Size, Speed, and Efficiency Drive Components Trends

This file type includes high-resolution graphics and schematics when applicable.

As electronic-component suppliers race to meet design engineers’ requirements, their eyes and ears are tuned into a handful of trends dominating the industry—especially the Internet of Things (IoT). OEMs, startups, and makers are placing new demands on manufacturers and distributors of the products and solutions essential to meet today’s IoT designs, driven largely by the competitive marketplace and a growing need to get new products to market even faster these days. Compact design, greater functionality, and the trend toward ready-made solutions—including board-level products with far greater functionality than ever before—are hallmarks of the changing electronic components landscape, distributors say.

Randall Restle, vice president of applications engineering for Digi-Key Electronics, points to advances in sensors and transducers as well as the proliferation of more advanced board-level products as cases in point. He agrees that the IoT is driving these trends, and that keeping up with the newest offerings is one of the greatest challenges facing electronic-components suppliers today.

“I have never seen more sensors and transducers coming to market. The IoT, it seems, is spawning a resurgence in sensor development, in particular” says Restle, a 40-year industry veteran. “Board-level products are another [growth area]. A lot of people want to design something that goes on the internet, but they don’t necessarily have the expertise [at the component level], so they are looking for as much of a finished solution as possible. We have brought on more board-level and modular-level suppliers than ever before.

“If there’s a challenge in all this, it’s keeping up with all the innovation in the industry.”

This fall, Electronic Design asked experts from five of the industry’s largest electronic-components distribution companies to weigh in on the hottest trends that they are seeing in the components market. Five rose to the top of the list: low power; wireless; sensor fusion technology; “edge” computing; and board-level solutions. Here’s a look at what distributor executives had to say about each category.

“Small Power” Rules

Industry watchers continue to point to demand for low-power solutions, an issue that cuts across all component categories. Restle’s colleague Jeremey Purcell, portfolio manager for design tools at Digi-Key, takes the issue to another level, pointing to a need for “small power” as designers seek ways to pack more technology into smaller products—particularly in the wearables market.

“It’s not so much low power, but small power,” says Purcell. “We get a lot of questions about how we can shrink power, because they are packing [so much] into a small space.”

Restle adds that the trend is affecting all facets of the supplier landscape, creating greater power-saving options for designers.

“Everyone seems to be concerned today with low power,” he says, noting an oscillator supplier Digi-Key works with that is developing low-power devices. “I don’t think of that kind of device as being low power, but everyone is thinking of this issue. They’re thinking about battery power, portability. And it’s driving a lot of their internal development process.”

Eric Williams, vice president of IoT for Avnet, adds that cost goes hand-in-hand with low power when it comes to demand for IoT solutions. He points to data communications and demand for low-power wide-area-network (WAN) offerings as one example of where the technology is headed.

“Cellular operators have the main advantage of coverage, but services are expensive and the radios are expensive (and costly to certify), and not nearly as power-efficient. For applications that require low power and low data rate, the low-power WAN offerings solve these problems,” explains Williams. “That creates pressure on the mobile network operators (MNOs) to create new technology and services to fill the gap. Narrowband IoT (NB-IoT) is one such example. In addition, they will also work with the module vendors to significantly reduce the cost of radios and certification.”

“I think you’re really going to see a lot of work [in this area],” adds Williams. “Certainly, cost and low power consumption is key.”

Wireless on the Rise

Although wired products are still in demand for IoT design—especially in industrial settings—Restle adds that “fundamentally, the rage seems to be on wireless products.” Raymond Yin, director of technical content at Mouser Electronics agrees, pointing to low-power, long-range wireless technology as a key growth area. Wireless modules that leverage the technology are a particular boon to engineers designing new IoT solutions, he adds.

“Some of these new wireless modules are incredibly easy to deal with,” says Yin. “It really minimizes the effort of the design engineer when you can design in a wireless link.”

TTI Inc.’s Brian Wellhouse, supplier marketing manager for sensors, suggests Bluetooth and wireless networks as among the most cutting-edge developments in component technology today. As a passives supplier, TTI is focused on adding sensor technology to its product lineup as a way to serve the IoT market.

Wellhouse says one of the most prevalent customer trends he sees in both of these areas involves adding networking and data to existing devices or creating new sensor networks. He points to advances in pressure-transducer technology that can accommodate wireless modules, allowing for remote monitoring of systems. Heating, ventilating, and air-conditioning systems are a case in point. By removing additional components and cabling, data can be transmitted wirelessly to a data-acquisition system. As one example, incorporating connectors with Bluetooth technology eliminates the need to source the cable that would typically transmit data from the system.

Yin explains that, in addition to ease of use and convenience, such transformations give customers greater access to data. This can lead to improved performance in the application they are working on as well as in larger, system-wide operations.

“Once you’re able to hook some sort of node or sensor up to the Internet and monitor it remotely and act on that data, it’s incredibly powerful,” he says. “And it’s really not that difficult to do anymore.”

Sensors Get Complex

Wellhouse names combination sensors—or “sensor fusion”—as another important industry trend. Customers now demand a wider range of functions out of their sensors. One example, he says, is a sensor used to gauge only temperature that can now sense humidity output as well—at a good price point. Street lighting is another example. Customers are adding sensors to lighting that not only measure energy use, but count cars and gather other traffic flow information. The drive is toward fewer components that gather more data.

