SmartNIC Architectures: Landscape Update

This article is part of the Communication and System Design Series: Have SmartNIC - Will Compute

What you'll learn:

- What players have moved up, and down, in the fast-changing SmartNIC market?

- Prognostications on how the various SmartNIC architectures will fare among customers.

It’s been six months since “SmartNIC Architectures: A Shift to Accelerators and Why FPGAs are Poised to Dominate,” and we thought it might be best to do a quick SmartNIC/DPU (data processing unit) update. Since that article, all of the big players have made some sweeping moves, some dramatically improving their board position, while others lost vital material. New entrants, positioned as pawns, have been marching down the board and are now blocked and defended.

It will be interesting to see how the game plays out. Below is one perspective on how things are shaking out.

NVIDIA Bluefield

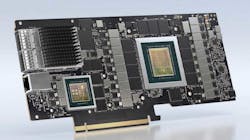

NVIDIA and its Mellanox Bluefield architecture is perhaps the queen on the board. In October, NVIDIA’s CEO announced the “Bluefield-2X,” which couples a GPU with a Bluefield DPU onto a single board. We chuckled at the initial marketing photograph (Fig. 1) that showed both silicon pieces on the same board, but no auxiliary power port. The stock Bluefield-2 photo includes a 6-pin VGA power plug. There’s no way a DPU+GPU can survive on only 75 W.

In the company’s roadmap, later versions, through to the Bluefield-4, would fuse the two processing technologies into a single-chip package. The Bluefield-2X includes an Ampere GPU for handling machine-learning workloads, and the platform is scheduled to ship sometime in 2021.

As you might recall, Bluefield also is part of VMWare's Project Monterey. Moreover, NVIDIA announced that it was extending its DOCA SDK to make developing applications for DPUs easier. As discussed in several prior pieces in this series, software development for SmartNICs by customers or third parties has always been the Achille's heel of SmartNIC platforms. NVIDIA displayed a slide (Fig. 2) that still shows a Bluefield-3 and Bluefield-3X as separate packages.

As mentioned earlier, the Bluefield-4 would drop the X designation as the Ampere GPU would be tightly integrated into the package. NVIDIA didn’t disclose timeframes for these chips, only the integration levels as shown on the slide. One might expect a two-year separation between each generation on the slide.

Finally, last September, NVIDIA proposed a $40B plan to acquire Arm. Recent reports show that Google, Microsoft, and Qualcomm have all filed documents opposing the acquisition, and the FTC has recently opened a probe into the terms of the deal, so some think this may not happen.

Intel Inventec and Silicom FPGA

Intel, the undisputed king on the SmartNIC board, in October 2020 announced two new FPGA-based SmartNICs (Fig. 3): the Inventec C5020X (codenamed Big Springs Canyon) platform for cloud by Inventec and the Silicom FPGA SmartNIC N5010 (Lightning Creek) for networking. The C5000X incorporates both a Stratix 10 FPGA and a Xeon D processor into a full-height, short, single-slot, dual-port 25-GbE NIC, with a PCIe Generation 3 x16 connector drawing 75 W. Also, it has 16 GB of DDR4 and 32 GB of eMMC flash.

By comparison, the N5010 is a beast with four QSFP28 connectors behind which is a Stratix DX210 FPGA and a pair of Intel E810 NIC controllers. This card's active cooling version is full-height, three-quarter length, and double-wide with 8 GB of HBM memory on the Stratix and 32 GB of DDR4. The board draws a whopping 225 W at maximum power, 75 W from the PCIe interface, and another 150 W from a GPU plug. Expect to see other SmartNICs and DPUs follow this power envelope. There’s no way you can be a leading-edge network accelerator in 2022 and beyond and survive on just 75 W.

Broadcom Stingray

Broadcom, one of the bishops on the board with its Stingray platform, had some early success at Baidu, but word on the street is that the follow-on project, Stingray 2, has been canceled. Little news has leaked out of Broadcom and acquiring a Stingray from the channel has proven challenging.

One major thing Broadcom did have going for it is its SDK. This was perhaps one of the first SmartNIC development platforms made available to customers. Unfortunately, it appears that this bishop has been captured, and possibly Broadcom may be exiting the SmartNIC market?

Xilinx Alveo

Xilinx, the other bishop on the board, in March of 2020, announced its Alveo U25, which was a fusion of Solarflare's wildly popular X2 chip and a Xilinx system-on-chip (SoC) Zynq onto a single board, delivering a two-chip SmartNIC platform. We discussed this board during our IEEE Hot Interconnects panel. While this board was deployed into several Hyperscale accounts, it was never made generally available—that’s now changing.

In parallel, at the 2019 Open Compute Platform (OCP) summit, Xilinx demonstrated an impressive concept platform, a single FPGA chip driving a dual-port 100-GbE network interface card (NIC). This demonstration NIC was rendered entirely within programmable logic gates, and additional space had remained available on the FPGA. The additional space could be allocated to code to manage storage or further accelerate computing. This demo was all on a full-height, full-length, single-slot, 16-lane PCIe card within a 75-W envelope.

