Solid-State Cooling: A Potentially Greener Refrigeration Alternative

What you’ll learn:

- Several companies and research teams are in the process of commercializing solid-state cooling technologies.

- Once several technical challenges are overcome, the technology is expected to provide a more efficient, greener alternative to compressor-based technologies.

- A recent study by the Rocky Mountain Institute looks at the technologies, the key players and the challenges involved in disrupting a staid global market.

Vapor compression systems have dominated the refrigeration market for nearly a century. Solid-state cooling technologies are looking to change that game, possessing the potential to deliver much higher efficiencies and reliability.

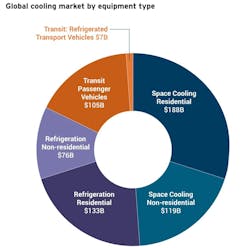

While several technical obstacles must be overcome before they’re ready for wide commercialization, a recent study finds that solid-state cooling is maturing rapidly and may soon be ready to compete in markets currently valued at over $272B/yr today, and expected to grow to $600B by 2050.

The study, “Innovation to Impact: Advancing Solid-State Cooling to Market - Challenges and opportunities for scaling breakthrough cooling startups,” published by the Rocky Mountain Institute, provides an overview of several of the most significant solid-state cooling technologies, the technical obstacles they must overcome, and their potential to compete in various sectors of the global cooling market.

Beyond the Carnot Barrier

Vapor compression technologies, used by roughly 95% of the world’s refrigeration equipment, are very mature and approaching the “Carnot Limit.” This describes the maximum efficiency achievable within the physics that govern the transfer of heat between a hot and cold reservoir.

In contrast, solid-state cooling systems don’t operate by moving heat between reservoirs. Thus, in theory, it gives them the potential to achieve coefficient-of-performance (COP) scores above 10, almost double the COP of the best conventional AC systems, which is roughly 5.5.

>>Check out this TechXchange for similar articles and videos

Besides dramatic improvements in energy efficiency, solid-state coolers eliminate the need for compressors, hoses, and other failure-prone mechanical parts, as well as the need for refrigerants. All refrigerants have very high global warming potential (GWP), such as commonly-used R-134a, which has a GWP 1,430X that of CO2.

As an earlier RMI study explains, solid-state cooling technologies can be classified into roughly four categories:

- Barocaloric systems use pressure changes to alter the molecular structure of their active materials, causing them to generate heat.

- Elastocaloric systems use mechanical stress or stretching to alter the molecular structure of their active materials, causing them to generate heat.

- Magnetocaloric systems use rotating magnetic fields to induce a shift in the structure of their active materials to produce a change in their temperature.

- Thermoelectric systems take advantage of the Seebeck Effect or some other quantum phenomenon to use current flow between two dissimilar materials to create a temperature differential between them.

Overcoming Barriers Toward Commercialization

Despite their promise, solid-state cooling developers must overcome several challenges before the technology can be commercialized. For example, efficiency drop occurs when elastocaloric materials are fully integrated into a cooling system. At present, this can reduce their actual performance by as much as a factor of 3.

Material fatigue is another potential problem for both barocaloric and elastocaloric technologies, which generate cooling through the repetitive stretching or compression of materials.

Would-be developers must also be prepared to ride a steep cost-reduction curve as the market matures. In addition to designing products that can use as many existing high-volume production technologies as possible, they must figure out how to leverage existing components whenever possible to save development time and costs while reducing potential supply-chain risks.

The potential opportunities have attracted several teams of academic and commercial developers who are investing heavily in overcoming these and other barriers to commercialization.

For example, MIMiC, a New York-based company, is developing thermoelectric solid-state systems specifically to replace the conventional packaged thermal AC (PTAC) units used in hotels and multi-tenant buildings. Meanwhile, Germany-based Magnotherm is developing magnetocaloric refrigerators for supermarkets, grocery stores, and other retail applications. Although new competitors regularly enter the market, the table below provides a fairly complete list of the major players at the time of this writing.

>>Check out this TechXchange for similar articles and videos

Next in This Edition of PowerBites

More PowerBites

About the Author

Lee Goldberg

Contributing Editor

Lee Goldberg is a self-identified “Recovering Engineer,” Maker/Hacker, Green-Tech Maven, Aviator, Gadfly, and Geek Dad. He spent the first 18 years of his career helping design microprocessors, embedded systems, renewable energy applications, and the occasional interplanetary spacecraft. After trading his ‘scope and soldering iron for a keyboard and a second career as a tech journalist, he’s spent the next two decades at several print and online engineering publications.

Lee’s current focus is power electronics, especially the technologies involved with energy efficiency, energy management, and renewable energy. This dovetails with his coverage of sustainable technologies and various environmental and social issues within the engineering community that he began in 1996. Lee also covers 3D printers, open-source hardware, and other Maker/Hacker technologies.

Lee holds a BSEE in Electrical Engineering from Thomas Edison College, and participated in a colloquium on technology, society, and the environment at Goddard College’s Institute for Social Ecology. His book, “Green Electronics/Green Bottom Line - A Commonsense Guide To Environmentally Responsible Engineering and Management,” was published by Newnes Press.

Lee, his wife Catherine, and his daughter Anwyn currently reside in the outskirts of Princeton N.J., where they masquerade as a typical suburban family.

Lee also writes the regular PowerBites series.