Report: Semi content in electronic systems to drop to 26.4% in 2019

On July 17, semiconductor market research company IC Insights previewed its upcoming Mid-Year Update to the McLean Report 2019, highlighting that the group forecasts that while the forecasts the global electronic systems market to grow 4% in 2019 to $1,680 billion, the global semiconductor market is expected to drop by 12% this year to $443.8 billion. This comes after exceeded the $500.0 billion level for the first time ever.

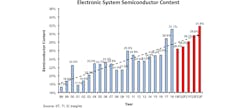

If IC Insights' 2019 forecasts pan out, the average semiconductor content in an electronic system would drop to 26.4%—down 4.7% from 2018's all-time record high of 31.1%. See the group's chart below showing electronic system semiconductor content from 1998 through a forecasted 2023.

That chart shows the steady correlation between the growing average growth rate of the semiconductor industry as compared to the electronic systems market over that 1998-2023 range, and IC Insights noted that the driving force behind that correlation is the increasing value of content of semiconductors used in electronic systems. The group said that the spike in average semiconductor content during 2017-2018 was primarily due to the surge in DRAM and NAND flash ASPs and average electronic systems growth. However, that memory IC ASP jump (56% in 2017 and 29% in 2018) is expected to reverse this year (-33%) and has brought the semiconductor content percentage down with it.

On the bright side, IC Insight's forecast shows that beginning in 2020, the semiconductor content percentage figure is expected to resume its climb, eventually reaching a new high of 31.8% in 2023.

"The trend of increasingly higher semiconductor value in electronic systems has a limit," IC Insights said. "Extrapolating an annual increase in the percent semiconductor figure indefinitely would, at some point in the future, result in the semiconductor content of an electronic system reaching 100%. Whatever the ultimate ceiling is, once it is reached, the average annual growth for the semiconductor industry will closely track that of the electronic systems market (i.e., about 4%-5% per year)."

What does this mean for electronic test & measurement?

Naturally, as the market for semiconductors contracts, so does the demand for semiconductor test equipment. This is directly evidenced in SEMI's Mid-Year Total Equipment Forecast unveiled at SEMICON West earlier this month, which showed that semiconductor test equipment sales are forecast to decline 16.4% this year to $4.7 billion. That decline is part of the overall decline of the semiconductor equipment market, which SEMI forecasts to fall 18.4% to $52.7 billion in 2019, an 18.4% drop compared to 2018's historic high of $64.5 billion.

About the Author