At the end of February, Xilinx announced this platform as the Alveo SN1000 SmartNIC family (Fig. 4). This platform is the company’s first entry into the portable, programmable, and composable SmartNIC space, and it’s entirely software-defined and hardware-accelerated. Xilinx is also pulling out all the stops on bringing SmartSSDs to market, so we should expect to see storage acceleration bleeding over into network adapters soon. Several of the SN1000 family articles that have come out recently referenced an NVMe use case where the NIC directly managed storage.

Finally, this time last year, Xilinx announced its Versal Premium line of chips, which added thousands of machine-learning cores to the company’s already unique programmable acceleration platform. This chip is likely to power future accelerators and SmartNICs. In addition, last October, AMD announced its intent to acquire Xilinx in a deal that would close sometime in the early fall of 2021. In January 2021, according to SeekingAlpha, the acquisition was still on target for later in the year.

Netronome Agilio

Netronome is the knight that few understand how to leverage. Its line of Agilio SmartNICs has been mentioned at various times, and several years ago, we would have included them. However, we've not seen anything new from them for some time. Spinning new silicon these days is hugely costly—think eight figures—and if you're not a leader or exceptionally well-funded, survival is well, challenging. At this point, we feel that this knight has been forked, which is somewhat ironic for a knight.

Pensando Capri

Pensando is one of the new pawns added to the SmartNIC board in the past few years. It has made numerous runs at Wall Street customers, but success among this customer set is often hard-won.

In January, The Linley Group, a well-known network analyst, gave Pensando's Capri chip their Analyst Choice award for 2020. Awards are nice, but customer wins are the fuel that keeps the fire of innovation alive. Pensando recently lost a critical hyperscale deal to one of the above. Still, it’s marching down the board with several other advanced PoCs, and it will be interesting to see if the company makes it to back to the rankings in 2021 and elevates to a knight—we’re hopeful.

Fungible

Fungible debuted at the IEEE's Hot Chips conference last summer, then hit all of the fall trade shows. Soon afterward, it appears Fungible may have started to reposition itself as a storage DPU. While that has worked out for Chelsio Communications, we question if there’s room for another. The company’s technology requires its DPUs on both ends to achieve the stated 30% CPU offload gain advertised.

Like Pensando, Fungible is one of the new pawns on the board, perhaps the King's Rook pawn. After marching down a square or two, we fear it’s now pinned on the edge of the board, waiting for some attention as a storage DPU. The company needs that file and the one adjacent to it to open. Good luck.

Marvell LiquidIO III

Marvell is the Queen's Knights pawn that you need to move to get the Bishop out. Some have suggested its OCTEON TX2 DPU platform in the LiquidIO III may be worthy of exploration. This is a 32-core Arm v8 at 2.2 GHz. As we see this platform gain traction, we may need to explore it further. It’s similar to others above in that Arm cores are being placed in both the data and control planes. Arm cores in the data plane is a potentially doomed long-term strategy, but let's see how it goes.

Achronix Speedster 7

Achronix is that Queenside Rook's pawn that few have yet to pay attention to until someone castles queenside. It’s a name not many know, but the company is indirectly dipping its proverbial toe into the SmartNIC pool in 2021 through Bittware.

Achronix’s new Speedster 7 silicon is cutting-edge, on par with Xilinx's Versal, and the company is poised to become significant soon. Those not familiar with Achronix should know that it’s the #3 FPGA chip vendor behind Xilinx/AMD and Intel (formerly Altera).

The other reason for listing them is that earlier this year, Achronix announced its plan for a reverse IPO, expected to close in June. IPO money, even reverse IPO money, is back the Brinks truck up capital, which can fuel substantial innovation. Thus, this pawn may play a pivotal role in the future of SmartNICs, especially future AI-based SmartNIC trading applications.

The SmartNIC/DPU market is moving forward at a pace consistent with a round of speed chess. Unlike traditional chess, where you can sometimes afford to invest a few moves in a false flag operation to distract your opponent while setting up your primary board position, this market is unforgiving, time is money, and customers follow winners. The only players who can afford to dither about are NVIDIA and Intel, and their initial leads are already weakening.

Read more articles from the Communication and System Design Series: Have SmartNIC - Will Compute

About the Author

Scott Schweitzer

Director of SmartNIC Product Planning, Achronix Semiconductor

Since his baptism on the altar of the TRS-80, Scott has been a lifelong technology evangelist. He's written profitable software products, built hardware, and formally managed programs for IBM, NEC, Solarflare, and now Xilinx.

After two decades plugging along with single socket computing platforms, Scott joined NEC in 2003 to manage its new Intel Itanium multi-core 64-bit Super Computing Server, and he's never looked back. In 2005, Scott shifted his focus to clustering for Super Computing and extreme performance networking.

As 10-GbE adoption ramped up, he launched his wildly popular 10GbE.net blog. With market changes in 2017, Scott rolled 10GbE.net into the Technology Evangelist, a blog with thousands of monthly page views, and an accompanying podcast.