More-Efficient Motors and Transformers — If You Can Get Them

That’s when new DOE minimum efficiency requirements kick in for both medium- voltage dry-type and liquidfilled transformers and induction motors.

That’s a lot of transformers and motors. Approximately 1.2 million distribution transformers are sold in the U.S. annually. And motors account for about half of all electricity consumed in the U.S.; 90% of those are induction motors.

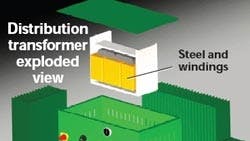

The only problem: There may not be enough steel to make NEMA Premium motors and transformers the new standards call for. At least that’s the feeling of Phil Hopkinson, a consultant and technical advisor to the U.S. contingent of the IEC TC 14 committee working on international standards for power transformers. Both superefficient motors and transformers boost efficiency by using high-grade copper windings and by putting more electrical- quality steel in their laminations than found in ordinary motors and transformers. Only a handful of steelmakers worldwide make the grain-oriented and nonoriented steel the new transformers and motors will use. “Distribution transformer production tends to follow housing trends. U.S. industry doesn’t really know how tight things will get if we come out of the housing crunch,” Hopkinson says. “So steel companies have gotten a breathing period.”

The new DOE regulations cover a wide range of induction motors and distribution transformers. In the transformer area, perhaps the most visible items affected by the legislation are pole-mounted low-voltage units that bring power to residences. But the Act also applies to larger 2,500-kVA transformers that step down utility-grid voltages for use in factories. Many general-purpose induction motors fall under provisions of the new Energy Act.

Steel is already in tight supply and the upcoming mandates could exacerbate the trend. According to Research analysts at KeyBanc Capital Markets, surcharges for electrical steel have gone from $300 to about $1,000/ton and there has been a 25 to 50% year-over-year increase in its price. There are only a few domestic producers of electrical steel and the low value of the U.S. dollar makes it costly to import the metal. “The bottom line is that materials will be tough to get,” says Hopkinson. “I am picking up a feeling in the industry that new transformers are going to be about 33% more expensive than transformers in 2007.”

But steelmakers aren’t just sitting on their hands. The biggest U.S. producers of electrical steel are AK Steel Holding Corp. and ATI Allegheny Ludlum Corp. And it seems they are boosting production to meet anticipated higher demand. “The capacity to make higher-end categories of electrical and grainoriented steel has been constrained for the past several years,” says Mark L. Parr, KeyBanc Capital Markets Equity Research Analyst. “Both AK Steel and ATI have been installing new annealing furnaces and extra equipment. The market is looking for the supply situation to almost double between now and 2010 with the capacity expansion that has been announced.”

But will there be enough electrical steel for NEMA Premium motors and transformers if the housing market recovers and industrial manufacturers stay busy?

“I don’t know,” shrugs Parr. Tight electrical steel supplies are unlikely to affect all manufacturers equally. NEMA Premium motor maker Baldor Electric Co., for example, processes much of its own electrical steel. “We have a new heat-treating oven going in this month,” says Baldor Electric Co. motors manager John Malinowski. “We’ll figure out a way of building NEMA Premium units. The companies that will be hurt are the smaller ones that buy part kits instead of building their own laminations. But if the economy gets going, you will have bigger problems than just laminations. Copper, aluminum, and castings will all be tight.”