dethrone Korea as the largest equipment market and lead the world with 21.1% growth this year, followed by North America with an 8.4% gain. China will maintain the second spot for the second consecutive year, and Korea will fall to third after throttling back capital expenditures. All regions tracked except Taiwan and North America will contract this year.

While 2020's semiconductor manufacturing equipment market recovery won't match the decline of 2019, it should be noted that 2018 was the market's best year ever and can make 2018's contraction appear dramatic. SEMI elaborated on what will fuel the 2020 recovery:

"SEMI forecasts that, in 2020, the equipment market is expected to recover on the strength of memory spending and new projects in China. Equipment sales in Japan will surge 46.4 percent to $9.0 billion. China, Korea, and Taiwan are forecast to remain the top three markets next year, with China rising to the top for the first time. Korea is forecast to become the second largest market at $11.7 billion, while Taiwan is expected to reach $11.5 billion in equipment sales. More upside is likely if the macroeconomy improves and trade tensions subside in 2020."

The Mid-Year Total Equipment Forecast is based on SEMI's industry-recognized World Fab Forecast database and input from equipment manufacturers. Total equipment includes wafer processing, other front end, total test, and assembly and packaging equipment.

The following results are in terms of the market size in billions of U.S. dollars.

About the Author