He also echoes comments about today’s resurgence in sensor development, adding that one of the greatest challenges faced by TTI is in educating customers on the wide range of solutions available to achieve a particular result. He says as many as four to five different technologies can do the same thing, at widely varying price ranges.

“Much of our work has been educating engineers on different technologies and solutions based on the sensing need they have for the application,” explains Wellhouse. “We’re supporting design and making sure engineers are aware that there are multiple solutions for a single problem.”

Aiden Mitchell, vice president of IoT sales for Arrow Electronics, agrees and emphasizes growing demand for sensing at the “edge”—that is, embedding more and more sensors at the device level. This underscores the growing importance of data, says Mitchell, noting that ubiquitous sensing is giving customers the real-time execution they need to generate new and better information to improve operations.

“In components, the biggest opportunity is at the edge. On the sensor side, we’re seeing sensor unit growth and low-power wireless as the two fastest growing technology areas. That growth is only matched by embedded computer solutions—board-level and box-level solutions,” he says. “More and more, the value is shifting to the data. Companies run on data either because that’s what’s going to drive their efficiency, or maybe because it’s going to drive their new revenue model. Either way, it’s all about the data.”

Edge Computing Takes Hold

Like the IoT itself, trends surrounding IoT component technology are also connected. Mitchell’s point about putting more sensing technologies at the “edge” of a process is part of a separate trend toward “edge computing.” It’s something both Arrow and Avnet say is beginning to drive growth in the segment and has considerable long-term potential.

Essentially, edge computing pushes computing technology away from centralized networks and toward the source of data by using a variety of devices—laptops, tablets, cell phones, and sensors, to name some. Avnet’s Eric Williams describes it as “pushing the processing mode out to the edge.” And he says it’s all about data and efficiency.

“Edge computing allows you to manage some portion of the workload so you don’t have to stream that information back up to the cloud 24/7,” Williams explains. “Suppliers and customers are looking for edge-based solutions—to create processing at the edge.”

Once again, lighting is a prime example. In the case of street lighting, an edge-based solution tracks information at the lighting source and sends back only necessary data, such as the need for service when a certain lumen level has been reached. The end result is more focused data generation that enables organizations—businesses, municipalities, and others—to make better decisions.

“Components and hardware are still vital, but it’s all about what you need [in order] to generate data,” adds Mitchell. “It’s about sensing embedded in that edge device. Then it’s about the mobilized, embedded compute options … All of this allows you to predict a lot more accurately what’s going to occur.”

Kits/Board-Level Solutions in Demand

Many of today’s components trends can be wrapped into a single package, leading to growing demand for development boards, modules, and other ready-made solutions. The trend speeds time-to-market for many customers and allows others—“makers” and “maker professionals” in particular—a faster, easier way to solve a problem.

“We’re seeing a lot more of this activity because it speeds up the time from idea to prototype,” says Digi-Key’s Purcell. “It also helps the makers or ‘maker pros’ who have an idea, are trying to fix a specific problem, and are almost there. It gives them a boost, as well.”

Restle emphasizes the potential of the maker-pro market.

“These are entrepreneurs who are looking for ready-made solutions. And some of them will be tomorrow’s big [customers],” he says.

Component manufacturers are rising to the call for more of these products, adds Avnet’s Williams, pointing to manufacturer-distributor collaboration to create boards and kits.

“You’re seeing our suppliers looking at opportunities to take their solutions and then create development boards,” he says. “It isn’t just chip level. It’s [taking] their solution and creating a development board product that can bring that solution to life and make it easier for the customer.

“That’s why you’re seeing a lot of development around use cases, starter kits [and the like]. It’s critical that we embed our suppliers’ technology into those starter kits. There is a proliferation of starter kits in the market to ease the initial experience for the customer.”

More Room for Growth

Distributors agree the sky’s the limit when it comes to the potential of the IoT, pointing to industrial applications, smart cities, building automation, and the wearables market—especially as it relates to medical and health industries—as some of today’s hottest technology areas. Mitchell adds that Arrow has seen growth in telematics and transportation as well, and looks forward to growth areas such as smart agriculture, where customers are searching out monitoring and detection solutions to tackle a wide range of problems.

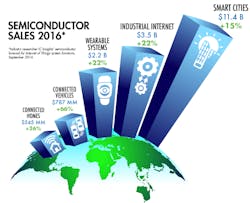

These suggestions mesh with recent industry data predicting sales growth in semiconductors for IoT-related systems. Industry researcher IC Insights said this fall that IoT semiconductor sales will rise 19% this year to $18.4 billion. Connected cars, homes, wearables, industrial applications, and smart cities will drive that growth.

“It’s a really fun and interesting time in the industry,” says Mitchell. “There are still challenges in many other markets. But one thing is for sure: we’re seeing IoT really drive growth.”

Market Trends: Industrial, Wearables Drive IoT Growth

Electronic-component suppliers point to six key markets that are driving demand for Internet of Things projects. They say these end-markets are seeing the most demand for low-power components of all types, more advanced sensors, and ready-made solutions that speed time-to-market.

IoT Chip Sales to Rise 19% in 2016

Sales of semiconductors for Internet of Things projects are expected to rise nearly 20% this year—to $18.4 billion—driven by growth in connected vehicles, homes, wearables, industrial markets, and smart-city applications, according to market researcher IC Insights. This matches what many suppliers are seeing, too.

Executives from five of the industry’s largest electronic-components distributors have identified industrial automation, building control, smart cities, wearables, medical/health markets, and transportation as areas where they see the most demand for IoT-related electronic components.